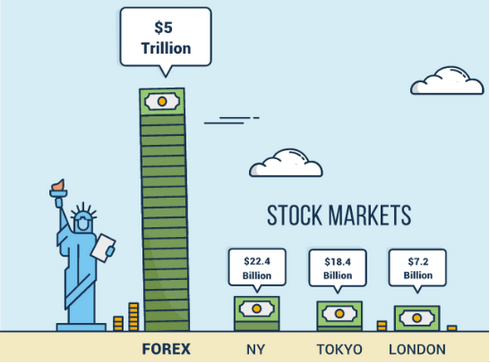

Forex Market Size

As we have mentioned in other forex school lessons, weekly turnover of the forex market is over $25 trillion. That means on any given trading day, an average of $5 trillion of currency changes hands. In Donald Trump’s words: HUUGE!

Forex trading by retail investors makes up just 5% of trading volumes. This means you must understand and accept you are a little fish in a giant ocean but that doesn’t mean you can’t chase the big sharks and make money!

Don’t forget to check out the best Forex apps for trading!

Buying (Going Long) and Selling (Going Short)

- If you think the price of a currency will increase, you will want to buy it (go long/up).

- If you think a currency’s value will decrease, then you will want to sell the currency (go short/down).

Going long is easy, you buy the asset and sell it when it’s price rise. Going short is a little more complex, but it’s taken care of without you lifting a finger. Basically, the broker or trading simulator will lend you the currency you want to sell. When the price falls, you pay the broker back at the lower price. The difference between the price that you borrowed at and the price that you pay back is your profit.

As a Forex trader, you will be going simultaneously long and short as you trade a pair. For example, long EUR/USD means you buy Euros and sell Dollars. You will make money if the chart rises, and lose money if it falls. It’s best to try out how it works in the forex game with real-time market data.

Currency Pairs Being Traded

The price of a currency pair is, essentially, a reflection of what the global market thinks the future of its economy will be, compared to another country. For example, if you are buying British Pounds against U.S. Dollar (GBP/USD), you are basically betting for the British economy. In other words, you think the British economy will grow more rapidly compared to United States. Afterwards you just have to know how to read currency pairs.

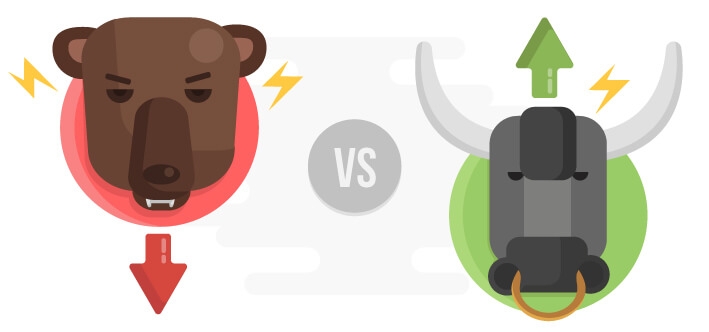

Bulls versus Bears

While bulls are known for throwing an opponent in the air, bears tend to smash them down to the ground. This is a iconic analogy in the Forex as it represents rising and falling markets. A bull market is a market that is rising in value. A bullish trader is one who believes the market will rise, thus goes long.

Pips and Pipettes

A pip is the abbreviation of the phrase “Price Interest Point”. This is the basic and most important unit of measurement in forex.

Pips are used to measure gains and losses. The cash figure that a pip actually represents will vary depending on the pip value. The pip value varies depending on the pair being traded. Luckily, all best forex brokers will calculate the pips automatically for you.

Spread

The spread is the fee that you incur when trading currency. The broker executes your trade at a slightly higher (Buy) or lower (Sell) price than the market rate, and takes the difference between the two as its fee.

Lots

The concept of a lot is the same as any grocery item that is sold in a multiple pack (like a six-pack for beer). Currencies are bought and sold in minimum size packs that are called lots. This is so that tiny amounts cannot be traded, because this would be inefficient and unprofitable for market participants.

- Standard lot – 100,000 units of the base currency

- Mini lot – 10,000 units of the base currency

- Micro lot – 1,000 units of the base currency

- Nano lot – 100 units of the base currency

Leverage

Leverage allows you to earn large profits without having to raise huge amounts of cash. U.S. maximum leverage is 1:50. In Europe, normally it is up to 1:30 due to ESMA restrictions. Without any leverage, you would need $100,000 in your account in order to trade a standard lot. With leverage of 1:100 you need just 1/100 of the amount, or $1,000 as you are lent your account size X100 by your broker. Remember, that leverage works on both sides of the trade – when you’re winning, and also when the market goes against your prediction.

If you think a currency will rise, you would buy it. This is also known as going what?

Which of these is the largest social trading community?

Selling short means that you think a currency will…?

Share your Results: