So, you're curious about forex. At its core, a forex trading course for beginners will teach you one simple idea: you're swapping one country's currency for another. Think of it like swapping your dollars for euros before a trip to Paris, but you're doing it on a massive digital stage to try and make money from the changing values between them.

What Is Forex Trading Anyway?

Welcome to the foreign exchange market- or "forex" for short. This isn't just another financial market; it's the biggest one on the planet. Trillions of dollars change hands here every single day.

Unlike the stock market, which has opening and closing bells, the forex market is a 24/7 party that runs five days a week. This nonstop action creates a constant stream of opportunities for traders all over the globe, from London to Tokyo.

When you trade forex, you're not actually buying a physical thing. You're speculating. It's like making an educated guess on where a currency's value is headed. If you think the Euro is about to get stronger against the US Dollar, you'd "buy" the EUR/USD pair. If you're right, you pocket a profit.

The Sheer Scale of the Forex Market

It's hard to get your head around just how massive the forex market is. It makes all the world's stock markets combined look tiny. As of April 2025, the daily trading volume hit a mind-blowing $9.6 trillion. That's enough money to buy Apple Inc. three times over, every single day!

You might think it's all big banks and suits, but individual traders like us make up about 2.5% of that volume. That still adds up to roughly 9.6 million regular people trading worldwide, and get this- a surprising 27% are in the 18-34 age group.

This incredible scale is what allows for legendary moves. Think of George Soros, the investor who famously "broke the Bank of England." He bet against the British pound and reportedly made over $1 billion in a single day. While that's like winning the lottery, it shows the power of this market.

"I'm only rich because I know when I'm wrong…I basically have survived by recognizing my mistakes." – George Soros

Getting to Grips With the Lingo

At the heart of forex are currency pairs. You're never just buying one currency; you're always trading one against another. It's like a constant tug-of-war.

To get started, you need to speak the language. Here's a quick cheat sheet for the terms you'll see everywhere.

Your Quick Guide to Forex Terms

| Term | Simple Explanation |

|---|---|

| Pip | The tiny little price move a currency pair can make. It's how you count your profits and losses. |

| Leverage | Basically, borrowing money from your broker to trade bigger positions. It's like using a power-up, but it's risky! |

| Spread | The small difference between the buy price and the sell price. This is how the broker makes a little money on each trade. |

| Lot | A standard unit of currency. Think of it like buying a "box" of currency. |

| Long/Short | "Going long" means you're buying, betting the price will go up. "Going short" means you're selling, betting it will fall. |

These are the building blocks. Getting comfortable with them is your first real step toward understanding what you see on the screen.

The Main Players: Major, Minor, and Exotic Pairs

Not all currency pairs are created equal. They fall into three main groups:

- Majors: These are the A-listers, the most traded pairs in the world. They always have the US Dollar (USD) in them. Think EUR/USD, USD/JPY, or GBP/USD. They're popular because they're busy and have lower fees.

- Minors: Also called "cross-currency pairs," these guys feature other big currencies, just not the US Dollar. A classic example is EUR/GBP or EUR/JPY.

- Exotics: This is where things get wild. An exotic pair matches a major currency with one from a smaller economy, like USD/TRY (US Dollar vs. Turkish Lira). They can be super unpredictable, so it's best to leave them alone until you know what you're doing.

The prices of these pairs are always moving, pushed around by everything from economic news and interest rates to political drama. Your job as a trader is to sort through this info and predict where the price is headed next.

If you want to dive deeper into trading basics, a great place to start is vtrader.io's Trading Academy. They break down these core ideas in a way that's easy to get.

Setting Up Your Trading Headquarters

Before you can even think about your first trade, you need to set up your mission control. This means getting a reliable broker and a solid platform. A broker is your ticket to the forex market; you literally can't get in without one.

Picking the right broker is a huge deal. This isn't like choosing a new phone- it's your hard-earned money on the line. The number one thing you need to look for is regulation. A regulated broker has a financial watchdog making sure they play fair, which gives you a crucial layer of protection.

Your Broker Checklist

Don't just sign up with the first broker you see with a flashy ad. You need to do your homework and compare the stuff that actually matters.

Here’s a quick rundown of what to look for:

- Rock-Solid Regulation: Is the broker watched by a big financial authority like the FCA in the UK or ASIC in Australia? This is a must-have, no excuses.

