Let's pull back the curtain on stock market investing. At its heart, it's a super simple idea: you're buying a tiny piece of a real business.

When you buy a stock, you become a part-owner in a company like Apple or Nike. You get to share in its future wins (and yeah, sometimes its losses). The goal? To grow your money over time as these companies get bigger and better.

Your First Guide to the Stock Market

Welcome to the world of investing. It might look like some complicated game for Wall Street pros in suits, but honestly, it’s for everyone – especially young people who have time on their side.

Forget the crazy charts and fast-talking experts you see in movies. Investing is way simpler than that.

The stock market is basically a giant marketplace, kind of like an eBay for companies. Here, people buy and sell tiny pieces of ownership, called shares. When a company is crushing it, more people want a piece, and the price of its shares goes up. If the company struggles, the price usually goes down.

From Saver to Investor

Just stashing cash in a savings account is like hiding it under your mattress. It’s safe, but it’s not growing. In fact, thanks to inflation (the reason a coffee costs more today than it did ten years ago), your saved money actually loses its buying power over time.

Investing is different.

Investing is like planting a tree. You start with a small seed (your first investment), and with time and patience, it can grow into a huge tree that gives you fruit (your returns). This is how you build real, long-lasting wealth. The investing legend Warren Buffett, who bought his first stock when he was just 11 years old, said it perfectly:

"Someone's sitting in the shade today because someone planted a tree a long time ago."

The Language of Wall Street in Plain English

Before you dive in, you'll need to know a few key terms. They sound way more complicated than they actually are.

Think of this table as your quick cheat sheet for the most important words you'll see. It's a simple, no-jargon dictionary to get you started.

Key Investing Terms in Simple English

| Term | What It Really Means |

|---|---|

| Stock | A small slice of ownership in one company. Owning a stock makes you a shareholder. |

| Stock Market | The place where stocks are bought and sold. Think of big names like the New York Stock Exchange (NYSE) or Nasdaq. |

| Portfolio | Your personal collection of all the investments you own – stocks, funds, and whatever else. |

| Dividend | A bonus cash payment that some companies give to their shareholders. It's like a 'thank you' for being an owner. |

| Bull Market | A time when the stock market is generally going up and people are feeling optimistic. |

| Bear Market | A time when the stock market is generally going down, and people are feeling pretty pessimistic. |

Getting these basic ideas down is your first real step. You don’t need to be a math genius or an economics professor to do this.

Just remember, you're not buying a random ticker symbol on a screen – you're investing in the future of real businesses. Our goal here is to take the fear out of finance and show you that you've totally got this.

Why You Should Start Investing Now

Think you need a huge pile of cash to get started in the stock market? That's probably the biggest myth holding people back. The truth is, your most powerful asset isn't a fat wallet – it's time. Starting right now, even with just a few dollars, can make a massive difference in your financial future.

The secret sauce is something called compound interest. It sounds complicated, but it's not. You earn a return on your original investment, and then you start earning returns on those returns. It’s a snowball effect where your money literally starts working for you, making more money all by itself.

It's so powerful that Albert Einstein supposedly called it the "eighth wonder of the world." This is the real magic behind building wealth, turning small, regular contributions into a fortune over the long run.

The Power of Compounding in Action

Let’s play this out. Imagine you start investing just $50 a month at age 18. Assuming a pretty standard average stock market return of 10% per year, by the time you're 65, that small habit could turn into over $580,000. Wild, right? But if you wait until you’re 28 to start, you'd have to invest almost three times as much every month just to catch up.

This isn't just theory; it’s how financial freedom is built. The whole game is about giving your money as much time as possible to grow. Even the legendary Warren Buffett, one of the richest people on the planet, got his start early. He bought his first stock when he was just 11 years old.

"The rich invest in time, the poor invest in money." – Warren Buffett

This quote nails the mindset. While many people wait for a big paycheck to start, smart investors know that starting early is the ultimate cheat code. Your youth is your single biggest financial advantage.

Don't Just Save – Grow Your Money

Saving money is a great habit, but it's not enough to build serious wealth. Cash sitting in a regular savings account barely grows and, thanks to inflation, often loses its buying power. Investing, on the other hand, puts your money to work in the economy.

This infographic paints a clear picture of how an investor’s money can grow like crazy compared to a saver’s.

As you can see, the saver's piggy bank doesn't grow much. Meanwhile, the investor's plant shows the incredible power of compounding. Investing is what gives your money the potential to beat inflation and build a truly secure financial future.

