Are you ready to take your Forex skills to the next level? With these apps, you’ll have the latest market insights, real-time data, and cutting-edge tools at your fingertips, giving you the confidence and knowledge you need to make profitable trades. Whether you’re new to the market or an experienced trader, these apps will help you stay ahead of the game and achieve your trading goals.

A quick sneak peek: Best Forex Trading Apps & Simulators

For 2023, these are our top forex app picks based on functionality, features, and value.

🥇Best Forex trading school and market simulator in your pocket: Go Forex App

🥈Best For a Simple and Clean Interface: eToro

🥉Best for Advanced Traders: TradingView

Best For a CFD Trading: Plus500

🥇Go Forex App – First practice then trade

With GoForex’s trading simulator app, users can practice with a virtual $10 000 without the risk of losing real money. The app allows users to trade not only forex, but also stocks, cryptocurrencies, oil, and gold using real-time prices.

Main features GoForex stand out from other trading simulators available:

- Real-time market prices: The app uses real-time market prices to provide users with a more accurate and realistic trading experience.

- User-friendly interface: GoForex is designed with a user-friendly interface that is easy to navigate, making it suitable for both novice and experienced traders.

- Daily signals from analysts: traders can save time and effort on their own research.

- Full in-depth trading school: real-time examples, proven strategies, and user-friendly illustrations to enhance the learning process and ensure faster and better understanding of the markets. The platform covers all the aspects of forex trading, including technical analysis, fundamental analysis, and risk management, and provides users with the tools and knowledge they need to make informed trading decisions.

- Go Forex app is available since 2014 and has more than 3 million downloads.

🥈eToro – Investing made social

eToro is a social trading and investment platform that has gained popularity among traders and investors worldwide. eToro’s unique features set it apart from other trading platforms, including:

- Social trading: eToro’s social trading feature allows users to copy the trades of more experienced traders, giving them access to the strategies and insights of top traders.

- Wide range of financial instruments: eToro offers a wide range of financial instruments, including stocks, currencies, commodities, and cryptocurrencies, allowing traders to diversify their portfolios. US customers only have access to cryptocurrencies.

- User-friendly interface: eToro’s platform is designed to be user-friendly and intuitive, making it easy for beginners to navigate and start trading.

- CopyPortfolio: eToro’s CopyPortfolio feature allows users to invest in a diversified portfolio of assets, managed by eToro’s investment team.

- Educational resources: eToro provides educational resources such as webinars, tutorials, and market analysis to help traders stay informed and improve their skills.

- Regulated: eToro is a regulated platform and it’s overseen by multiple regulatory agencies such as FCA, CySEC, and ASIC.

