Ever wish you could hit "undo" on a bad decision? In the stock market, you can’t. But what if you could practice trading without the stomach-churning stress of losing real money? That's exactly what paper trading is for.

Imagine playing a high-stakes poker game, but with monopoly money. Paper trading is a simulation that lets you buy and sell stocks, crypto, and other assets using fake money in a real-time market environment. It's the perfect way for a beginner to get their feet wet and practice their moves without risking a single actual dollar.

Your Personal Stock Market Sandbox

Think of it like a flight simulator for a pilot or a scrimmage before the big game. It’s a dedicated space where you can get comfortable with a trading platform, figure out how market orders really work, and watch your decisions play out with zero financial consequences.

This isn't some new idea. The legendary trader Jesse Livermore – one of the most famous speculators of all time – reportedly got his start by mentally "trading" the stock prices he saw ticking by on the tape. That was just an old-school, manual version of what we do today.

In fact, it's become a standard first step for new traders. One study found that over 60% of new retail traders in the United States jump into a paper trading platform before putting their own capital on the line. It's just a smarter way to learn. You can find more insights about paper trading and its growing popularity online.

To give you a better idea of what we're talking about, here's a quick summary.

Paper Trading at a Glance

This table breaks down the core components of paper trading into simple terms.

| Feature | Description |

|---|---|

| Environment | A simulated trading platform that mirrors a real brokerage account. |

| Capital | You're given a virtual cash balance (e.g., $100,000) to trade with. No real money is ever at risk. |

| Market Data | Uses real-time or slightly delayed data from actual stock exchanges like the NYSE and NASDAQ. |

| Primary Goal | To practice trading strategies, learn platform mechanics, and build confidence without financial loss. |

| Key Benefit | A completely risk-free educational tool. |

| Main Drawback | Doesn't replicate the real emotional pressure of having your own money on the line. |

Essentially, it's the ultimate "try before you buy" experience for the stock market.

What Does a Paper Trading Account Look Like?

Most modern paper trading platforms are designed to look and feel exactly like a real brokerage account. This screenshot from Investopedia shows a pretty standard paper trading interface.

You've got your portfolio balance, live stock charts, and the same buttons to buy or sell that you'd find in a live account. The only difference? That account balance is just for show. It’s all virtual, which lets you click "buy" and "sell" without a second thought.

The whole point is to build muscle memory and sharpen your strategic thinking. As the investing icon Benjamin Graham famously said, "The investor's chief problem – and even his worst enemy – is likely to be himself."

Paper trading gives you a safe arena to face that challenge head-on. It helps you learn to control your impulses and stick to a plan – the perfect foundation for anyone hoping to build the skills and confidence needed to step into the real market.

The Real Benefits of Practicing with Virtual Money

So, why would anyone bother trading with fake money? Simple: it’s your personal, zero-risk sandbox. This is where you get to build confidence, test-drive different investing styles, and make all the classic rookie mistakes without losing a single real dollar.

Think of it as a flight simulator for traders. You learn the ropes and figure out the technical side of placing orders – like the difference between a “market order” and a “limit order” – when the stakes are literally zero. It’s your chance to rehearse before the big show.

“The beautiful thing about learning is that nobody can take it away from you.” – B.B. King

That quote wasn’t about the stock market, but it hits the nail on the head. The knowledge you bank from practicing is yours forever. The losses? They're completely imaginary. It's a pretty powerful trade-off.

Mastering Your Mindset and Skills

Beyond just clicking buttons, paper trading is where you forge the discipline and emotional control every real trader needs. It's like a basketball player shooting hundreds of free throws in an empty gym. That repetition builds the muscle memory and mental toughness required to perform under pressure.

It’s the perfect place to explore different strategies and see what fits your personality:

- Day Trading: Get a feel for the lightning-fast pace of buying and selling within the same day.

- Swing Trading: Learn to hold positions for a few days or weeks to catch those short-term market "swings."

- Long-Term Investing: Practice the art of buying and holding quality assets, focusing on the big picture just like the pros.