This visual shows a simple choice: do you want your money to sleep, or do you want it to work? Plenty of celebrities get this. Ashton Kutcher, for example, is a well-known tech investor who turned his acting paychecks into a massive fortune by investing early in companies like Uber and Airbnb. He didn't just stash his cash; he put it to work.

Kicking off your journey into stock market investing for dummies is less about how much you start with and more about when you start. You have the gift of time on your side – don’t waste it.

How to Open Your First Investment Account

Okay, you get why starting early is a huge deal. Now it's time to take that first real step: opening an account.

This part might sound like a pain, but honestly, it's about as complicated as signing up for TikTok or Instagram. Thanks to modern tech, you can get it all done from your phone in about 15 minutes. You just need some basic personal info (like your Social Security Number) and a bank account to link up.

The best part? You don’t need to be rich to start. Most of the big-name brokers have $0 account minimums, meaning you can get in the game with whatever you feel comfortable with.

Choosing Your Account Type

Before you pick an app, let's quickly talk about the two main "flavors" of accounts you'll see. Think of them as different wrappers for your investments, each with its own special perks.

-

Standard Brokerage Account: This is your basic, do-it-all investment account. It’s super flexible with no limits on how much you can put in, and you can take your money out whenever you need to. It’s the perfect, no-fuss starting point for general goals.

-

Roth IRA (Individual Retirement Account): This account is like a superhero for your long-term goals, especially retirement. The deal is simple: you put in money you've already paid taxes on, and in exchange, your investments grow 100% tax-free. That’s a huge deal. It means when you pull that money out in retirement, you won't owe the government a single dime on all those years of growth.

For most young investors, a Roth IRA is an absolute game-changer. You have decades for that tax-free growth to work its magic. You can even have both types of accounts, but starting with one is a fantastic first step.

Finding the Right Broker for You

So, what’s a broker? It’s just the company that gives you access to the stock market. Not long ago, you had to call a guy in a suit to buy a stock. Today, it’s all done through slick, easy-to-use apps on your phone.

When you're starting out, you want a broker that’s known for being beginner-friendly. This usually means they have:

- Low or zero fees: Most top brokers now offer commission-free trading on U.S. stocks and ETFs. This is a must-have.

- A simple, clean app: A good mobile app makes the whole process feel way less scary.

- Helpful learning resources: They should offer articles and videos to help you along the way.

The chart below shows a few popular choices that consistently get high marks for being great for beginners.

Platforms like Fidelity and Charles Schwab are solid choices because they hit all these points and have a long history of being trustworthy. They really make the whole process of stock market investing for dummies as painless as possible.

The Step-by-Step Setup Process

Ready to go? Here’s a quick rundown of what setting up an account looks like, no matter which platform you choose.

- Pick Your Broker and Get the App: Do a little research, pick a company you like, and download their official app.

- Enter Your Personal Info: You'll fill out a standard application with your name, address, birthday, and Social Security Number. This is a legal requirement to verify who you are.

- Answer a Few Financial Questions: They'll ask about your income and your goals. Don't sweat this part – just be honest. It helps them suggest the right products.

- Fund Your Account: The last step is linking your bank account to make your first deposit. You can start with any amount you're comfortable with, whether that's $20 or $200.

Once your account is open and funded, that's it. You're officially an investor!

After you’re set up, a crucial next step is getting comfortable reading your monthly or quarterly broker statements. This is how you'll track your progress. It can look a little confusing at first, but it's a great habit to build.

It's also smart to understand what you're being charged. You can get a clearer picture by comparing brokerage fees to make sure you're not giving up too much of your returns to hidden costs.

