Ever looked at a stock and seen two prices? Welcome to the club. When you first get into trading, you'll see a bid price and an ask price for everything, from stocks to crypto. The difference is super simple once you get the hang of it.

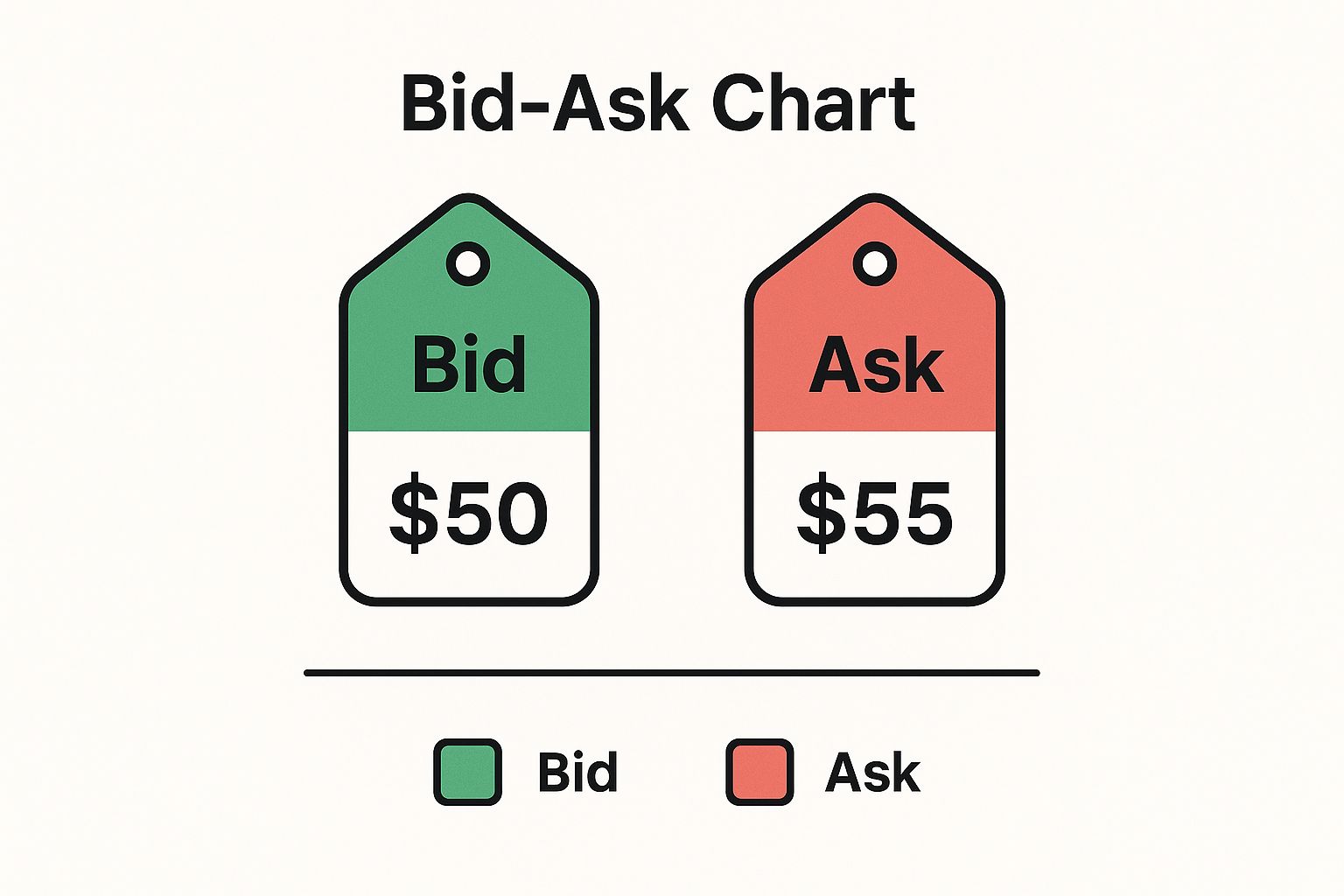

The ask price is the lowest price a seller is willing to accept for their asset. Think of it as the "sticker price." On the other side, the bid price is the highest price a buyer is willing to pay for that same asset. As a trader, you almost always buy at the ask price and sell at the bid price.

What Are Bid and Ask Prices in Trading?

Imagine you're trying to sell a limited-edition sneaker. You list it for $500 – that's your ask price. At the same time, someone out there is offering to buy that exact sneaker for $475. That's their bid price. The stock market is basically a massive, lightning-fast version of this.

The ask price is always higher than the bid price. It's a constant, silent negotiation. The seller wants the most money possible (the ask), and the buyer wants to pay the least (the bid).

Bid and Ask Explained

When you hit the "buy" button on a stock, you agree to pay a price close to the current ask. When you decide to sell, you get a price near the current bid. That small gap between the two is called the spread, and it's how brokers and market makers make their money.

This visual gives you a clear look at how these two prices show up on a trading platform.

