So, what's the real difference between ETFs and mutual funds? It really comes down to one simple thing: how you trade them. ETFs (Exchange-Traded Funds) trade all day on a stock exchange, just like a share of Tesla or Nike. On the other hand, you can only buy or sell mutual funds once per day, at a price that’s set after the market closes for the night.

Think of it this way: buying an ETF is like grabbing a snack from a vending machine-you can do it anytime you want, and the price is right there. A mutual fund is more like placing an order for pizza delivery-you place your order, but you have to wait until the end of the day for it to show up at a set price.

ETF vs Mutual Fund At a Glance

You're looking at these two popular ways to invest and wondering where to even begin. It might seem complicated, but the main idea for both is super simple. Both are basically "baskets" that hold a mix of investments, like stocks and bonds. This lets you own a bunch of different things at once without having to buy each one individually.

Instead of betting all your money on one company, you're buying a tiny piece of hundreds of them. The real debate isn't about which one holds "better" stuff; it's about how they work. And that small difference in how they operate changes everything, from how much they cost to how you can use them to build your wealth.

"The stock market is filled with individuals who know the price of everything, but the value of nothing." – Phillip Fisher

This classic quote reminds us to look beyond just the price tag. The way these funds are built can either help you stick to a smart plan or tempt you into making emotional mistakes. One gives you the power to react instantly to market drama, while the other encourages you to be more patient and chill.

Let's do a quick breakdown of the main differences.

Here is a quick summary of what sets ETFs and mutual funds apart.

| Feature | ETF (Exchange-Traded Fund) | Mutual Fund |

|---|---|---|

| Trading Style | Traded all day on a stock exchange, like a single stock. | Priced and traded only once per day after the market closes. |

| Typical Minimum Investment | As low as the price of one share (sometimes under $100). | Often requires a higher starting amount (like $1,000 to $3,000). |

| Cost (Expense Ratio) | Usually have lower fees, since many just copy the market. | Can have higher fees, especially if a manager is trying to be a stock-picking genius. |

| Best For | Hands-on investors who want flexibility and low costs. | "Set-it-and-forget-it" investors who prefer to automate their savings. |

This table gives you the bird's-eye view. Now, let's dive into what each of these points really means for your money.

Understanding the Building Blocks of Your Portfolio

Before we get into the weeds, let's get a feel for what ETFs and mutual funds really are. I like to think of them as investment playlists. Instead of trying to find every hit song one-by-one, you just buy a ready-made "Greatest Hits" album.

With one click, you can own a slice of hundreds of companies. This instant diversification is their superpower. It's like not putting all your eggs in one basket. Did you know that even rap mogul Jay-Z is a big believer in diversification? He didn't just stick to music; he invested in art, tech companies like Uber, and real estate. Spreading your risk is a key to building lasting wealth.

Even the most famous investor in the world, Warren Buffett, champions this idea, although he says it with his classic humor:

"Diversification is protection against ignorance. It makes very little sense for those who know what they're doing." – Warren Buffett

For most of us who aren't spending all day analyzing stocks, that "protection" is a lifesaver. ETFs and mutual funds are your straightforward ticket to owning a piece of the entire market.

The New Kid on the Block: ETFs

ETFs, which stands for Exchange-Traded Funds, are the more modern of the two. They showed up in the 90s and have become super popular, especially with younger investors.

Their main feature? They trade on a stock exchange, just like a share of Apple or Amazon. This means you can buy and sell them anytime during the day when the market is open (usually 9:30 AM to 4:00 PM EST). Their prices go up and down in real-time, giving you a ton of control.

The Original Portfolio-in-a-Box: Mutual Funds

Mutual funds are the old-school champs, the original workhorses of investing. They've been around for almost 100 years and became the foundation of retirement plans like 401(k)s. For a long time, they were the main way for regular people to invest for the future.

Here’s the main difference: mutual funds only trade once per day. All the buy and sell orders get bundled together and happen at a single price that's calculated after the market closes. This price is called the Net Asset Value (NAV). This system naturally makes you a more patient, long-term investor, since you can't panic-sell the second the market gets a little shaky.

The Trillion-Dollar Shift in How We Invest

The amount of money pouring into these funds is mind-blowing, and it tells a really interesting story. More and more, people are choosing simple, "passive" funds that just copy the market instead of "active" funds that try (and often fail) to be stock-picking heroes.