Even seasoned pros know the power of practice. Mark Cuban, the billionaire owner of the Dallas Mavericks, famously reads for hours every day to keep his edge. Paper trading is your active-learning equivalent. It’s how you prepare for the real game.

Ultimately, the goal is to get a genuine feel for the market's natural ups and downs in a completely safe space. By mastering the tools and getting a handle on market psychology first, you’re building a solid foundation before you ever put your own money on the line. Honestly, it's the smartest first step you can possibly take.

Choosing The Best Paper Trading Platform

Alright, you're ready to jump in and practice, but where do you even start? Picking a paper trading platform is a bit like choosing your first car. They all get you on the road, but some have more horsepower, better handling, or just a dashboard that makes sense to you.

Not every simulator is built the same, and the one you pick will absolutely shape how you learn. The goal is to find a platform that clicks with what you want to achieve. Are you just trying to get the hang of buying and selling stocks? Or are you aiming higher, wanting to test-drive complex options strategies with professional-grade tools?

What To Look For In A Simulator

As you shop around, there are a few features that are non-negotiable. First and foremost, you need real-time or near-real-time market data. Practicing with prices from 20 minutes ago is like trying to learn baseball with a massive video delay – it’s just not going to prepare you for the real game.

Next, look at the variety of assets available. Some simulators are pretty basic and only offer stocks. Others let you experiment with everything from crypto and forex to options and futures. A clean, intuitive interface is also huge. You want to spend your time learning how to trade, not getting frustrated with confusing menus.

Finally, don't forget the fun factor! Exploring different trading games can be a surprisingly effective way to build your skills. For a deeper look, check out our guide on the 2024-2025 must-have stock market games for traders.

A high-quality platform like TradingView will give you an interface packed with powerful charting tools for analyzing market movements.

Getting comfortable with powerful charts like this is key. It allows you to practice technical analysis, a core skill for countless professional traders.

Top Paper Trading Platforms For Beginners

To help you narrow down the options, I've put together a quick comparison of a few popular platforms that are great for beginners. Each has its own strengths, so think about which one aligns best with your learning style.

| Platform | Best For | Key Feature |

|---|---|---|

| TradingView | Charting and social trading | Incredible, easy-to-use charts and a huge community. |

| thinkorswim | Serious, in-depth strategy testing | Professional-grade tools that mimic a real brokerage desk. |

| eToro | Beginners interested in copy trading | Simple interface and the ability to simulate copying pros. |

Ultimately, choosing the right tool is your first real trade, so don't rush it. Take a couple for a spin, see what feels right, and pick the one that makes learning feel less like a chore and more like a game you’re determined to win.

Your First Paper Trade in Four Easy Steps

Ready to jump in? Getting started with paper trading is a lot simpler than most people think. We'll walk you through it, step-by-step, so you can place your first practice trade in just a few minutes.

