Are you looking for the best trading brokers that are safe, easy to use, and have a low minimum deposit? Here is the complete online guide for finding the best forex brokers. You’ll find answers to every question, including how many forex traders make money, why some brokers have lower losing percentages than others, and what risks are involved. You’ll learn about industry leaders such as Etoro, Oanda, and everything else you need to know about online trading platforms

For the first time in the history of trading, thanks to the new European regulations that came into effect on August 1, 2018, European brokers are required to show what is the percentage of their clients that lose their money. This applies to all broker traded CFDs (forex, stocks, commodities, etc.) Don’t worry this list will help you find the best way to trade forex, whether you’ve heard of TD Ameritrade or Saxo bank, we have the right FX broker for you to choose from.

Best Forex Brokers Available Today

– Plus500 CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

– Oanda offers Bitcoin trading through Paxos.

What is ESMA and how can understanding the new ESMA regulations help you lose less when trading forex?

Anyone getting into forex trading has probably heard that 95% of participants lose money when trading. Given that FX brokers were able to hold tightly onto the real statistics, the 95% to 99% estimations were precisely that, just estimations.

Now, however, given the implementation of stricter regulations designed to protect retail investors by ESMA (European Securities & Market Authority), it is a legal requirement that a broker displays the winning (and losing) percentage of its clients.

ESMA is a financial safeguard of the European Union. Its purpose is to protect investors as well as consumers and those working within the trading market by ensuring a stable market with open information. They do so through carefully written rulebooks and supervision of various financial agencies and repositories. In short, the ESMA has made Forex a more “friendly” place without as many hidden agendas. Those interested in trading can do so with a more educated decision based on the mandatory data published by brokers and ESMA themselves.

To discover this ESMA-required information, look for a statement similar to “76% of retail investor accounts lose money when trading CFDs with this provider” on any marketing material or advertisements from the broker.

To reduce the financial risk for retail traders, ESMA has introduced leverage limits for European brokers. Gone are the days when small clients could day trade with 100x or 200x their deposited funds. According to the new ESMA intervention measures, leverage rates can only be offered between a margin of 2:1 and 30:1, depending on the specific instrument.

The new leverage limitations are as follows:

- 30:1 for major currency pairs (such as EUR/USD)

- 20:1 for non-major base currency pairs (such as EUR/NZD), gold and major indices

- 10:1 for commodities with the exception of gold and non-major equity indices

- 5:1 for Forex and CFD stocks

- 2:1 for cryptocurrency CFD

As you can see from the list, average volatility dictates how much leverage can be utilized. For this reason, cryptocurrencies, typically the most volatile asset, have the tightest leverage cap, while conventional forex pairs can use the maximum 30:1 margin when trading.

Ensuring you have the right broker from the start can make a world of difference when it comes to making money plus, it’s your money that you’re potentially losing, so it’s crucial it’s in the right hands.

Who Are The Best Brokers In 2024?

Considering all these factors will help you to make the best possible decision when choosing which broker you deposit with. To make the process even easier, we did the research for you.