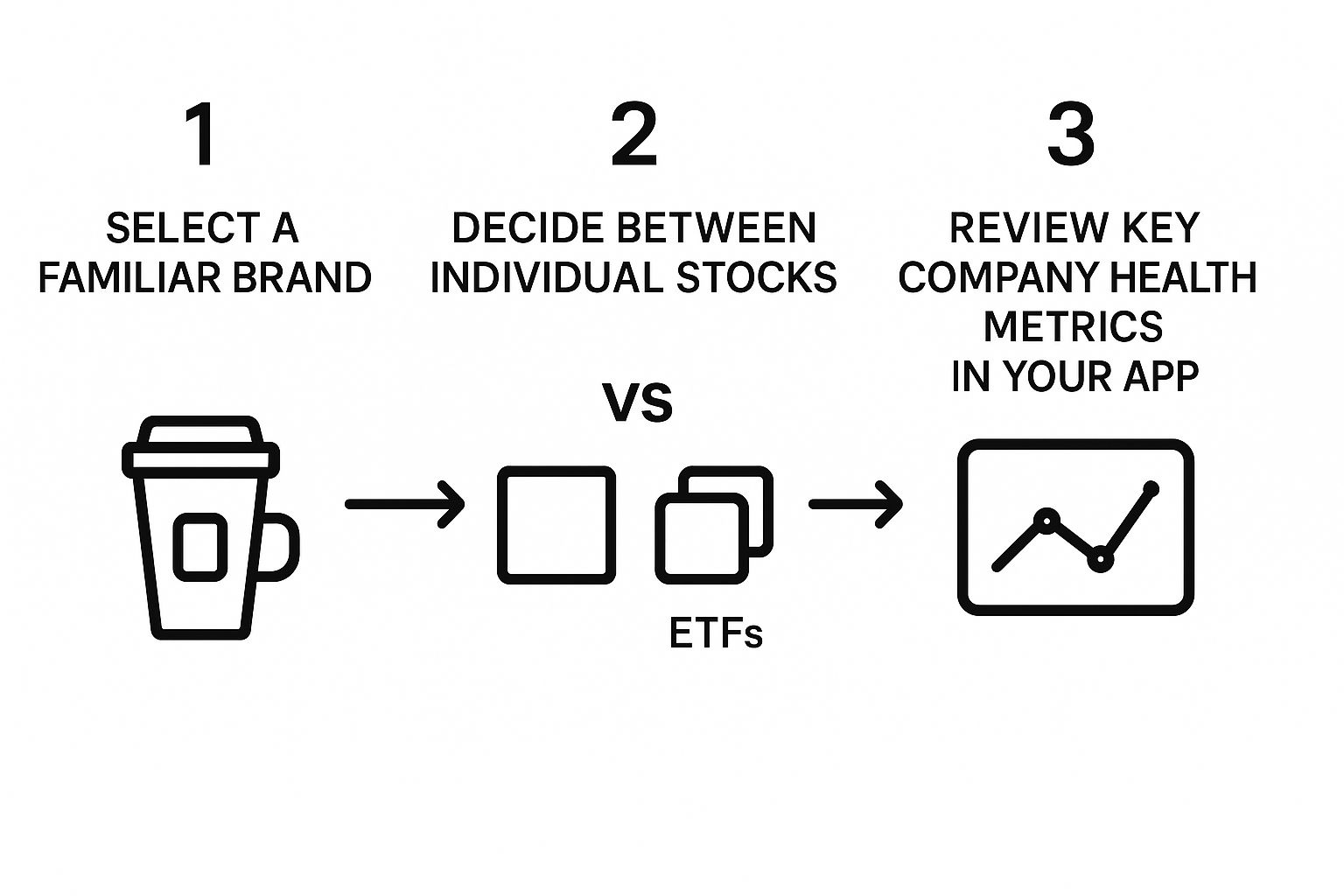

Smart Ways to Pick Your First Investments

Okay, so your account is open, funded, and ready to go. Now for the fun part – what do you actually buy?

If you're picturing yourself as a Wall Street hotshot trying to find that one magic stock that's going to blow up, let's just slow down for a second. For most people starting out, that's not the smartest (or least stressful) way to begin.

Instead of hunting for one needle in the haystack, what if you could just buy the whole haystack?

Embrace the Power of Index Funds and ETFs

Instead of stressing over whether to buy Apple, Tesla, or Nike, what if you could own a tiny piece of all of them – plus hundreds more – with a single click? That's the simple genius behind an index fund or an Exchange-Traded Fund (ETF).

Think of it like this: an index fund is just a giant basket holding hundreds, sometimes thousands, of different stocks. The most famous one is the S&P 500 index fund.

When you buy one share of an S&P 500 ETF, you instantly become a part-owner in 500 of the biggest and most successful companies in America. This is a total game-changer because it gives you instant diversification. If one company hits a rough patch, you've got 499 others to help balance things out.

Even billionaire investor Mark Cuban is a huge fan of this strategy for new investors. He's famously said that a low-cost S&P 500 index fund is the single best investment most people can make.