Just look at the numbers. The combined cash in U.S. ETFs and mutual funds has ballooned to a massive $34.87 trillion. Of that, $18.00 trillion is in simple index funds that just try to match the market. You can see the details in this report on combined asset flows.

This shows just how much people trust these tools to build wealth. Both are awesome, but the way they work creates different experiences and makes them better for different goals.

How Trading Fees and Taxes Impact Your Money

When you first start investing, it’s easy to get excited about finding the "perfect" stock. But the real secret to getting rich isn't just picking winners-it's about keeping what you earn. Fees and taxes are like silent partners that can take a surprisingly big bite out of your money over time.

Think of it like a subscription service you forgot about. A few bucks a month doesn't seem like much, but over years, it adds up to a ton of wasted money. Investment costs work the same way. A tiny fee can cost you thousands of dollars that could have been growing for you.

This is where the differences between ETFs and mutual funds really start to hit your wallet. Their unique structures lead to very different costs and taxes, which directly affects how much money you end up with. Let's see how this works in the real world.

Trading Flexibility and Associated Costs

One of the first things you'll notice is how you buy and sell these funds. ETFs trade just like stocks-you can buy or sell them anytime the market is open, watching prices change by the second. This gives you laser-point control.

Mutual funds are different. They only trade once per day, after the market closes, at a calculated price called the Net Asset Value (NAV). All the buy and sell orders from that day get processed at that one price. It’s a small detail with big effects on your investing style.

- ETFs offer instant access: If you see the market dip and want to buy, or need to sell your shares fast, you can do it right away. This flexibility is a huge plus for more active investors.

- Mutual funds build discipline: The once-a-day pricing stops you from making rash decisions based on market drama. For many, this forced patience is a feature, not a bug.

This all-day trading for ETFs does come with a small catch, though. You'll probably run into the bid-ask spread-a tiny price difference between what buyers are willing to pay and what sellers are willing to accept. For popular ETFs, it's often just a penny, but it's still a small cost to be aware of.

