Most people assume that the only way to make money through stock trading is by capital gain – essentially buying low, and then selling for a higher price at a later time. However, another way to earn money through the stock market is by investing in stocks dividends. This can be a great way to boost your income – without having to do anything! ✌️

If you take just 5 minutes to read this article, your understanding of dividend-paying stocks will skyrocket (like Bitcoin ??), meaning you can then use your knowledge to help you create a passive income stream. Let’s go? ?

Which Stocks Pay the Highest Dividends?

The stock dividends list below highlights some of the companies that pay the highest dividends. Companies such as Royal Dutch Shell and Altria Group are attractive prospects for investors, as they offer a reliable way to generate more cash flow. Furthermore, if these companies continue to grow and prosper, dividend payments can increase even more and will provide a growing passive income stream for stockholders. If you want to invest in these dividend stocks, check also the best forex brokers article to choose the most reliable fx broker.

Your capital is at risk

COMPANY NAME | DIVIDEND YIELD (%) | ||

Energy Transfer Equity (ET) | 17.81% | ||

Icahn Entrpres Depositary Units (IEP) | 14.04% | ||

Royal Dutch Shell (RDSB) | 10.65% | ||

Imperial Brands (IMB) | 9.15% | ||

Altria Group (MO) | 7.80% | ||

British American Tobacco (BATS) | 7.62% | ||

Enterprise Products Partners (EPD) | 7.61% | ||

Kinder Morgan (KMI) | 6.61% | ||

International Business Machines Corporation (IBM) | 5.43% | ||

Ford Motor (FORD) | 5.23% |

What are dividends?

Although you may not have heard of the term before, dividends are pretty simple to understand. The stocks dividend definition is a ‘token reward paid to the shareholders of a company for their investment in their equity’. The easiest way to think of them is as a cash payment made from the company to the shareholders. A lot of the time, companies will use their profits to further enhance their business by purchasing new equipment, hiring new employees, and so on; companies that do this tend to be expanding, and pay what’s known as growth stock dividends (smaller amounts), if they pay at all. However, companies that do pay dividends will instead take a portion of these profits and distribute them to shareholders as a sort of ‘bonus’.

But you might be wondering how often do stocks pay dividends? Usually, these dividends are paid once a year, twice a year, or even monthly. Dividend payments are usually calculated as a percentage of the share price. So, imagine you own a share of a company that is worth $50, and the company pays a 5% dividend annually. You would then receive 5% of $50, which is $2.50, as a dividend payment. Furthermore, if you owned two shares of that company, you would receive a dividend on both shares; so you’d receive a $5 dividend. As you can see, the more shares you hold, the larger your dividend would be.

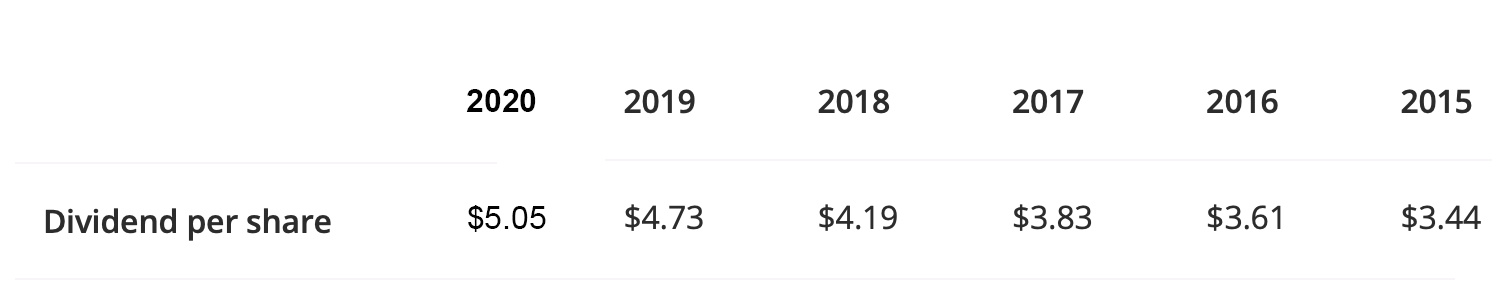

You might be wondering what stocks have dividends? One example of a dividend-paying company is Mcdonalds. In 2020, it paid its investors a total of $5.05 per share in dividends. For example, if you bought 10 shares of Mcdonalds in 2019, you would receive $50.50 in dividends in 2020. That’s enough to buy 8 Big Mac’s afterwards! ?

McDonalds’ dividend history

5 Steps to Choose the Best Dividend Stocks

Following this step-by-step guide will help to ensure that you select the best dividend stocks:

1. Look for consistency

Long term profitability is one of the key metrics you should look out for when researching which stocks have dividends. The best stocks dividends come from companies that demonstrate consistent growth in revenue. Furthermore, you should also ensure that the company has consistently paid dividends over the previous few years, to provide confidence that they will continue to do so. Inconsistent companies may decide to suddenly stop paying dividends on common stock, choosing to only pay out preferred stocks dividends.