"The S&P 500 is your best friend. It’s a great way to participate in the market without needing to be an expert." – Mark Cuban

This approach is way safer than betting all your money on one single company. Historically, betting on the overall market has been a winning move. The S&P 500, which makes up over 80% of the U.S. stock market, is the benchmark everyone watches. Over the decade ending in late 2024, it delivered a total return of 261%, which is an incredible 13.6% average return per year. You can discover more insights about these market returns on Nasdaq.com.

While index funds and ETFs are very similar, they have some small differences. For a deeper look, check out our guide on the differences between ETFs and mutual funds.

A Stress-Free Investing Technique

Now that you know what to buy, let's talk about how to buy it without losing sleep. The secret is a simple but super powerful technique called dollar-cost averaging.

It sounds fancy, but the idea is simple: you invest a fixed amount of money on a regular schedule, no matter what the market is doing.

Here’s how it works:

- You decide to invest $50 every two weeks.

- When the market is up and prices are high, your $50 buys fewer shares.

- When the market is down and prices are low, your $50 buys more shares.

Over time, this automatically helps you buy more shares when they're cheap and fewer when they're expensive. Most importantly, it saves you from trying to "time the market" – which is basically impossible.

This disciplined, automated approach has huge benefits:

- It builds a consistent habit: Investing just becomes a normal part of your routine.

- It takes emotion out of the equation: You won’t be tempted to panic-sell when the market dips or get greedy when it's soaring.

- It simplifies everything: Just set it and forget it. Your portfolio builds itself in the background.

This is how real wealth is built – steadily and calmly over the long haul. By pairing a simple investment like an S&P 500 ETF with dollar-cost averaging, you're using a proven, powerful strategy that successful investors use every day.

How to Stay Calm During Market Swings

Let’s be real: the stock market is a rollercoaster. There are amazing climbs and stomach-dropping dips. One day your account is up, the next it’s down. This up-and-down movement is called volatility. It’s a totally normal part of investing, so you might as well get used to it.

Watching your hard-earned money seem to disappear, even for a bit, is scary. But the key is to understand that these swings aren't a sign you did something wrong. They're just the price you pay for long-term growth.

Zoom Out and Look at the Big Picture

When the market gets shaky, our gut reaction is to panic and hit the "sell" button. That’s almost always the worst thing you can do. The most powerful tool you have during a downturn isn't some fancy trading strategy; it's perspective.

If you zoom in on any single day or week, the market looks like pure chaos. But when you zoom out and look at its performance over decades, a clear pattern shows up: it consistently goes up.

Despite major crashes, wars, and recessions, the stock market has always recovered and climbed to new highs. This history is your best friend as an investor. It’s a constant reminder that patience is your ultimate superpower.

"The real key to making money in stocks is not to get scared out of them." – Peter Lynch

This gem from investing legend Peter Lynch says it all. Your biggest enemy often isn't a bad stock – it's your own fear.

Your Behavior Is Your Biggest Advantage

Controlling your emotions is way more important than trying to be a stock-picking genius. Reacting to scary news headlines or a friend's panic is a recipe for losing money. Instead, focus on what you can actually control.

Here are a few tips for staying cool when the market gets heated:

- Don't Check Your Portfolio Daily: Seriously, stop. Looking at your balance every day will only make you anxious. Check once a month or even once a quarter to keep your eyes on the long-term prize.

- Remember Why You Started: Think about your original goals. Are you saving for retirement in 30 years? If so, a dip today is just a tiny blip on a very long timeline.

- Keep Investing (Especially During Dips): If you're using a dollar-cost averaging strategy, a market dip means you're buying shares on sale. Think of it as your favorite store having a massive discount.

Diversification: The Built-In Safety Net

We've talked about diversification before, but it really shines during market swings. If all your money is in one company and that company has a bad year, your whole portfolio suffers.

But if you own a broad market index fund, you own hundreds of companies across different industries. A problem in one area gets balanced out by success in others. It's like having a full sports team – if one player is having an off day, the others can still win the game.

This strategy helps smooth out the ride. Over the past century, the U.S. stock market has delivered an average annual return of about 10%. But that average hides some wild years. For example, the market shot up 33.8% in 1995 but crashed 36.61% in 2008. This is exactly why patience and diversification are so important. You can discover more about average stock market returns on Carry.com.

Ultimately, successful investing is about discipline and thinking long-term. Accept that downturns will happen, stay diversified, and trust in the market's long history of growth.

Where Do You Go From Here?

Give yourself a pat on the back. Seriously. You've just built a solid foundation for your financial future, and the world of stock market investing is no longer some confusing, secret club. You've learned how to get in the game, from understanding the basics to knowing how to keep your cool when things get wild.