- Low Fees (Spreads): Brokers make their money from the 'spread'- a tiny fee in each trade. You want tight spreads so fees don't slowly eat your profits.

- A Great Platform: Is their trading software easy to use? Most beginners start with MetaTrader 4 (MT4). It's the industry standard for a reason: it's reliable, powerful, and pretty simple to learn.

- Helpful Support: When something goes wrong (and it will), you want to know you can reach a real person who can help. Check if they have good customer support before you sign up.

The Power of a Demo Account

Once you've picked a broker that ticks all the boxes, your next step is not to deposit real money. I can't say this enough. Instead, open a demo account.

Think of it as a flight simulator for traders. You get to play with a big stack of fake money, but you're trading in real, live market conditions. This is where you’ll learn the platform, test your first strategies, and make all your beginner mistakes without losing a single real dollar. It’s a critical step.

Shockingly, tons of new traders skip this. Data shows that around 72% of traders jump straight into live accounts without ever using a demo. This is a big reason why only about 15% of retail traders end up profitable. You can see more details about forex trading statistics and success rates on Moneyzine.com.

By starting with a demo, you're immediately putting yourself ahead of the game. You're building priceless confidence and learning how the market really moves.

As you get your setup ready, it's also smart to see how people in other markets pick their platforms. For a different perspective, check out some of the best cryptocurrency exchanges for beginners to see what features they prioritize. It gives you a bigger picture of what makes a great trading home base.