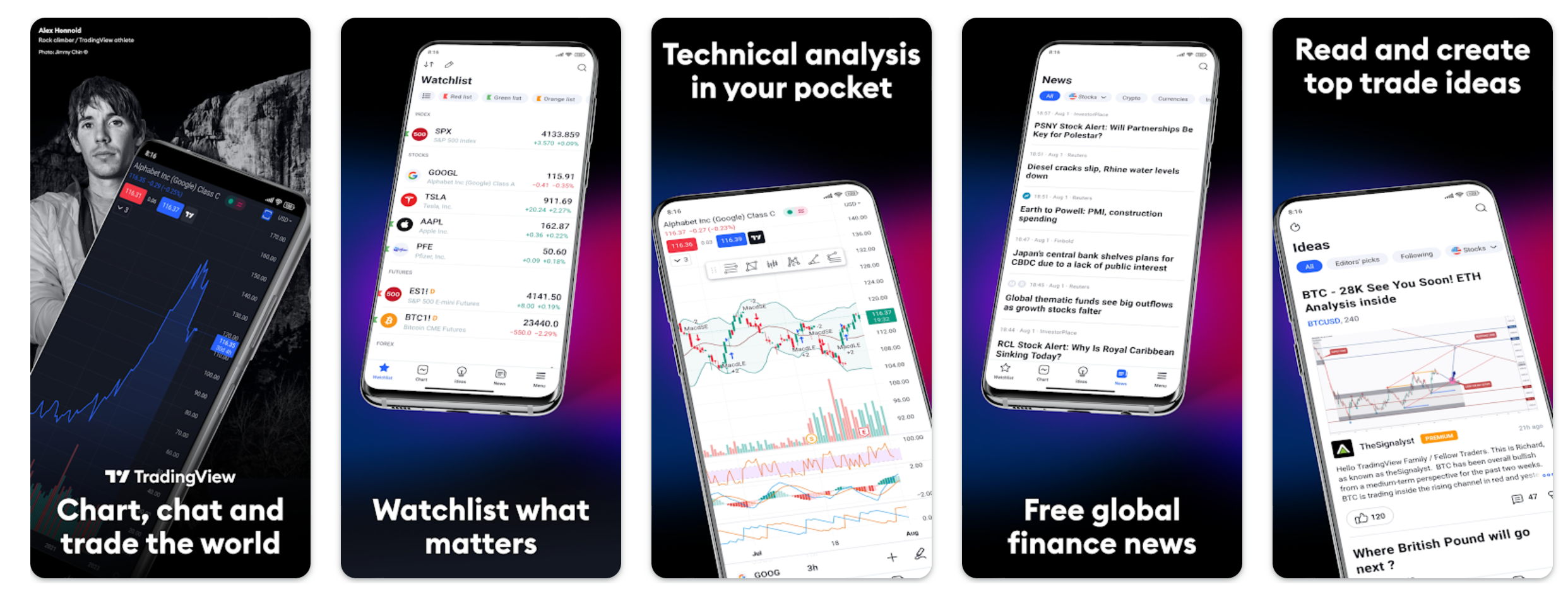

🥉TradingView – Look first, Then leap

TradingView is a popular social platform for traders and investors to share ideas, strategies, and market insights. With its user-friendly interface and advanced charting tools, TradingView has become a go-to destination for traders of all levels. Some of the key features that make TradingView stand out include:

- Real-time market data: TradingView offers real-time market data from multiple exchanges, allowing traders to stay on top of the latest market movements.

- Advanced charting tools: TradingView’s charting tools are highly advanced and customizable, allowing traders to analyze historical price patterns and make informed trades.

- Community-driven platform: TradingView is a social platform where traders can share ideas, strategies, and market insights, providing a unique collaborative aspect to trading.

- Large selection of indicators: TradingView offers a vast selection of indicators, including more than 100 built-in indicators and the ability to create custom indicators.

- Available on multiple devices: TradingView can be accessed on any device including PC, mobile and tablet.

Plus500 – it’s trading with plus

CFDs are complex and high-risk due to leverage, with 82% of retail investors losing money. Ensure you understand CFDs and can afford the risk.

Plus500 is a popular online trading platform that offers a wide range of financial instruments, including forex, stocks, commodities, and cryptocurrencies. Some of the key features that make Plus500 stand out include:

- User-friendly interface: Plus500’s platform is crafted to be intuitive and accessible, ensuring a seamless experience for beginners to navigate and initiate their trading journey.

- Free demo account: Plus500 offers a free demo account for users to practice their trading strategies before investing real money.

- Wide range of financial instruments: Plus500 offers a wide range of financial instruments trough CFD, allowing traders to diversify their portfolios.

- Advanced charting tools: Plus500’s charting tools are highly advanced and customizable, allowing traders to analyze historical price patterns and make informed trades.

- 24/7 customer support: Plus500 offers 24/7 customer support, providing assistance to traders whenever they need it.

- Regulated: Plus500 is a regulated platform and it’s overseen by multiple regulatory agencies such as FCA, CySEC, and ASIC

Key features to look for in a Forex app

When looking for a Forex app, there are several key features that you should keep in mind.

- Real-time market updates that keep you one step ahead of currency fluctuations.

- Charting tools to analyse historical price patterns and make smart trades.

- A wide range of currency pairs to diversify your portfolio.

- Customisable price alerts to never miss an opportunity.

- A user-friendly interface that makes navigating the app a breeze.

- Advanced security features to protect your account and personal information.

- A dedicated customer support team to help you navigate any issues.

- Educational resources to help you stay informed and make informed trading decisions.

Can I trade Forex with $100?