The Power of Low Fees

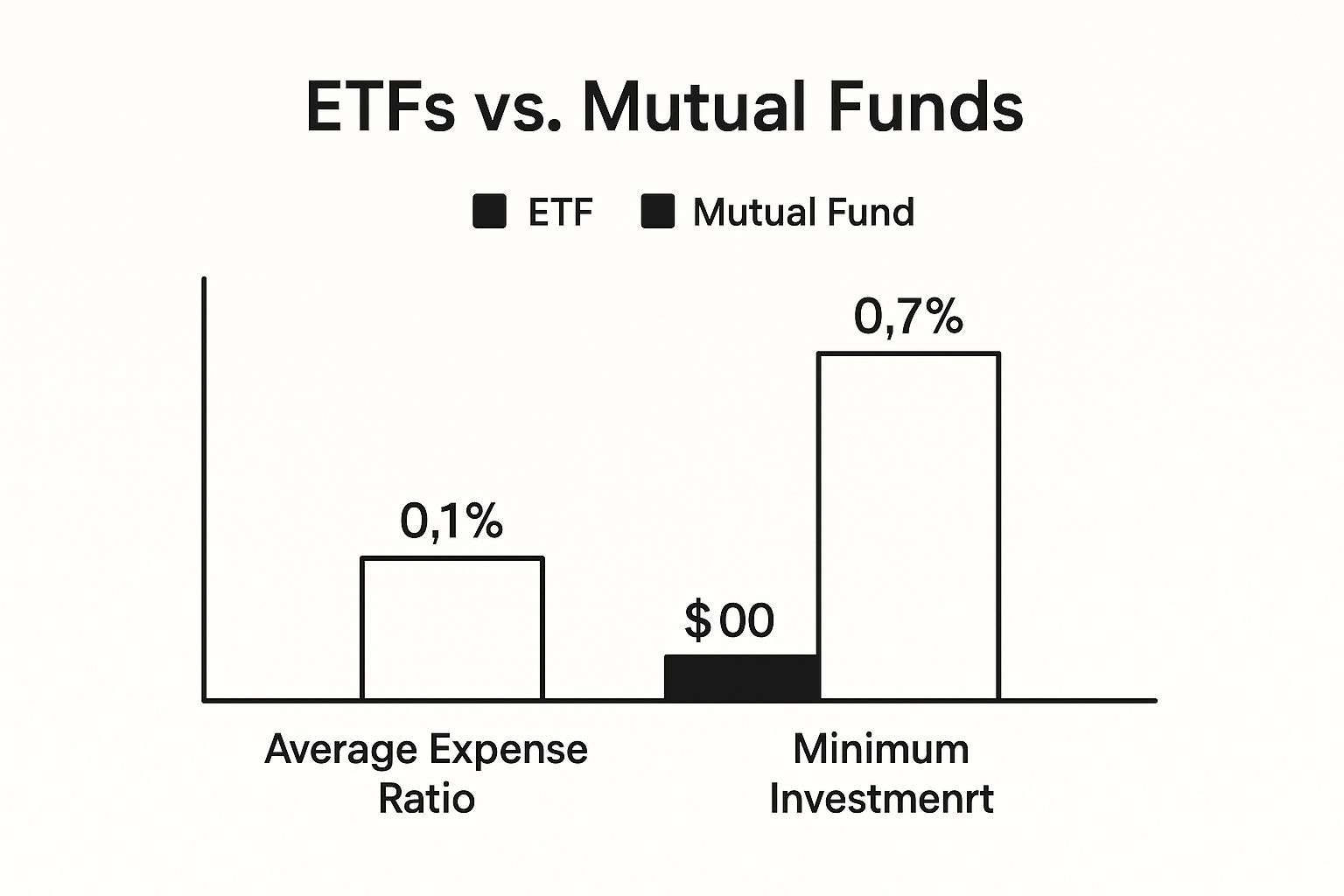

The biggest and most important cost is almost always the expense ratio. This is an annual fee, charged as a percentage of your investment, that covers the fund's operating costs. And this is where ETFs usually win.

ETFs, especially simple "passive" ones that just track an index like the S&P 500, are famous for their super-low expense ratios. On the other hand, many mutual funds, especially those with managers actively trying to beat the market, charge a lot more for that service.

"The miracle of compounding returns is overwhelmed by the tyranny of compounding costs." – John C. Bogle, Founder of Vanguard

That quote from the guy who basically invented index investing says it all. A small difference in fees might not seem like a big deal in one year, but over decades, it can have a huge impact on your final account balance. Less money paid in fees means more money is left working for you.

This chart makes the point crystal clear, showing how different the average costs and starting amounts can be.

As you can see, ETFs usually make it easier and cheaper to get started, both in how much you need upfront and how much it costs you each year.

The Hidden Advantage of Tax Efficiency

Here’s a secret weapon that many new investors miss: taxes. When a fund manager sells a stock inside the fund for a profit, that profit-a capital gain-gets passed on to you. And guess what? You owe taxes on it, even if you never sold a single share yourself.

This is where ETFs have a superpower. Because of the clever way they are built, ETFs are masters at avoiding these taxable events. They can swap stocks in and out without "selling" them in a way that creates a tax bill for you.

The numbers are pretty wild. In 2024, only 5.08% of stock ETFs had to pay out taxable capital gains. Compare that to a whopping 64.82% of stock mutual funds. With an ETF, you usually only pay capital gains tax when you decide to sell, giving you way more control. To make sure you're being as smart as possible with your money, it's always good to stay informed about investment tax. Over a lifetime, this tax advantage can save you a fortune.

Active vs. Passive: The Real Battle for Your Returns

When you get right down to it, the "ETF vs. mutual fund" debate is really about a much bigger fight: active versus passive investing. This is the real tug-of-war for your money, and figuring out which team you're on is key to making smart choices.

Think of it like this. An active manager is like a celebrity chef trying to invent a new, mind-blowing dish. A passive manager is like a chef who perfectly follows a classic, beloved recipe every single time.

Most ETFs are firmly on the passive team. They don’t try to be heroes. Their one job is to perfectly copy a market index, like the famous S&P 500. If the S&P 500 goes up 10%, the ETF aims to give you a 10% return (minus a tiny fee).

In the other corner, many mutual funds are active. They’re run by professional managers who hand-pick investments they think will crush the market. They're trying to be better than average, and you pay them a higher fee for that effort.

The Surprising Truth About Beating the Market

So, who wins more often? The highly-paid expert trying to find the next big thing, or the simple fund that just copies everyone else? The answer might shock you. Over and over, studies show the same thing: the vast majority of active fund managers fail to beat their simple, passive competition over the long run.

It feels weird, right? You'd think paying more for an expert should get you better results, but in investing, it usually doesn't. It’s like paying extra for a "gourmet" burger only to find out the classic one from the diner next door tastes better and costs half as much.

This simple truth is what made investing legends like John C. Bogle, the founder of Vanguard, so famous. He built a massive company on what was, at the time, a crazy idea.

