My story is simple, it started with one of my best mates Johhny K. investing about $2k in a trading guru’s course. Long story short he lost more than five thousand dollars in total and three of his life learning BS. I went on a different path and this article is gonna illustrate my journey. You will realize why buying trading courses from fake gurus is probably the worst idea you can have.

Track record – all the achievements or failures that someone has had in the past

You don’t have to be a trading genius to understand the importance of a track record. When going to see a movie, you read the reviews first. When buying a car, you look at its service history, yet when believing bogus claims from fake gurus, people (That’s you Johhny) tend to disregard track records completely… or so I thought…

During my research I concluded that fake gurus are substituting a lack of real trading results with other methods:

1. Supposedly Verified Trading History by sites like MyFXBook.

2. Flashy Lifestyle to Create an Image of Wealth and Expertise.

3. Positive Fake Review Ratio That Far Exceeds Even Reputable Financial Outlets and Premium Course Learning Platforms.

Realizing this I knew Johhny was trapped, but I didn’t have anything to offer as a better alternative. Learning to trade from books and YouTube videos was obviously something that all the course victims have already tried. So I continued to traverse the bullsh*t to find if there are real traders with transparent track records. And I did!

I can’t lie, the premise of copy trading hooked me. Yet very few people know about it. What surprised me the most – no shady marketing, empty words, or promises. Only results, which you can freely access. The idea is, that you take some money, and copy a pro trader. Every trade they make, you make automatically.

Since you’re not paying these traders, but they are first and foremost trading in their own interests, it sounded almost too good to be true. Am I jumping into the same rabbit hole as Johnny did?

We’ll the only way to find out was to try it.

So starting Jan 1. 2022, I hand-picked a set of traders that had good results over the past few years, and spread out $2,500 across them.

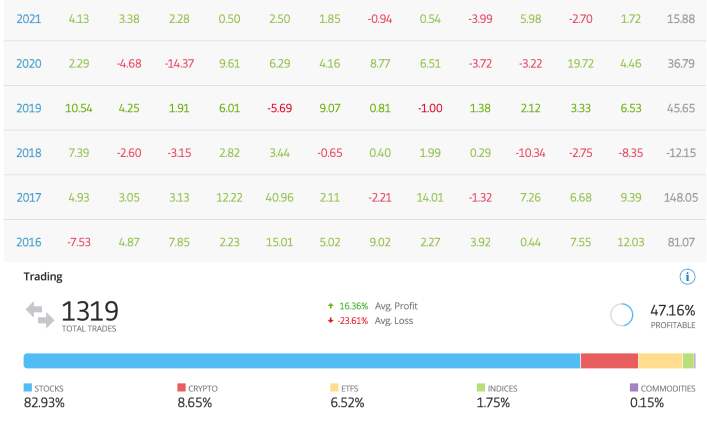

Here are my results over the past 8 months:

I do have to note: during this time I changed the 2 traders I was invested in as they started to perform quite badly. Honestly, that just illustrated one of the strong points of copying pro traders – a fully transparent track record.

Here’s one of a trader I plan to copy with my profits soon.👇

Full disclosure: This is not financial advice, I’m certain many of you are eager to try copying but you should always research the traders you are investing in. The way copy trading works is that pro traders get a commission from the broker based on how many people copy them. If they perform well, they get more copiers, thus more commissions. This incentivizes winning, which is good for you but can sometimes lead to more risky trades, so research the risk score carefully before copying.

I’ve picked a few traders as a good starting point for you.👇

Jeppe Kirk Bonde | Gain 18.80% | Risk score 4 | Manages $500K+ | 29502 Copiers | VIEW 61% of retail CFD accounts lose money |

Amit Kupfer | Gain 4.99% | Risk score 5 | Manages $500K+ | 8522 Copiers | VIEW 61% of retail CFD accounts lose money |

Thomas Parry Jones | Gain 29.72% | Risk score 5 | Manages $500K+ | 31552 Copiers | VIEW 61% of retail CFD accounts lose money |

Dario Martiskovic | Gain 19.19% | Risk score 5 | Manages $500K+ | 647 Copiers | VIEW 61% of retail CFD accounts lose money |

Pietari Laurila | Gain 12.23% | Risk score 4 | Manages $500K+ | 12862 Copiers | VIEW 61% of retail CFD accounts lose money |

Celestino Brunetti | Gain 11.97% | Risk score 5 | Manages $500K+ | 1807 Copiers | VIEW 61% of retail CFD accounts lose money |

Mike Moest | Gain 11.70% | Risk score 4 | Manages $500K+ | 2909 Copiers | VIEW 61% of retail CFD accounts lose money |

Catalina Norena Valderrama | Gain 6.49% | Risk score 2 | Manages $500K+ | 1103 Copiers | VIEW 61% of retail CFD accounts lose money |

Rhys Adams | Gain 12.41% | Risk score 5 | Manages $500K+ | 2249 Copiers | VIEW 61% of retail CFD accounts lose money |

Vasile Iliescu | Gain 12.27% | Risk score 3 | Manages $500K+ | 813 Copiers | VIEW 61% of retail CFD accounts lose money |

What does science say about Copy trading?

- In 2012 the Massachusetts Institute of Technology (MIT) funded a study directed by Dr. Yaniv Altshuler, which showed that traders on the eToro social investment network who benefited from “guided copying”, i.e. copying a suggested investor, fared 6-10% better than traders who were trading manually, and 4% better than traders who were copy trading random investors of their choice.

Decoding Social Influence and the Wisdom of the Crowd in Financial Trading Network Yaniv Altshuler, Alex (Sandy) Pentland, Wei Pan

- Another dataset shows that hands-off copy trading beats manual trading across 3 different time frames. On average, the difference is 14% more wins.

- In 2014, Mauro Martino from the Watson research center of IBM Research and Altshuler collaborated with Yang-Yu Liu, Jose C. Nacher, and Tomoshiro Ochiai on a financial trading study that showed: that copied trades are more likely to produce positive returns than standard trades, but the return on investment of profitable copy trades is lower than the return of successful regular trades.

Lesson Learned

People will always look for a shortcut, but that’s not a bad thing if the net result is positive. Johhny sought a shortcut, got swindled and the net result was financial loss and frustration. I spent more time on the research phase and discovered something which has resulted in a net positive. I’ve almost returned my investment and learned a lot about the markets along the way.

In this time of high inflation and uncertainty, it’s best that you be extra careful about online hucksters selling you wild dreams and easy results.

Trading and investing is certainly a skill to weather any financial crisis, just make sure you learn it from people who are experts in it, not experts in selling courses and emptying your pockets.

Best of luck!