The beauty of Forex is that you can start trading with $100 – $2000. However, it’s important to keep in mind that trading with a small amount of capital can come with its own set of challenges and limitations.

Firstly, you’ll need to be extra careful with your trade management and risk management, since a small loss can have a big impact on your account balance. You’ll also need to be mindful of the leverage you’re using, as using too high leverage can quickly deplete your account.

Additionally, you’ll have to be selective in the currency pairs you trade, as some pairs can be too volatile for a small account. Instead, look for currency pairs that tend to have smaller spreads and are less volatile.

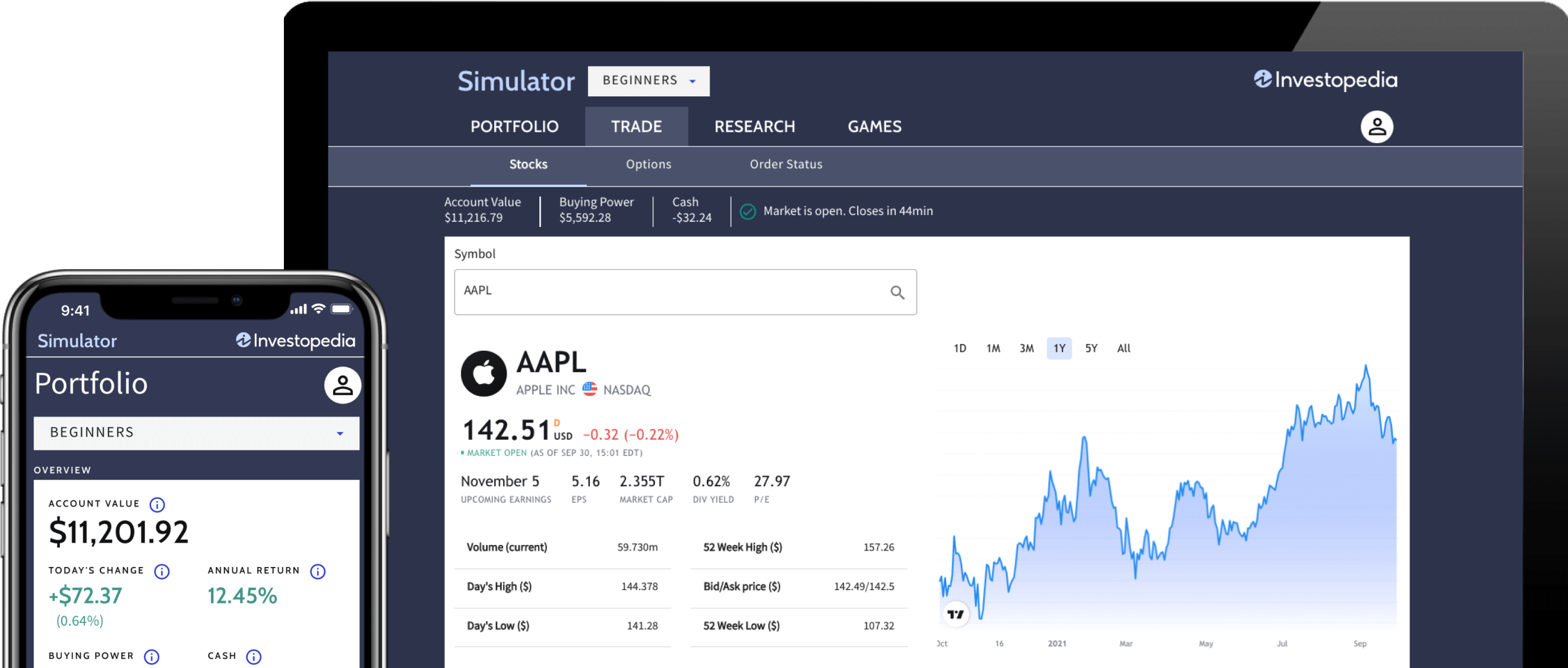

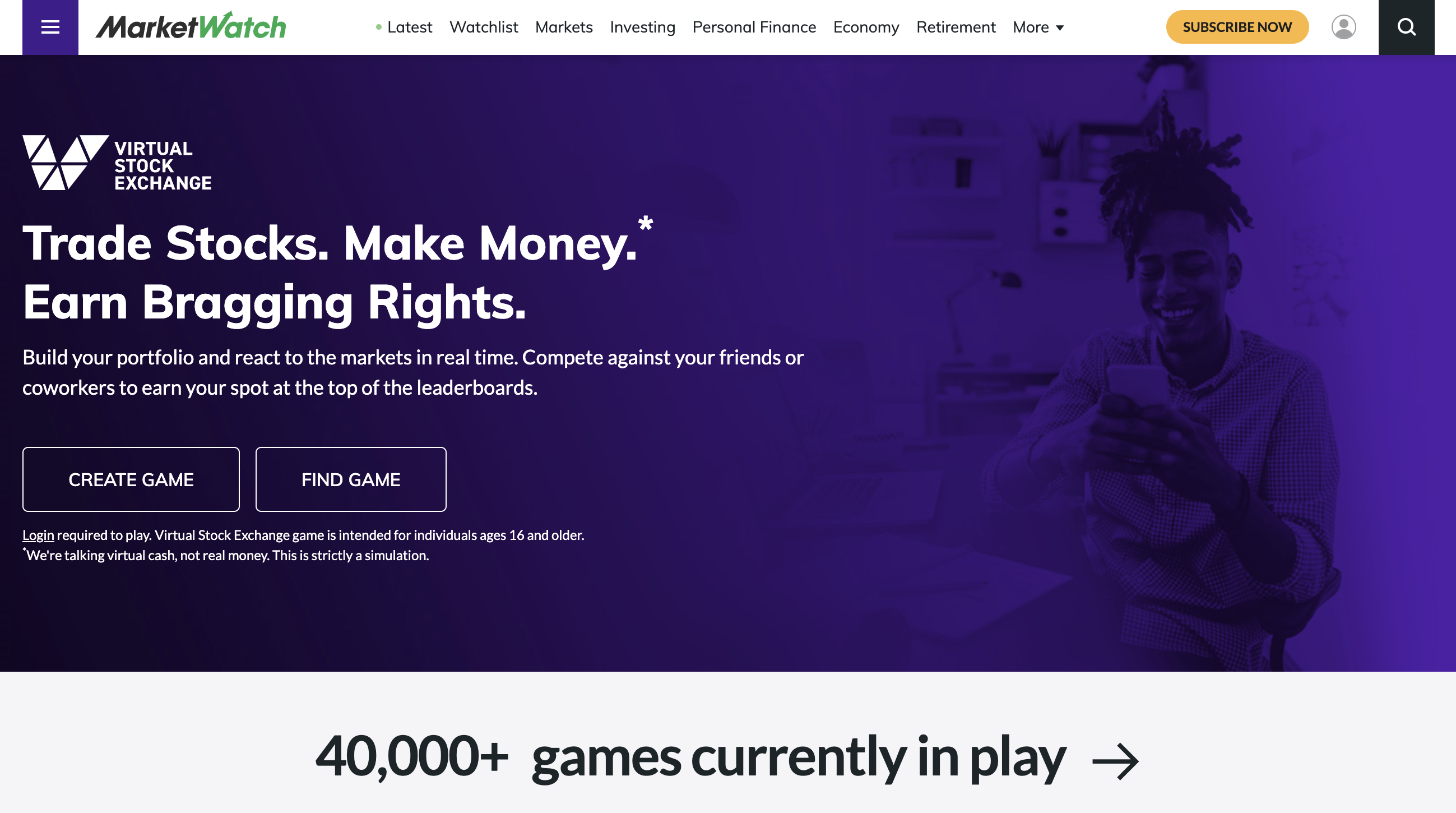

Why use the Forex trading simulator before risking real money

Forex trading can be a thrilling and potentially profitable endeavour, but it can also be risky if you don’t know what you’re doing. That’s why a Forex trading simulator is such a valuable tool for aspiring traders. With a simulator, you can practice your trading strategies and learn about the market without risking any real money.

Not only does this allow you to gain confidence in your abilities, but it also allows you to test out different trading strategies and find the one that works best for you. Plus, since the simulator allows you to make mistakes and learn from them without any real-world consequences, it’s a great way to gain experience and improve your skills. Overall, using a Forex trading simulator is a smart way to prepare yourself for the real thing and increase your chances of success in the currency market.