"Don't look for the needle in the haystack. Just buy the haystack." – John C. Bogle

Bogle's idea was beautiful in its simplicity: instead of trying (and probably failing) to pick the few winning stocks, just own a tiny piece of all the stocks. That way, you're guaranteed to get your fair share of the market's overall growth.

Why Being Average Is a Winning Strategy

Trying to be "average" by just matching the market’s return might sound boring, but it's one of the most powerful ways to build wealth. It all comes down to two big things: lower costs and human mistakes.

- Lower Costs: Active funds charge higher fees to pay their managers, research teams, and for all the trading they do. These costs act like a constant anchor, dragging down your returns.

- Human Error: Even the smartest people on Wall Street can't predict the future. They can get emotional, chase hype, or just be wrong. A passive index fund takes all that human guesswork out of the picture.

It’s a bit like driving in traffic. You could be the hero, constantly switching lanes trying to get ahead. Or you could just pick a lane, set your cruise control, and enjoy a much smoother, less stressful-and often faster-trip to your destination.

Of course, just picking an ETF doesn't automatically mean you'll win. Fun fact: some research has found that about 60% of ETFs actually performed worse than the overall market, which is surprisingly close to their active mutual fund cousins. You can find more insights about these ETF performance findings.

This just shows that the secret isn't just choosing "ETF" over "mutual fund." The key is picking the right kind of fund-usually one that tracks a big, diverse, low-cost index.

Choosing the Right Fund for Your Investing Style

Okay, we've gone through all the techy differences between ETFs and mutual funds. Now for the part that really matters: figuring out which one is right for you. The truth is, there's no single "best" fund. It's about finding the right tool for your goals and, just as important, your personality.

Think of it like buying a car. A sports car is fun and gives you total control, but a simple sedan is perfect for getting you where you need to go without any drama. Neither is better; they just fit different people with different needs.

Let's look at how this plays out for different types of people. See which one sounds most like you.

The Hands-On Trader

Do you check stock prices on your phone all the time? Does the idea of buying when the market dips sound exciting? If you like being in the driver's seat of your money, ETFs are probably your new best friend.

Since ETFs trade like stocks, they give you amazing flexibility. You can buy shares at 10 AM and sell them by 2 PM if you want. This kind of real-time control is perfect for active investors who want to manage their portfolios closely and jump on opportunities as they happen.

- You want control: ETFs let you use more advanced trading moves, like setting specific prices where you want to buy or sell.

- You're a strategic thinker: Maybe you want to invest in a specific trend, like robotics or clean energy. The ETF world is full of these kinds of specialized funds.

This approach takes more attention, for sure. But for many people, being that involved is half the fun.

The Automatic Saver

On the other hand, maybe looking at market charts makes your eyes glaze over. You just want to build wealth slowly and steadily, like a subscription service for your future. If you're a "set it and forget it" kind of person, mutual funds were made for you.

Their best feature is automation. You can set it up so that $50 or $100 is automatically moved from your bank account and invested into your fund every payday. This simple but powerful trick is called dollar-cost averaging, and it's an amazing way to build wealth without any stress or effort.

"The individual investor should act consistently as an investor and not as a speculator." – Benjamin Graham

Warren Buffett's teacher, Benjamin Graham, knew that the slow-and-steady tortoise usually beats the hare in the long run. Mutual funds make it super easy to put that wisdom into action. It’s the perfect engine for a retirement account or any long-term goal where being consistent is more important than being a genius.

Real-World Scenarios: Which One Are You?

To make it even clearer, let's look at a couple of common situations.

Scenario 1: The New Investor with $50

You just got paid from your part-time job and have an extra $50 you want to invest. You're excited to get started right now.

- Your Best Bet: ETFs. You can easily buy a single share of an ETF that tracks the whole S&P 500, often for much less than $500. Even better, most brokers now offer fractional shares, so you can start with as little as $1. In contrast, many mutual funds require you to start with $1,000 or more, which can be a huge barrier.

Scenario 2: The Future Retiree

You're opening your first retirement account, like a Roth IRA, and want to contribute a little bit from every paycheck for the next 40 years.

- Your Best Bet: Mutual Funds. Here, the power of automation is a total game-changer. By setting up a recurring investment into a low-cost index mutual fund, you make sure you're always building that nest egg without even thinking about it. It takes the emotion and effort out of the equation-the perfect strategy for long-term saving.