How to Actually Read the Market

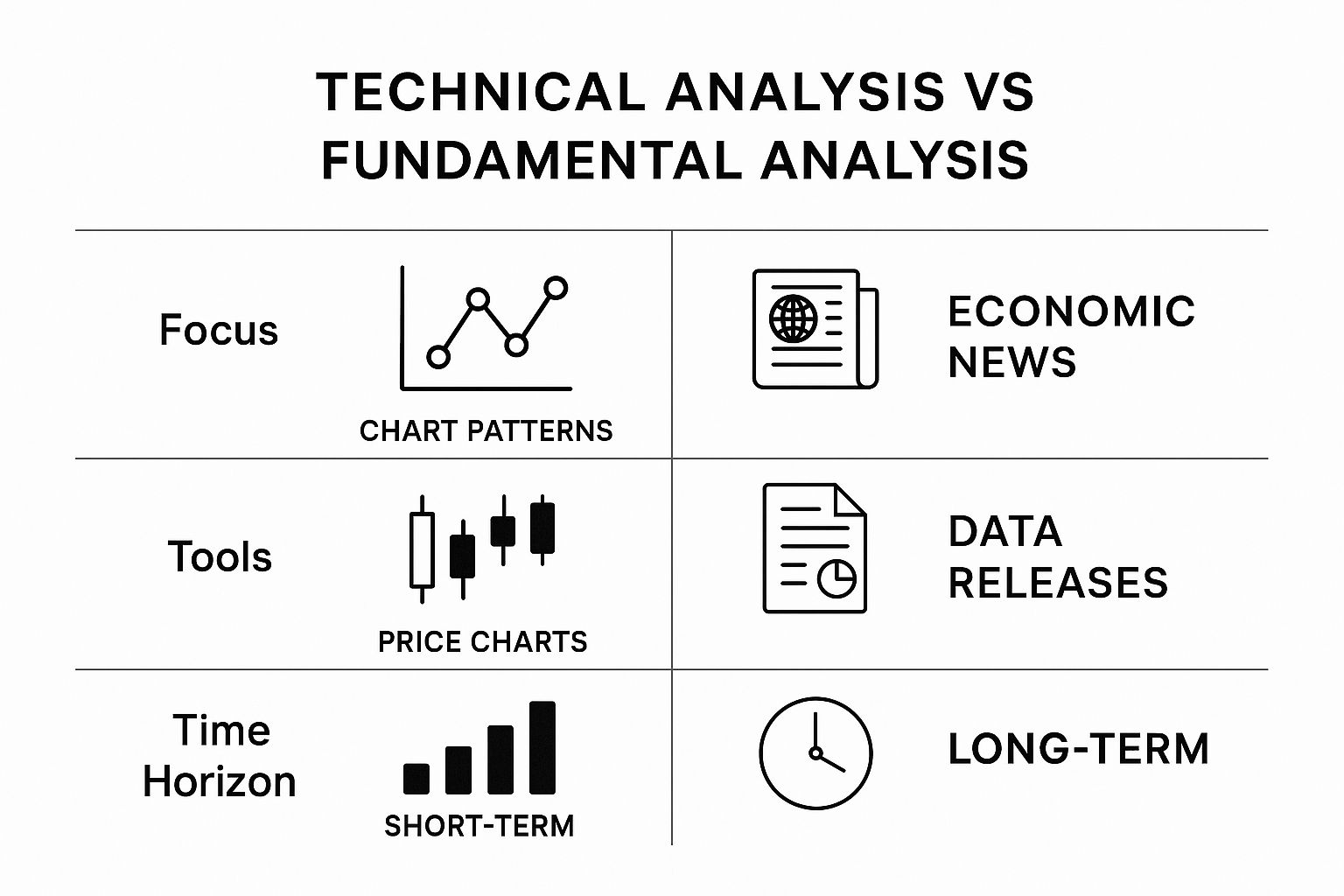

So, how do traders decide when to hit "buy" or "sell"? It's definitely not a lucky guess. They're reading the market's mood using two main methods: technical analysis and fundamental analysis.

Imagine you're a detective. You could analyze fingerprints and clues at the crime scene- that's technical analysis. Or, you could interview witnesses and check alibis to understand the motive- that's fundamental analysis. The best detectives, and the best traders, learn how to do both.

The Chart Detective Approach

Technical analysis is all about studying price charts. The idea here is simple: everything you need to know, from a news event to a trader's emotions, is already shown in the price you see on the screen.

You're basically a chart detective, looking for patterns and trends that hint at where the price might go next. This isn't just for forex; it's a universal language for markets. You're looking for repeating patterns of human psychology played out on a chart.

One of the first things you'll learn is support and resistance.

- Support: This is like an invisible floor where the price seems to stop falling and bounce back up.

- Resistance: This is the invisible ceiling where the price struggles to push higher and often gets knocked back down.

Spotting these levels is a basic skill for any trader. If you want to really get the hang of it, our detailed article on how to read forex charts is the perfect next step.

The Economic Journalist Approach

On the other side, we have fundamental analysis. This is less about charts and more like being an economic journalist. You zoom out to look at the big picture- the real-world events and data that can make a currency's value swing like crazy.

This means you're glued to the economic calendar, watching for big news releases that can move the market. These are your heavy hitters:

- Interest rate decisions from central banks

- Monthly unemployment numbers

- Gross Domestic Product (GDP) reports

A single comment from the head of the U.S. Federal Reserve can send the dollar soaring or crashing in minutes. Fundamental traders try to get ahead of these moves by digging into a country's economic health.

"The key to making money in stocks is not to get scared out of them." – Peter Lynch

This quote from legendary investor Peter Lynch is just as true for forex. When you understand the fundamental reasons why a currency is strong or weak, you have the confidence to stick with your trade, even when things get rocky.

Technical vs Fundamental Analysis At a Glance

Here’s a quick comparison to help you see the core differences between being a chart detective and an economic journalist.

| Feature | Technical Analysis | Fundamental Analysis |

|---|---|---|

| Primary Tool | Price Charts | Economic Data & News |

| Core Focus | "When" to trade (timing your moves) | "What" to trade (finding value) |

| Time Horizon | Short to medium-term | Medium to long-term |

| Key Question | "What is the price doing?" | "Why is the price doing it?" |

| Example | Buying when price bounces off a support level | Buying a currency after a good GDP report |

As you can see, your choice often comes down to your personality. Day traders who are in and out quickly often lean on technicals, while long-term investors might focus more on fundamentals.

Ultimately, this isn't about which one is "better." The most successful traders I know don't pick a side; they blend both.

They might use fundamental analysis to get a big-picture idea- "Okay, the Eurozone economy looks strong, so I want to be buying EUR"- and then use technical analysis to find the exact moment to enter that trade. This powerful combo gives you a much better view of the market.

Protecting Your Money Is Your First Job

Let's get one thing straight. The most important lesson you'll learn isn't about hitting a massive home run on a trade. It’s about staying in the game long enough to even get a chance to win.