Is there a secret to trading Forex?

It’s not exactly a secret, but more like a treasure map with a few missing pieces. You see, trading Forex is a bit like navigating a ship through a stormy sea. You’ve got to keep a steady hand on the wheel, keep an eye on the weather, and know when to make a move.

Some traders might tell you that the secret to success is all in the indicators, while others will say it’s all about following the big players. But the truth is, there’s no one-size-fits-all answer. It’s a combination of understanding market trends, having a solid trading strategy, and most importantly, having the discipline to stick to it.

So, if you’re looking for the magic key to unlocking the Forex market, you might be disappointed. But don’t worry, with a little bit of hard work, some experimentation, and a dash of patience, you’ll be able to find your own way to success. Just remember, the Forex market is always changing, so be ready to adapt and evolve your strategy. And remember, have fun with it!

Which strategy is most profitable in Forex?

There is no single strategy that is consistently the most profitable in Forex trading. Different strategies may work well in different market conditions, and what works well for one trader may not work as well for another.

That being said, some strategies that are commonly used by profitable traders include:

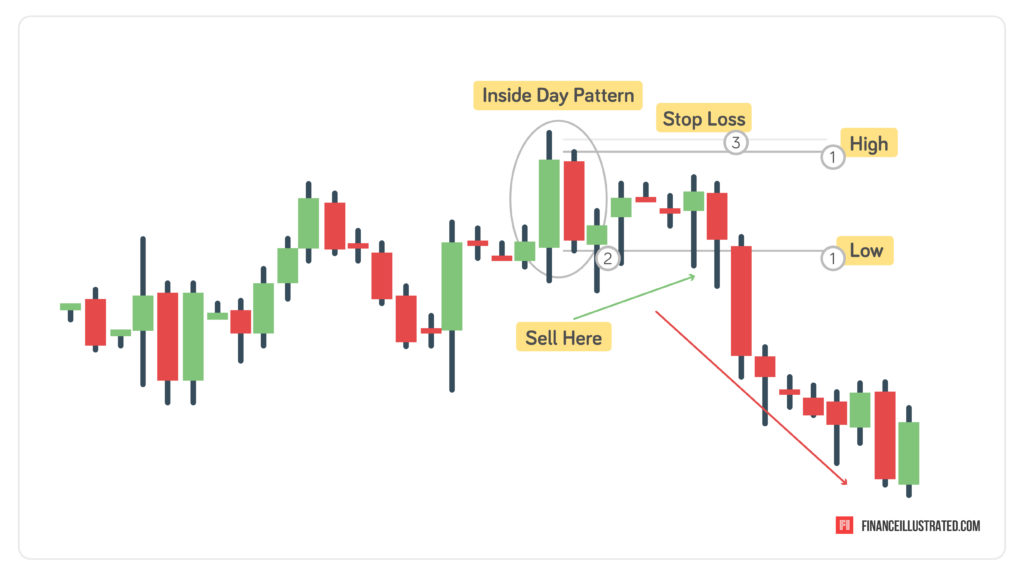

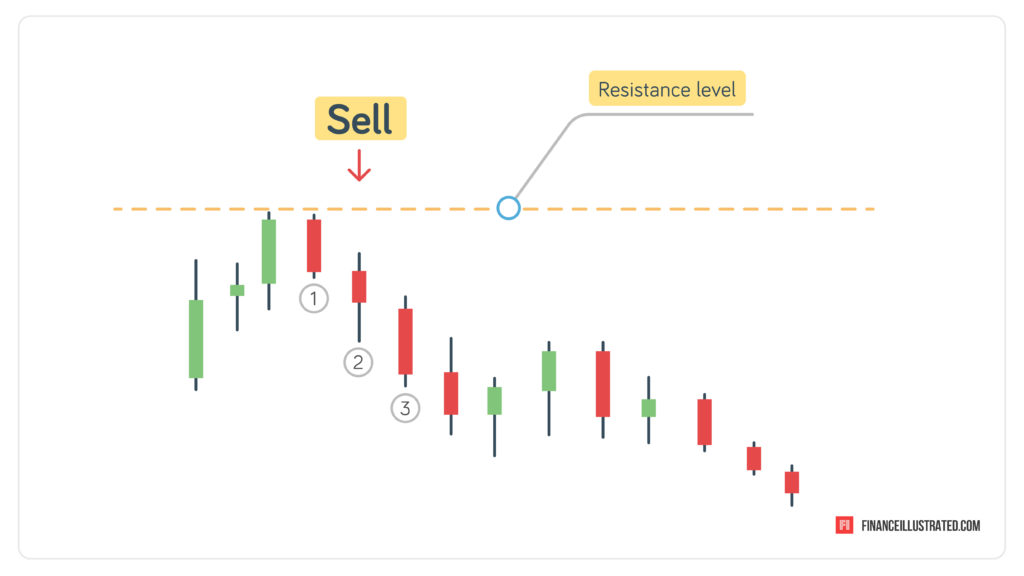

- Trend-following: This strategy involves identifying a current trend in the market, and then entering trades in the same direction as the trend.