How to Start Investing in Just a Few Steps

Alright, knowing the difference between ETFs and mutual funds is a great start, but knowledge only turns into wealth when you take action. It’s time to put your money to work.

Let’s walk through a simple roadmap to get you from square one to making your first investment.

Honestly, the whole idea of "investing" can sound kind of formal and scary. You might picture old guys in suits on Wall Street, but today it's so much simpler. As the famous author Morgan Housel says, “The most important thing you can do is increase the amount of time you’re investing for.” The sooner you start, the more time your money has to grow on its own.

Your Quick Decision Checklist

To figure out where to start, just answer these three quick questions. There are no right or wrong answers-it’s all about what fits your life.

- How much cash do you have to start? If you’re starting with a smaller amount, like under a few hundred dollars, ETFs are your best friend. Many brokers let you buy fractional shares, so you can start with just a few dollars.

- How hands-on do you want to be? If you like the idea of checking on your investments and want the freedom to trade whenever you want, ETFs give you that flexibility. If you'd rather "set it and forget it," mutual funds are perfect for setting up automatic, scheduled investments.

- How important are costs to you? While you can find cheap options for both, ETFs generally have lower average fees. Keeping costs low is one of the most powerful secrets to long-term success.

Making Your First Investment

Ready to do it? It’s genuinely easier than you think. You can be up and running in less time than it takes to watch an episode of your favorite show.

- Choose Your Brokerage: A brokerage is just the company that lets you buy and sell investments. Great, easy-to-use options for beginners include Fidelity, Schwab, and Robinhood. They all make opening an account online super fast and simple.

- Fund Your Account: Next, just link your bank account and transfer whatever amount you want to start with. It can be as little as $5 or $10.

- Find Your Fund and Buy: Use the search bar on the app to look up a fund. A great starting point for most new investors is a broad market index fund, like one that tracks the S&P 500. Just type in the dollar amount you want to invest, click "buy," and that's it-congratulations, you're officially an investor!

The single most important step is just getting started. If you want a bit more guidance, our free online stock trading course breaks down the basics even more.

As the old saying goes, "The best time to plant a tree was 20 years ago. The second best time is now."

Your Top Questions About ETFs and Mutual Funds, Answered

Let's be real, the world of investing is full of confusing words. It's easy to get lost. So, let's cut through the noise and answer some of the most common questions people have when comparing ETFs vs. mutual funds.

Can I Lose All My Money in a Fund?

This is usually the first question on everyone's mind, and it's a smart one. While every investment has some risk, the chances of losing all your money in a diversified fund that owns hundreds of stocks is incredibly small.

Think about it: for an S&P 500 index fund to go to zero, all 500 of the biggest companies in the U.S.-like Apple, Microsoft, and Amazon-would have to go bankrupt at the same time. Not very likely, right? The real risk isn't losing everything, but watching your account go down during a market dip. That's why thinking long-term is so important-it gives your investments time to recover and grow.

Which Is Better for a Roth IRA?

Great question! Both ETFs and mutual funds work perfectly inside a Roth IRA. A Roth account already gives you amazing tax breaks-your money grows tax-free and you can take it out tax-free in retirement. Because of that, the famous tax-efficiency of ETFs isn't as big of a deal here.

The best choice really comes down to your personality:

- Hands-Off & Automated: If you love the "set it and forget it" idea, a low-cost mutual fund is a perfect choice. You can easily set up automatic investments from every paycheck.

- Hands-On & Flexible: If you want more control, want to trade during the day, or want to invest in specific areas like AI or clean energy, ETFs give you that freedom.

"The stock market is a device for transferring money from the impatient to the patient." – Warren Buffett

This classic line from Warren Buffett is especially true for retirement saving. The goal is to pick the option that makes it easiest for you to stay patient and stick with the plan for the long run.

Do I Need a Financial Advisor to Start?

Nope, you definitely don't need a pro to get started. Thanks to modern apps and online brokerages, opening an account and buying your first fund is easier than ever. These platforms are designed for beginners and are filled with tools to help you learn as you go.

That said, if your finances get more complicated later on or you just want a second opinion from an expert, talking to a fee-only advisor is never a bad idea. For some great free advice, you can also check out some of the best investing podcasts to listen to for market news on the go. The most important thing is to just get started.

At financeillustrated.com, our mission is to make investing clear and approachable. Our free trading school and interactive simulators are here to help you build real skills and confidence before you invest a single dollar. Explore our resources today!