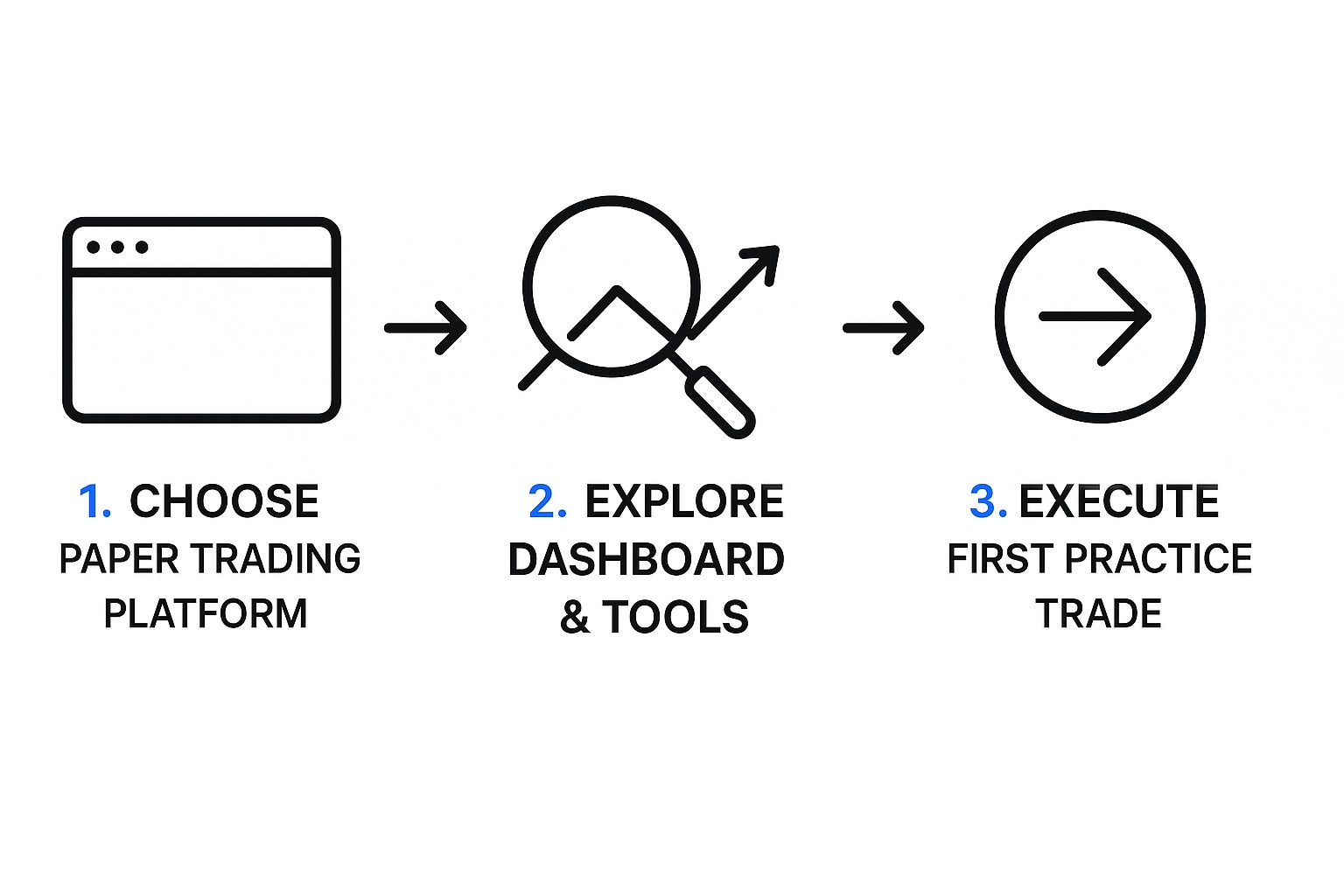

The whole point is to make this process feel welcoming, not intimidating. This infographic breaks down the basic flow, from picking your platform to making that first move.

As you can see, you don't need a massive instruction manual to learn the ropes. It’s all about taking one small step at a time and building up your confidence along the way.

Step 1: Pick Your Platform

First things first, you need a playground. Look back at our recommendations and choose a platform that clicks with you.

Maybe you love the slick charts on TradingView, or perhaps the professional-grade tools on thinkorswim catch your eye. There’s no wrong answer here – just find one you genuinely enjoy using.

Step 2: Create Your Virtual Account

Got your platform? Great. Now, sign up for your free virtual account. This is usually a quick, five-minute process that just needs an email.

Once you're in, the platform will typically drop a hefty sum of virtual cash into your account, often $100,000, to get you started.

Step 3: Explore the Dashboard

Hold on – don't start buying just yet. Take a few minutes to get your bearings.

Click around the dashboard, play with the charting tools, and locate the buy and sell buttons. Getting comfortable with the layout now will save you from fumbling around later when you need to act fast.

Step 4: Place Your First Practice Trade

Alright, it's go-time. Pick a company you already know and are interested in, like Apple (AAPL) or Nike (NKE), and place your first trade.