- Position trading: This strategy involves holding a position for a longer period of time, often for several weeks or months, in order to take advantage of longer-term market trends.

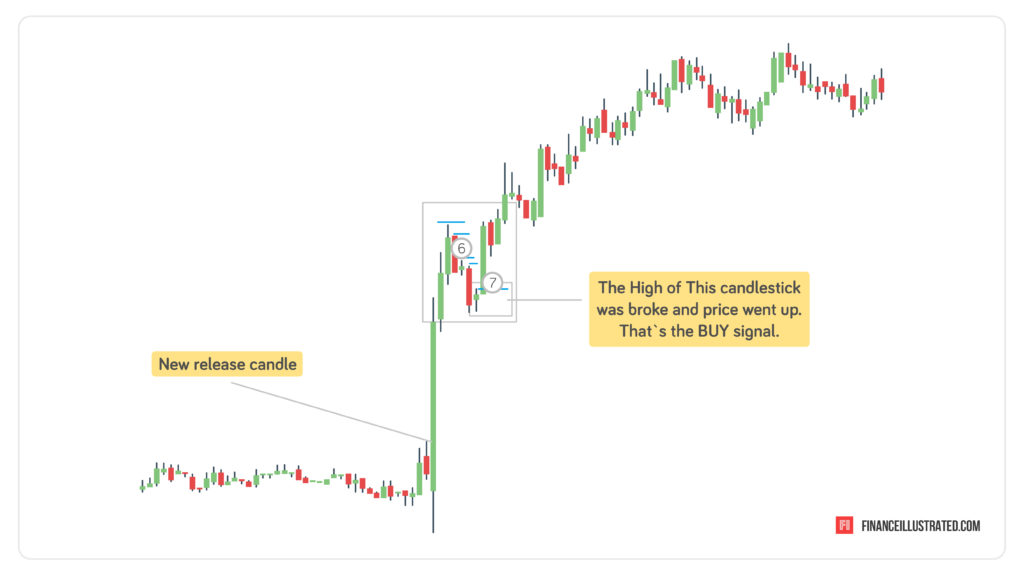

- Breakout trading: This strategy involves identifying key levels of support and resistance, and then entering trades when the price breaks through these levels.

- Scalping: This strategy involves making many trades over a short period of time, usually in the hopes of making small profits on each trade.

Ultimately, the key to finding a profitable strategy is to do your own research, experiment with different approaches, and continually monitor and adjust your trades as market conditions change.

Summary

In conclusion, trading in the foreign exchange market can be a challenging task, but with the right tools, it can also be highly rewarding. By using a Forex app, traders can stay on top of the latest market updates, analyse historical price patterns, and make informed trades. The key is to choose a Forex app that offers a wide range of features and is user-friendly.

The top Forex apps of 2023, such as Go Forex, eToro, TradingView offer all of these features and more. Whether you are a beginner or an advanced trader, there is an app out there that will suit your needs. It’s essential to do your research, try out a few different apps, and find the one that best fits your needs. With the right Forex app, you can trade smarter, not harder, and achieve success in the foreign exchange market.