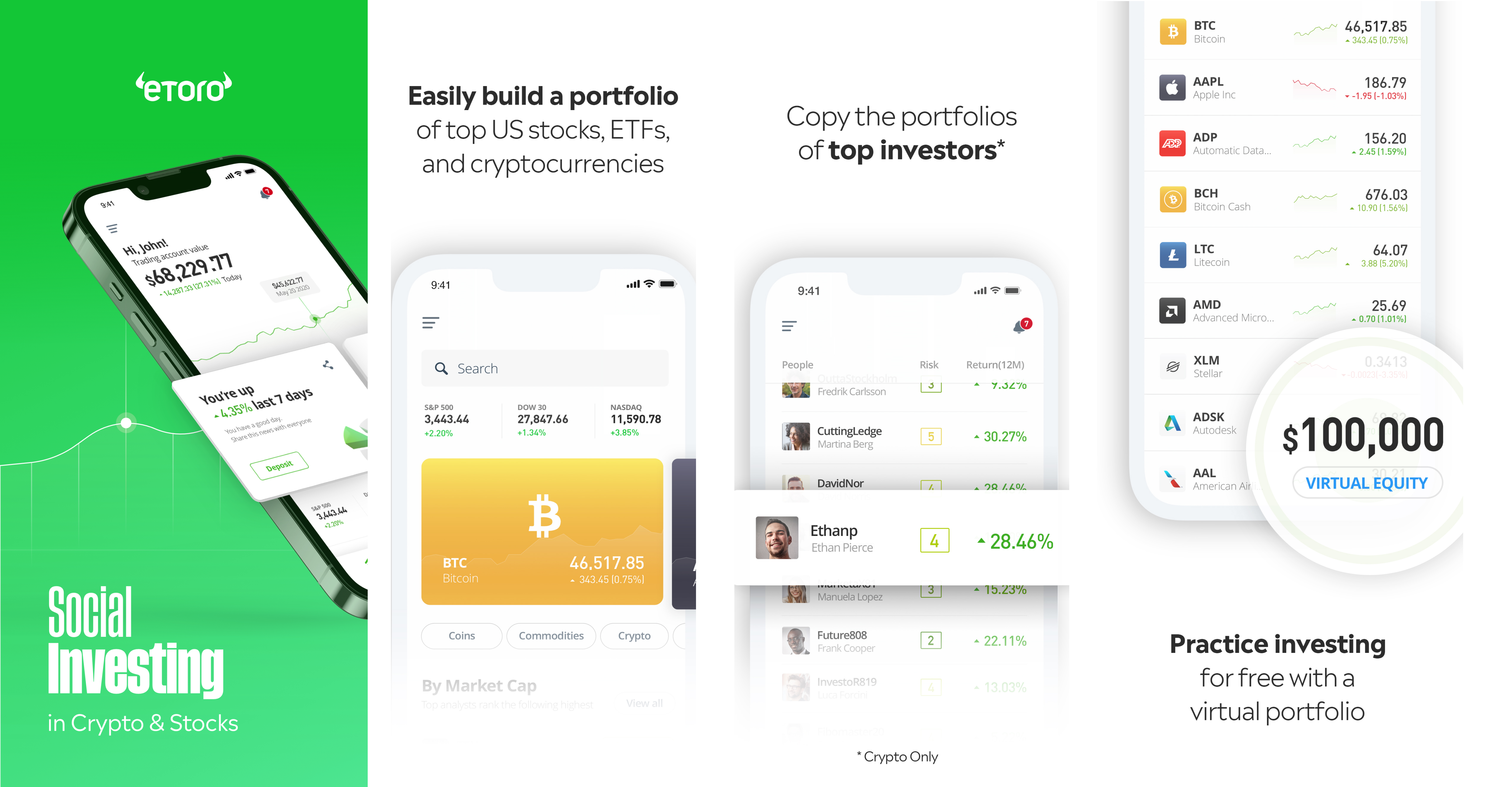

Best Overall: eToro

When you consider the hard numbers, it’s almost impossible not to put eToro at the top of the pile. The statistics don’t lie, and more traders are profitable at eToro than at any of the other brokers we checked out. Whether it’s thanks to its social platform or copy trade feature, eToro seems to be doing it right. With over 20 million users in a whopping 140 different countries around the world, this award-winning company has created a user-friendly platform that is more simple to learn and understan than any broker out there.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

*The minimum first deposit on the eToro platform starts at 50 USD and varies by country. Please verify this with the broker.

eToro USA LLC does not offer CFDs, real Cryptocurrencies are available for US users.

After eToro it becomes more difficult to separate the different companies, as they are mostly similar. However, there are some key differences in the areas of technical tools and ease of use, which allow us to differentiate between them.