The most important part? Treat this virtual money like it’s real. This single habit will help you build the right mindset from day one.

Common Paper Trading Mistakes and How to Avoid Them

Paper trading is an incredible tool, but it's far from a perfect mirror of the real market. Think of it like a flight simulator – it teaches you the controls, but it can't replicate the feeling of hitting real turbulence. The biggest trap is that without any real skin in the game, it's easy to develop some seriously bad habits.

The number one pitfall? The complete absence of real emotions. You simply don't feel that gut-punch of panic on a losing trade or the electric thrill of a big win when you’re not risking actual money. This emotional disconnect often leads to a false sense of security, encouraging you to make reckless bets you’d never dream of with your own savings.

"The four most dangerous words in investing are: 'This time it's different.'" – Sir John Templeton

This classic quote perfectly nails the overconfidence that can build up. A few lucky wins with fake money might make you feel like a market wizard, but the real market has a way of humbling everyone.

Treating It Like a Game Instead of Training

It’s tempting to start making huge, unrealistic bets just for the fun of it – a "Monopoly money" mindset. While entertaining, this is a massive mistake. The goal here isn't to get the highest score; it's to build real-world discipline and test strategies that will actually work.

To sidestep this, you have to treat it like serious training. Here’s how:

- Set Realistic Capital: Forget the default million-dollar account. Knock your virtual balance down to an amount you would genuinely invest, whether that's $1,000 or $5,000.

- Factor in Trading Costs: Most simulators conveniently ignore commissions and fees. Manually deduct a few dollars for each trade to see how those costs eat into your profits.

- Keep a Trading Journal: Don't just click buttons. For every trade, write down why you made it. This forces you to be strategic rather than just gambling.

While paper trading can't fully capture the emotional rollercoaster, it's fantastic for nailing the technical side of things. Modern platforms mimic real-time price action and market depth, which is a huge advantage for sharpening your execution skills before you put cash on the line. Pros use these simulators all the time to refine their strategies without risk.

Ultimately, your success hinges on how seriously you take the simulation. Use it to forge a solid plan and cultivate discipline, and you'll be far better prepared for what the real markets throw at you. A great next step is to explore our guide on how to backtest trading strategies to further strengthen your approach.

Got Questions? Let's Get Them Answered.

If you've still got a few questions buzzing around, you're in the right place. Let's walk through some of the most common things new traders ask when they first hear about paper trading.

Is Paper Trading Really Free?

Yes, it absolutely is. The big brokerage platforms like TD Ameritrade and E*TRADE offer paper trading accounts at no cost. Even popular charting sites like TradingView have free versions.

Why? It’s simple: they want you to get comfortable with their platform. If you learn the ropes with them, you're much more likely to stick around when you're ready to put real money on the line. Bottom line: you should never have to pay for a basic paper trading account.

Can You Make Real Money From Paper Trading?

Nope, you can't cash out your paper profits. Since you're using virtual money, any gains you see are just part of the simulation. Think of it less like a job and more like an education.

The real "profit" you're making is in knowledge, experience, and confidence. Those are priceless assets when it's time to invest your hard-earned cash. As the legendary investor Warren Buffett put it, "The most important investment you can make is in yourself." Paper trading is a direct investment in your financial education.

How Long Should I Paper Trade?

There isn't a magic number, but a good rule of thumb is to practice for at least one to three months. The goal isn't just about marking days on a calendar – it's about hitting key milestones.

Before you even think about going live, you should be able to:

- Navigate your trading platform like the back of your hand.

- Build a clear, written-down trading plan.

- Actually follow that plan, day in and day out, for weeks.

You’re trying to prove to yourself that you have the discipline to make smart decisions when there’s zero pressure. Once you can do that consistently, you might just be ready for the real deal.

Ready to start your learning journey? The Finance Illustrated Trading School offers free, bite-sized lessons to build your skills in just 60 minutes. Practice what you learn with fun simulators and become a more confident trader today. Explore our free resources.