Let's do a quick recap of your new investor toolkit:

- You get the basics: A stock is just a small piece of a company, and the market is where those pieces are traded.

- You're thinking long-term: Time is your secret weapon. You know to let the magic of compounding do the heavy lifting.

- You can open an account: Getting started with a beginner-friendly broker takes just a few minutes. No excuses!

- You know how to keep it simple: Index funds and ETFs are your best friends for building a diverse portfolio without the stress.

- You're ready to stay disciplined: When things get rocky, patience and consistency are your superpowers.

Keep the Momentum Going

Think of this guide as just step one. One of the best habits any investor can build is curiosity. To keep learning, check out some of these trusted resources – they're perfect for beginners.

- Podcasts: Shows like "The Ramsey Show" are great for practical, everyday money advice. If you want to understand the big picture, NPR's "Planet Money" makes complex economic ideas genuinely fun and easy to follow.

- Websites: You can't go wrong with financial news from The Wall Street Journal or Bloomberg. And for those "what does that even mean?" moments, Investopedia is basically the dictionary for every financial term you'll ever see.

Broaden Your Horizons

Once you're comfortable with your simple, U.S.-focused index fund strategy, you might want to look beyond our borders and add international stocks to your mix. This just means investing in companies based in other countries. Why? It adds another powerful layer of diversification.

While the U.S. stock market has been a beast, having a global footprint can help smooth out the ride. Sometimes, international markets do well when the U.S. market is taking a break. Just look at the S&P 500 between 1995 and 2024 – it saw incredible gains of 33.8% and stomach-turning drops of -36.61%. The long-term trend has been amazing, but a little global balance never hurts. You can see for yourself how global markets perform on morningstar.com.

The main takeaway is simple: you're in charge now. You have the knowledge to start building a better financial future, one small, smart investment at a time. This is a journey, not a race. You’ve already taken the most important step – just getting started.

Frequently Asked Questions About Investing

Let's run through some questions that always pop up when you're just starting. Think of this as a quick-fire round to bust some myths and give you the confidence to get going. Clearing these hurdles is a huge part of learning stock market investing for dummies.

How Much Money Do I Really Need to Start Investing?

Honestly? You can start with whatever's in your pocket right now. I'm not kidding – even as little as $1.

These days, almost every online broker lets you buy "fractional shares." It's a game-changer. It means you don't need to save up hundreds of dollars to buy a full share of a big company. You can buy $5 worth of Amazon or $10 worth of Apple and own a real piece of that business. How much you start with is way less important than just starting.

Is Investing in Stocks Just Like Gambling?

Not even close. Gambling is a game where the odds are mathematically stacked against you. The house always wins in the long run.

Investing, on the other hand, is about owning a piece of a real, productive business. You're buying into a company that makes things, sells services, and has the potential to grow. While nothing is guaranteed, long-term investing in a diverse portfolio has historically been one of the most reliable ways to build wealth. It’s about being a business owner, not pulling a slot machine lever and hoping for the best.

What Is the Difference Between a Stock and an Index Fund?

Let's use an analogy. Think of a single stock as one apple tree. If a storm hits it, you might lose your entire crop for the year. Pretty risky, right?

Now, an index fund is like owning a huge orchard with 500 different kinds of fruit trees. If the apple trees have a bad year, it's no big deal – you've still got oranges, pears, and 496 other fruits that are probably doing just fine. A single stock ties your fortune to one company, while an index fund spreads your investment across hundreds, making it a much safer way for a beginner to invest.

Will I Have to Pay Taxes on My Investments?

Yes, but how and when depends on the type of account you choose. With a standard brokerage account, you’ll pay capital gains tax on your profits when you sell an investment for more than you paid for it.

But here's the pro tip: if you use a retirement account like a Roth IRA, your investments can grow for decades and you can pull the money out in retirement completely tax-free. That’s a massive advantage that can save you tens of thousands of dollars over your lifetime. It's why so many experts tell young investors to start with a Roth IRA.

As you get more comfortable, you might wonder when to get professional help. It’s a natural next step, and a common question is, Do I Really Need a Financial Planner for Retirement?. Knowing when to call in an expert can be one of the smartest moves you make.

Ready to put your new knowledge into action? At financeillustrated.com, we make learning simple and fun. Explore our free Trading School, practice with risk-free simulators, and access easy-to-read guides to build your confidence before you invest a single dollar. Start your journey at https://financeillustrated.com.