Your first job isn't to make money; it's to protect the money you already have. This is risk management, and it's the biggest difference between traders who last and those who blow up their accounts in a week.

The Golden Rule of Risk

So, how do you protect your cash? It all comes down to one simple rule you must follow on every single trade.

Never, ever risk more than 1-2% of your total account balance on one idea.

If you have a $1,000 account, the absolute most you should be willing to lose on any single trade is $10-$20. That's it. It feels small, maybe even boring, but it's the secret sauce. It means one bad trade won't wipe you out. It means you can be wrong five or six times in a row and still be in the game, ready for the next chance.

Your Automated Safety Nets

Luckily, your trading platform has tools to enforce this discipline for you. Think of them as your personal bodyguards, protecting you from taking big hits.

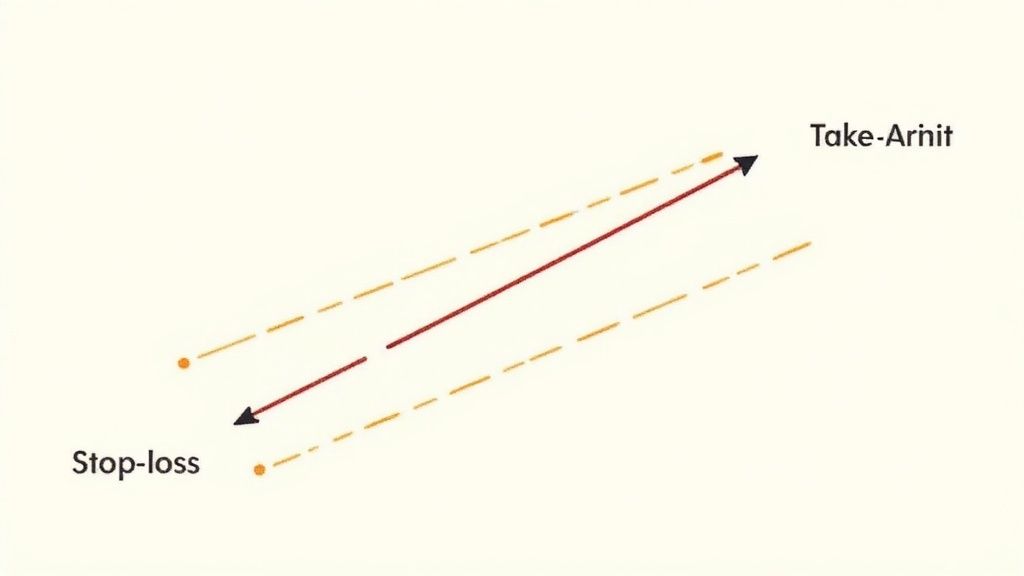

The two most important are the Stop-Loss and the Take-Profit order.

- Stop-Loss Order: This is your eject button. You set a price where your trade will automatically close if the market moves against you. It’s your pre-set maximum loss, making sure a small mistake doesn't become a disaster.

- Take-Profit Order: This is the other side. It’s an order to automatically close your trade once it hits a certain profit target. This locks in your wins before the market can change its mind and take them back.

Using these tools on every single trade isn't optional; it's essential. They take emotion out of the equation and force you to stick to your plan. You can practice setting them up with zero risk by learning what is paper trading in a demo account.

The Power of Risk-to-Reward

Now, let's tie this all together with the risk-to-reward ratio. This is just a way of making sure your potential wins are consistently bigger than your potential losses.

Imagine you're risking $10 on a trade (your stop-loss). A good goal is to aim for a profit of at least $20 or $30 (your take-profit). This gives you a 1:2 or 1:3 risk-to-reward ratio.

Why is this so powerful? Because it means you don't even have to be right half the time to make money. With a 1:2 ratio, you could win only 40% of your trades and still come out profitable. This is how pros think- not in single trades, but in probabilities over the long haul.

"The most important rule of trading is to play great defense, not great offense." – Paul Tudor Jones

This quote from legendary trader Paul Tudor Jones sums it up perfectly. Focus on protecting your money. The profits will follow.

Creating Your First Simple Trading Plan

Alright, let's get serious. The single biggest thing that separates disciplined traders from gamblers is a trading plan.