Honorable Mention: Plus 500

While Plus 500 does not boast an above-average amount of winning traders, their free, unlimited demo version is still a good option for a beginner trader. Boasting a great array of forex pairs, and user friendly desktop platform , most importantly this is a well regulated and well known CFD broker. Plus 500’s UK subsidiary is regulated* by the FCA in the United Kingdom, widely considered the gold standard for financial regulators in the world.

– Plus500UK Ltd authorised & regulated by the FCA (#509909).

– Plus500CY Ltd authorised & regulated by CySEC (#250/14).

– Plus500SG Pte Ltd, licensed by the MAS (#CMS100648-1).

– Plus500AU Pty Ltd (ACN 153301681), licensed by:

ASIC in Australia, AFSL #417727, FMA in New Zealand, FSP #486026; Authorised Financial Services Provider in South Africa, FSP #47546. You do not own or have any rights to the underlying assets. Please refer to the Disclosure documents available on the website.

– Plus500SEY Ltd authorised & regulated by the Seychelles Financial Services Authority. (#SD039).

82% of retail accounts lose money

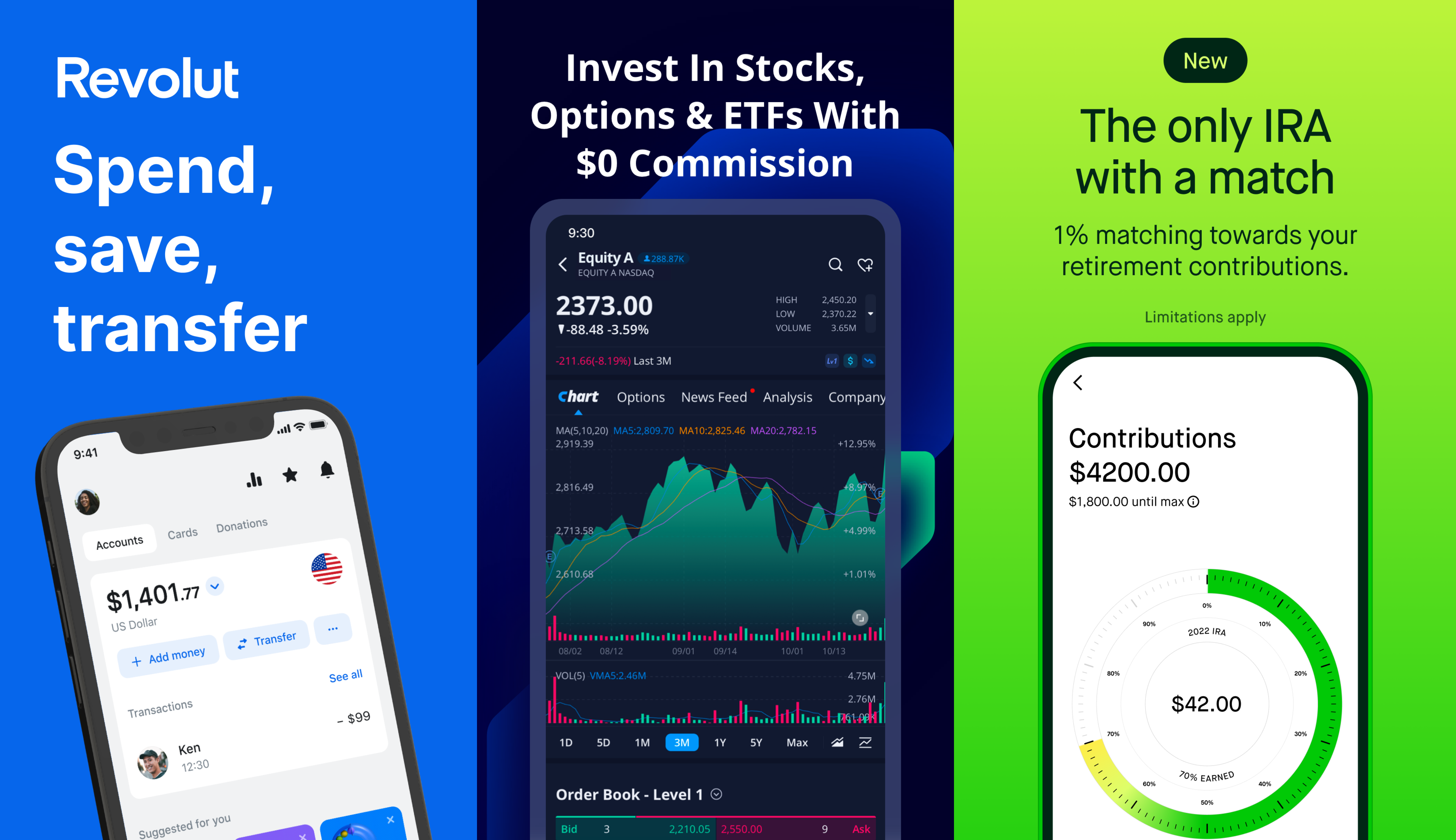

Best for US traders: Robinhood

Among the many US brokers, Robinhood is a breath of fresh air. The San Francisco based company bases its ethos on saving its clients money, and providing services for anyone, no matter how much money they have to trade with. While they don’t have forex, Robinhood offers commission free stock, cryptocurrency, ETF and options trading with no minimum trading account deposit. The platforms charts are clean and clear with no confusing frills. While