2.Check out the company’s financials

Stocks giving dividends tend to come from firms that have strong underlying financials. One of the key things to look out for is companies with a high debt level. These types of companies tend to either pay a poor dividend or don’t pay one at all, as they choose to use their profits to pay off sections of their debt. Another key thing to look for are companies that have a strong and consistent cash flow; firms that have this are much more likely to pay a suitable dividend.

3.Ensure a good dividend yield

The dividend yield refers to the stock’s annual dividend payment and is usually displayed as a percentage of the current stock price. A good yield is important as it indicates a strong company, and it also ensures you receive a solid payment each year. Blue chip stock dividends tend to provide the best yield; these are commonly thought of as the most reliable, established companies and are usually in a relatively good financial position.

4.Look for an acceptable payout ratio

The payout ratio is one of the most important things to consider when deciding which dividend-paying stocks to invest in. Put simply, it determines how much of the money a company makes is paid out as dividends. A bigger payout ratio is not necessarily better; larger ratios mean a company pays a lot of its revenue out to shareholders, and therefore might not have enough money left if their business unexpectedly takes a hit.

5.Analyze the historical dividend growth rate

Finally, investors must analyze the dividend growth rate over time to make the best decision. Companies that have a good annual dividend growth rate are more attractive than others for investors who are looking for good dividend-paying stocks, as these companies are usually the most motivated to provide larger dividends each year. This motivation can prompt management to make appropriate decisions to increase revenues and cash flow, which will allow for healthy dividends to be paid.

Do brokers pay dividends?

Your broker does not ‘pay’ the dividend per se; they essentially facilitate the transfer of the dividend payment from the company to your account. Imagine you had invested in Apple, and they paid out a dividend to you worth $50. Your broker would receive this dividend on your behalf and deposit it into your account. You would then be able to use the money as you see fit.

It’s important to note that your account can be credited OR debited, if you are investing in a stock, ETF or index that pays a dividend. This all comes down to whether you are holding a long or short position on the asset. If you are holding a buy position, you will receive the dividend payment into your available balance. If you are holding a sell position, the related dividend payment will be deducted from your available balance.

When am I entitled to receive dividends?

You will only receive or pay a dividend if you hold an open position at the market close the day before the ex-dividend date. To understand this, if you purchase a stock on the ex-dividend date or after, you will not receive the next dividend payment. You can find this ex-dividend date on the corporate website of the company.

An example of this would be if you read that Starbuck’s ex-dividend date is on December 12th. In order to receive a dividend, you must open a LONG position in SBUX before 20:59 (GMT) on the day before. On the other hand, if you open a SHORT position in SBUX before 20:59 (GMT), you will owe a dividend payment. So, make sure you know what to expect when making a buy/sell decision before the ex-dividend date.

How much will I get from stock dividends?

The dividend you are entitled to depends on the size of your trade and not on how many shares you hold; this is because you don’t hold the actual share, but a CFD contract that follows the price of the underlying share. As the size of your CFD trade isn’t usually 1:1 with the share price, some calculations must be made to estimate the dividend you will receive; check out the example below.

Calculating your dividend – example:

- Let’s assume that Coca-Cola is trading at $200 per share, and that you invested $50 in a LONG position through your broker.

- Obviously, the value of your trade would not be 1:1 with the share value, as you have not invested enough to buy one full share.

- So, to calculate what percentage of a share you own, you divide the amount you have invested with the share price. In this example, you would do the following – $50/$200. This would give you 0.25, or 25%.

- Then, to calculate how much dividend you are entitled to, you must multiply the dividend that Coca-Cola pays per share, with your trade size. So, using our previous example, let’s say Coca-Cola pays a $2.50 dividend per share. The calculation would then be as follows – $2.50 x 0.25. This would give us a dividend payment of $0.62.

An important point to note is that the calculations are the same for if you were involved in a short trade. You would follow the same format as in the example above to work out how much you would owe as a dividend.

FAQ

What stocks pay dividends monthly?

Stocks that pay dividends every month are a great way to earn a consistent income. Some examples of stocks that pay dividends monthly are Main Street Capital, Stag Industrial, and Shaw Communications.

How often do stocks pay dividends?

Stocks can pay dividends annually, twice a year, or even quarterly. It’s wise to check the company’s stocks dividend calendar to ensure you know when each payment will arrive.

How to tell if stocks pay dividends?

The best way to tell if stocks pay dividends if by looking at financial news sites, the company’s website, the stock exchange, or even through your broker.

What are some stocks with great dividends?

Cheap stock dividends tend not to have the highest dividend yield, but there are some great companies out there that pay high dividends. Some examples are Prudential (5.35% yield), IBM (5.14% yield), and the Omnicom Group (4.14% yield).