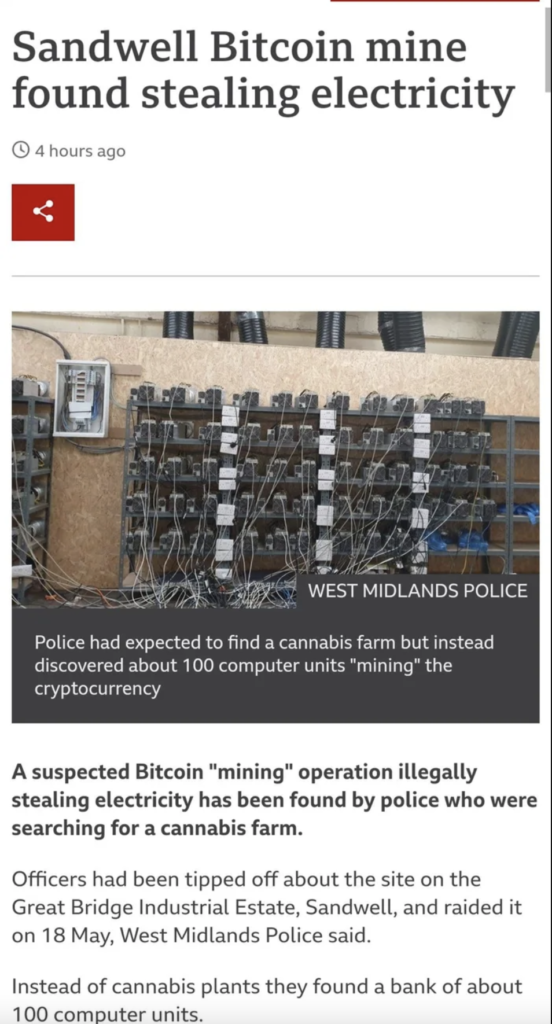

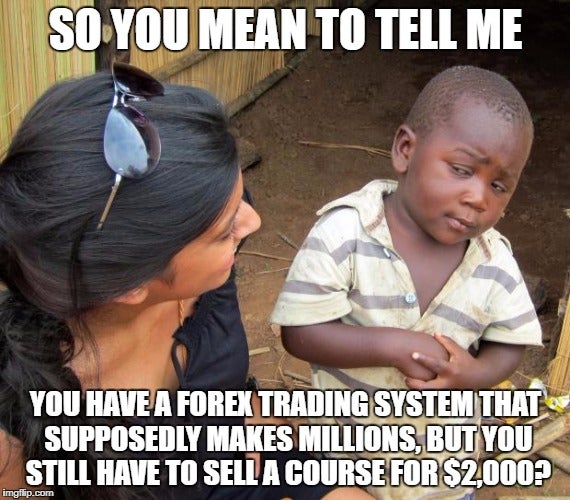

As long as the Forex market exists, there have been forex scams.? Many fake “traders” out there often promote big earnings ? and luxury lifestyles ?️ , which “you can have in few weeks” if you pay them, buy their signals, courses, or join their brokerage. These claims 99,9% are typically false. ?

As long as the Forex market exists, there have been forex scams.? Many fake “traders” out there often promote big earnings ? and luxury lifestyles ?️ , which “you can have in few weeks” if you pay them, buy their signals, courses, or join their brokerage. These claims 99,9% are typically false. ?

I used to know an extremely unlucky guy, who traded and spent years with zero return. One time, I was checking his Instagram profile and I could not recognize him. The number of fancy cars and classy places that were implied to be his was enormous. When I asked him: where did that come from? He said, nowhere, they were cars in the streets he came across and just posed next to them. Now, I know that guys need to satisfy their egos to show superiority and impress people, but in this case, it’s called deceiving people.

I used to know an extremely unlucky guy, who traded and spent years with zero return. One time, I was checking his Instagram profile and I could not recognize him. The number of fancy cars and classy places that were implied to be his was enormous. When I asked him: where did that come from? He said, nowhere, they were cars in the streets he came across and just posed next to them. Now, I know that guys need to satisfy their egos to show superiority and impress people, but in this case, it’s called deceiving people.