Unlock the power of expert trading through copy trading! This innovative approach allows you to mirror the moves of professional traders, transforming your trading journey from novice to knowledgeable in just a few clicks.

What is copy trading? Who are these pro traders? Don’t worry, all of your questions will be answered here.

We’ve compiled a list of the top Etoro traders below to get you started on your trade copying journey. Remember, it’s the internet, there is always a risk that people might not be who they say they are. Thus, we decided to provide this resource of carefully-analyzed pro traders that are safe to copy for any beginner trader. It is regularly updated to ensure you are not putting your capital at risk from scammers when social trading.

What if you had invested $ ago?

Curated List of the Top eToro Traders

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Pietari Laurila | Gain 31.01% | Risk score 4 | Manages $500K+ | 5787 Copiers | VIEW 76% of retail CFD accounts lose money |

Blue Screen Media ApS | Gain 40.90% | Risk score 4 | Manages $500K+ | 15656 Copiers | VIEW 76% of retail CFD accounts lose money |

Sergiu Andrei Niga | Gain 15.70% | Risk score 4 | Manages $500K+ | 430 Copiers | VIEW 76% of retail CFD accounts lose money |

Dario Martiskovic | Gain 30.08% | Risk score 3 | Manages $500K+ | 1315 Copiers | VIEW 76% of retail CFD accounts lose money |

Catalina Norena Valderrama | Gain 20.97% | Risk score 2 | Manages $500K+ | 1174 Copiers | VIEW 76% of retail CFD accounts lose money |

Jacobus Enslin | Gain 17.42% | Risk score 4 | Manages $500K+ | 4909 Copiers | VIEW 76% of retail CFD accounts lose money |

Melvyn Moncuit | Gain 9.50% | Risk score 1 | Manages $500K+ | 1743 Copiers | VIEW 76% of retail CFD accounts lose money |

Robier Sarofeem | Gain 28.58% | Risk score 4 | Manages $500K+ | 895 Copiers | VIEW 76% of retail CFD accounts lose money |

Mike Moest | Gain 13.07% | Risk score 3 | Manages $500K+ | 4527 Copiers | VIEW 76% of retail CFD accounts lose money |

Jay Edward Smith | Gain 17.94% | Risk score 5 | Manages $500K+ | 14899 Copiers | VIEW 76% of retail CFD accounts lose money |

*Total Gain calculations do not guarantee future profits.

Check out these traders to see if their investment strategies align with your goals. Not only do these traders generate impressive gains, an added bonus is their help to others by sharing their strategies and thoughts on their Etoro social feed.

Main Variables That Build Trust in a Pro Trader

1. Drawdown stats,

2. Risk level,

3. Consistency of profits,

4. The length of their trading history,

5. The number of current copiers.

Note that our table does not include profits as this should not be a defining factor in your decision to copy a trader. As with any broker or trader, you’re still investing your money and are responsible for any profits or losses you may encounter.

What is copy trading a.k.a social trading and how does it work?

Copy trading is a form of trading where the market positions of one trader are copied by other traders. It allows individuals to align part of their portfolio with experienced traders and take advantage of their market knowledge.

Experienced traders whose investments are copied are called popular investors. They act as de-facto portfolio managers. However, as a copier you do not give any money to pro traders, you only copy the market actions they take.

That means when they enter the market and buy, you buy. When they’ve done the analysis to sell, you sell. This process can be automatic or manual. With eToro the positions are copied automatically.

Trade copying is a passive form of investing where you’re relying on someone else’s expertise.

Similar to a more active approach like trading manually, copy trading is also about analyzing graphs and data. However, copy traders focus on analyzing past performances of other traders instead of market movements.

The number of copy traders following an experienced trader is unlimited. As a trader’s portfolio performs better, they’ll likely see an increase in individuals copying their market positions.

What are the pros and cons of copy trading?

Pros

✅ Great for individuals who don’t have the time or knowledge to trade independently.

✅ Allows investors to diversify their portfolio into markets they’re unfamiliar with.

✅ Perfect for beginners looking to learn from experienced traders.

✅ Ability to learn from successful traders and how they manage their portfolios.

Cons

❌ Not a risk-free way of investing as your money is tied to the decision of another trader who may or may not make a profit.

❌ Copy trading can inhibit traders from learning about the markets and instead spend their time learning about other traders.

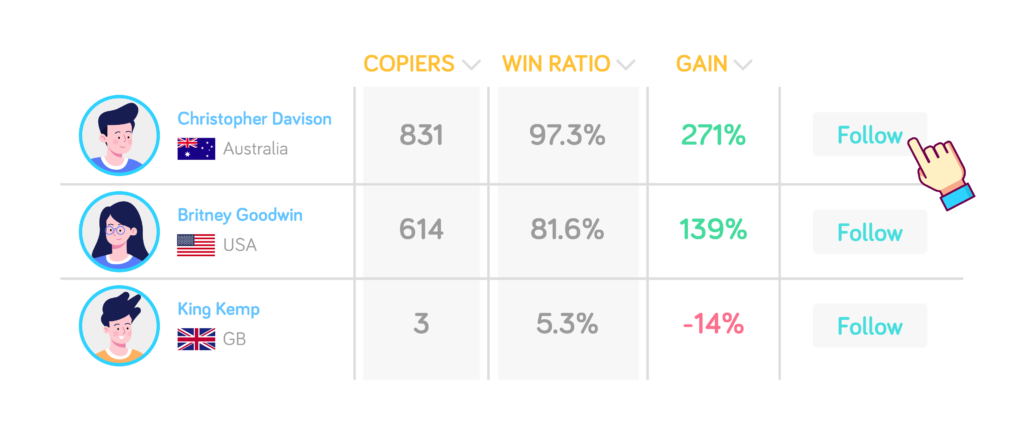

How to find the best traders to copy?

Before copying other traders, it’s important to do your research. Look out for the following elements to find the best traders to copy:

✅ Performance history. What has the trader’s performance been over the last 12 months? How was their performance when the market was bullish or bearish?

✅ Returns. What are the returns of the trader? Are the returns consistent or sporadic?

✅ Number of copiers. How many other investors are following or copying this trader? Is the number of copiers going up or down?

✅ Risk level. What is the trader’s risk level? What assets is the individual trading? Remember, don’t risk money you can’t afford to lose.

On trading platforms such as eToro, you’ll find this information on their profile dashboard. Trader ranking is based on their portfolio’s return, how many copiers they have, or if they have been specifically selected by the editors of the platform. You’ll find everything from pro forex traders to pro crypto traders, long-term investors, and day traders. Choose what suits your needs best.

FAQs

Is copy trading profitable?

As with all investment opportunities, there’s potential to make or lose money with copy trading. Yes, copy trading can be profitable. However, there’s always a risk of losing money if the trader you copy makes a loss. Do not trade with money you are unable to lose.

Is copy trading legal?

Yes, copy trading is legal in most countries around the world. However, always make sure you’re trading with a legally regulated broker.

What should you know before copy trading?

It’s important to do your own market research before copying a trader. At a minimum, you should know how a particular asset works and what trends and triggers you should look out for.

If you’re new to forex trading then take a look at our free Forex trading school. You’ll learn everything from what influences exchange rates to the best analyses you can conduct on the forex market.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Copy Tading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Past performance is not an indication of future results.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

Zero commission means that no broker fee will be charged when opening or closing the position and does not apply to short or leveraged positions. Other fees apply including FX fees on non-USD deposits and withdrawals. Your capital is at risk. For more information, click here.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.