some have complained about a lack of educational materials, this broker has made great strides in this area, adding notable research firm Morning Star’s stock brokers reports to their premium “Gold” service (leveraged trading is also available). All of these factors make Robinhood a great choice, particularly for a young trader getting started due to their low fees and no capital requirements.

Make sure you try each broker’s demo platforms before you invest any money in the markets. Finding a well-regulated broker that you like to use will save you a huge amount of stress and, most importantly, will mean your risk capital has the best chance of being looked after safely. As we can now see from the valuable data provided through ESMA, it pays to find the right broker. Literally.

Why do traders lose more money with some forex trading brokers and less with others?

The truth is, only a very low percentage of those trading on any market, including forex, will actually make a profit. It’s intended to work this way. Even if every single person knew exactly how to trade and did so properly based on the current situation, etc., the same approximate percent would still lose. And it could be for any reason, not simply bad luck.

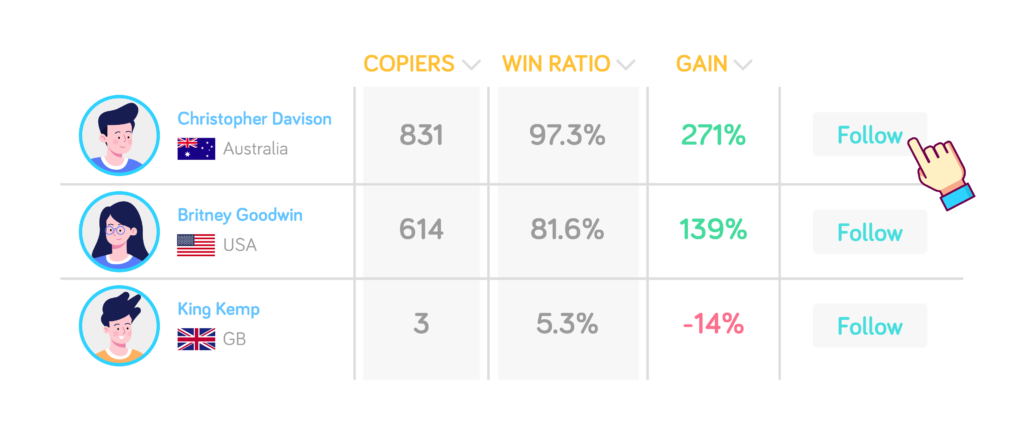

The number of winning trades can vary widely among different companies. eToro for example has one of the lowest numbers of losing accounts at 76%. . When you consider that eToro traders’ winning rate is roughly 3 times more than the worst-performing brokers, it demonstrates why choosing your trading platform carefully is so important.

There are several factors that may be contributing to eToro’s impressive figures.

First, unlike many brokers, they have pioneered the use of social trading. Users can interact with other users and even replicate their trading strategies using eToro’s pioneering use of the “copy” feature which allows beginners to learn from and mimic other successful traders on the web platforms. Given the disparity in winning percentage, it appears to be working.

At the other end of the table, the worst-performing Forex brokers could be down there for many reasons. Whether it be because they prey on inexperienced traders, have high costs, or don’t provide enough education, trading tools or training tools, the stats don’t lie. If 89% of users are losing money trading with a particular company, then new forex traders need to be wary of that fact. As a new active trader, you need to be aware of this as you could end up losing money rapidly due to your skills levels. Until you become an advanced trader of course!

Thankfully, we have access to these stats and more due to the new regulations imposed by ESMA.

How Do I Choose A Forex Broker?

Before going too in-depth into the winning percentage and features a broker provides, there are factors you should establish first to ensure you’re putting your money in the right hands.

Find out which brokers are regulated by the Financial Conduct Authority (FCA). This is critical because it means that the broker will be held legally responsible for holding transparency and fairness to a certain standard.

It also proves to you far more that, when you invest your money that it will still be there a year down the road. Some brokers who aren’t regulated may not have any proof that they will still be running long-term or be able to guarantee the privacy and safety of your money and your personal information.

Choosing the right forex broker is an important decision, so what exactly should you be looking for beyond the winning/losing percentage that we discussed earlier?

- First, you need to look for low fees. The cost of trading adds up in the long term and can eat into any profitable edge that you might have if you aren’t careful. There is good news here, due to heavy competition, most forex brokers offer competitive low spreads with no other trading commissions.

- Next, it’s important to consider how many different currencies are offered by the forex broker. Professional traders will look for opportunities across a vast array of forex pairs. Having these options can help you be more selective, and therefore more effective in your trading.

- Taking a look at the customer service provided by a broker can also be important. The last thing you want is to deal with a forex broker who is uncommunicative and unable to answer questions about your investments. You can set yourself up for happier, smoother trades by establishing a good relationship with your broker and their team from the beginning.

- Another important consideration is what technology tools are available. While you don’t necessarily need hundreds of fancy indicators, at the very least, you need clear and readable charts backed by intelligent analytics and true technical analysis.

- Finally, and perhaps most importantly, you need to find a company that makes it straightforward to deposit and withdraw money and has low withdrawals fees. There’s nothing worse than having long delays while waiting for your funds to arrive due to reasons such as the broker stalling on a withdrawal. Always read the fine print and find out the exact number of days, if any, in a waiting period.

There are so many factors to consider when choosing a broker. By now you should have learned enough to make the best possible decision when choosing which broker you deposit your money with. But there is one final question that needs to be answered:

What is the best way to tell if my forex broker is regulated?

To stop forex scams, it is critical to use a well-known, properly supervised broker. To see if any forex broker is regulated, look for the registration number in the disclosure text at the bottom of the homepage. Then, to double-check the registration number, look it all up on the regulator’s website. Do more research if the broker is not controlled in your region. We monitor, rate, and rank forex brokers across over 20 international regulators to assist traders like you.

We wish you good luck on your journey of choosing a broker to trade forex, stocks, crypto and beyond.

If there is a question, reach out for a conversation with a member of our team here or check out the rest of our blog to keep your financially creative juices flowing.

Well, according to a study by Harvard professors, CEO’s work approximately 62.5 hours a week (the average employee works 40 hours a week).

Well, according to a study by Harvard professors, CEO’s work approximately 62.5 hours a week (the average employee works 40 hours a week).