Jumping into the market without a plan is like trying to explore a new city without a map. You'll make a lot of wrong turns, get frustrated, and probably end up lost. It's a recipe for disaster.

Your trading plan is your personal rulebook. It's the calm voice of reason you listen to when the market gets wild and your emotions are screaming at you to do something stupid. Even a basic plan is way better than just winging it. We're not trying to write a novel here- the goal is to build discipline from day one.

The Core Questions Your Plan Must Answer

A good trading plan doesn't have to be complicated. Simple is often better when you're starting out. It just needs to give clear answers to a few key questions that will guide every move you make.

Think of this as your starting template- a foundation you'll build on as you practice in your demo account.

- What pairs will I trade? Don't try to watch every currency on the planet. Pick just one or two major pairs to start, like EUR/USD or GBP/USD. Get to know how they move.

- What times will I trade? The market runs 24/5, but you can't. You need to sleep. Focus on a specific trading session when things are busy, like the London or New York open. Stick to that window.

- What's my signal to enter? This has to be crystal clear. Define the exact conditions you need to see before you click "buy" or "sell." Is it the price bouncing off a support level? A specific pattern? Write it down.

- When do I get out? Honestly, this is the most important part. You must know your exit points before you ever enter a trade. Where is your stop-loss (your "I was wrong" point) and where is your take-profit (your target)? No exceptions.

A plan removes the guesswork. When your predefined signal shows up, you trade. If it doesn't, you do nothing. It’s that simple, but it's the hardest part for most new traders to master.

This structured approach is what separates amateurs from the pros. In the United States alone, there are now about 1.3 million forex traders. The average age is 43, which tells you that this is a game where mature discipline really pays off. You can see more details on the demographics of US forex traders on bestbrokers.com.

From Plan to Practice

Now you’ve got a basic framework. The next step is to test it- in your demo account, of course. For every single trade you take, log it in a journal.

Jot down why you entered, what the plan was, and what happened. This simple act creates a powerful feedback loop. You'll quickly see what’s working and what isn't.

Maybe you'll find out your entry signal only works well during the London session, or that your profit targets are a bit too high for the current market. This is how you get better. You make a plan, test it with zero risk, look at the results, and tweak the plan. This cycle is the real "secret" to finding your edge.

Your Top Forex Trading Questions, Answered

Got more questions? Perfect. Curiosity is what separates good traders from great ones. Let's tackle some of the most common things beginners ask.

How Much Money Do I Need to Start Trading?

This is the big one, and the answer is probably less than you think. You don't need a huge pile of cash. Many brokers let you open an account with as little as $100, thanks to something called leverage.

But the better question is, how much should you start with? I'd suggest aiming for around $500. This gives you enough breathing room to actually practice good risk management without freaking out over every little market move. The golden rule is simple: never, ever trade with money you can't afford to lose.

Isn't Forex Trading Just Gambling?

It's only gambling if you treat it that way. If you're just clicking "buy" and "sell" based on a gut feeling and hoping for the best, then yeah, you might as well be at a casino.

Real trading is the opposite. It's about having a tested strategy, managing your risk on every single trade, and making decisions based on solid analysis- not blind hope. It's a game of skill and probability, not just rolling the dice. Fun fact: even poker pros like Daniel Negreanu use similar skills- they don't just hope for good cards, they manage their bankroll and read their opponents to tilt the odds in their favor.

"The stock market is a device for transferring money from the impatient to the patient." – Warren Buffett

That classic quote is just as true for forex. A solid plan and a healthy dose of patience are what separate a serious trader from a gambler.

Can I Actually Get Rich from Forex?

It's possible, sure, but it won't happen overnight. Forget the flashy Instagram posts with rented Lamborghinis. Building real, lasting wealth from trading is a marathon, not a sprint.

Think of it this way: the legendary George Soros, a guy famous for making a billion dollars on a single trade, built his fortune over decades of hard work. The real goal isn't one huge win; it's being consistently profitable. If you can focus on making smart, disciplined trades day after day, your account will grow steadily over time. That's the power of compounding at work.

Ready to build your trading skills the right way? At financeillustrated.com, our free Trading School is designed to get you up to speed fast. Dive into our bite-sized lessons, practice with risk-free simulators, and start your journey with confidence at https://financeillustrated.com.