As you can see, the ask price always sits above the bid. If you're looking to brush up on more trading terms, a good comprehensive financial glossary can be a huge help.

For huge companies like Apple (AAPL), the spread can be tiny – sometimes just a penny – because millions of people are buying and selling all the time. For less popular assets, that gap can be much wider.

Quick Comparison of Bid vs Ask

Here's a simple table to break down the key difference between bid and ask prices from your perspective as a trader.

| Concept | Bid Price | Ask Price |

|---|---|---|

| Who sets it? | The buyer | The seller |

| What does it represent? | The highest price someone is willing to pay | The lowest price someone is willing to accept |

| Your action | This is the price you sell at | This is the price you buy at |

| Relative Value | Always lower than the ask price | Always higher than the bid price |

Ultimately, understanding this simple relationship is your first step to navigating the market. It dictates the price you pay and the price you get, forming the foundation of every trade you'll ever make.

Understanding the Bid-Ask Spread

So, you have the bid price (what buyers will pay) and the ask price (what sellers want). That little gap in between? That's the bid-ask spread. It’s not just empty space; it’s the engine room of the market and how brokers earn a small profit on every trade.

Think about it like changing money at an airport. They'll buy your dollars for one price (their bid) but sell you euros for a slightly higher price (their ask). That tiny difference is how they make money. The bid-ask spread in the stock market works the exact same way.

“The stock market is filled with individuals who know the price of everything, but the value of nothing.” – Philip Fisher

Getting a handle on the spread helps you see the true cost of placing a trade. It’s an invisible fee, baked right into the price of every transaction.

Why the Spread Matters to You

The size of the spread is like a health check for a stock. A tight spread – meaning a tiny gap between the bid and ask – is a fantastic sign. It usually means the stock is heavily traded, making it easy to buy or sell without your order messing with the price. You'll see this with giants like Amazon or Tesla.

On the other hand, a wide spread can be a red flag. It suggests there aren't many buyers and sellers, which can make getting a fair price a real headache. This is common with smaller companies or when the market gets spooked.

Here's what the spread is really telling you:

- Liquidity: A tight spread screams high liquidity (easy to trade). A wide spread signals the opposite.

- Volatility: Spreads can get wider during major news events, reflecting higher risk.

- Trading Costs: Every time you trade, that spread is a cost you pay. For active traders, these small costs can seriously add up and eat into your profits.

Ultimately, paying attention to the difference between the ask and bid price is more than just looking at numbers. You're getting a real-time report card on a stock's popularity and your actual trading costs.

Why Bid and Ask Prices Constantly Change

If you've ever watched a live stock chart, you've seen it: the bid and ask prices flicker non-stop. This isn't random noise. It's the market's heartbeat, the result of a constant tug-of-war between supply (sellers) and demand (buyers).

Think of it like an auction. When lots of people want to buy something, they start offering more money, pushing the bid price up. Sellers see this and raise their prices, pulling the ask price up too. If bad news hits and everyone wants to sell, they lower their prices to get out fast. This makes the ask price drop, dragging the bid price down with it.

What Makes the Market Move

So, what causes these sudden shifts? A few key things are almost always behind the action. Getting a feel for them is key to seeing the bigger picture.

- Breaking News: A company announcing a cool new product can start a buying frenzy in minutes.

- Company Earnings: A great earnings report can send a stock soaring. A bad one can cause it to crash.

- Economic Data: Big-picture news on things like inflation or jobs can shake the whole market.

- Social Media Hype: Never underestimate the power of a single tweet. A message from an influential figure like Elon Musk can create massive, instant demand. A funny fact: in 2021, Musk's tweets about Dogecoin sent its price flying over 400% in a week.

Each of these events changes how investors feel about an asset's future. Their collective buying and selling is what moves the bid and ask prices in real-time. To see how these ideas apply globally, our guide on what influences exchange rates is a great next step.

“The key to making money in stocks is not to get scared out of them.” – Peter Lynch

This classic quote perfectly captures how emotional reactions to news are what fuel most of the market's short-term swings.

Today, this process is supercharged by high-frequency trading (HFT) algorithms. These aren't people clicking buttons; they're powerful computer programs that scan the news and make trades in millionths of a second, which is why prices adjust almost instantly.

How to Place Smarter Trades Using Bid and Ask

Okay, you get the theory behind ask price vs bid price. Now it's time to actually use that knowledge to make smarter moves. This is where you go from being a spectator to a player with a game plan. It all comes down to how you place your trades.

You have two main tools: market orders and limit orders. Think of them as a choice between speed and precision. One gets you in the game now, the other lets you set the rules.

Market Orders for Speed

A market order is the simplest way to trade. You’re telling your broker, "Get me this stock right now at the best available price." When you buy, your order will be filled at or near the current ask price. When you sell, you'll get a price close to the bid price.

This is perfect when your top priority is getting the trade done immediately. You aren't worried about a few pennies – you just want in or out, fast.

Limit Orders for Control

A limit order, on the other hand, puts you in the driver's seat. Instead of taking whatever the market offers, you set the exact price you're willing to pay or accept. For example, you could set a limit order to buy a stock only if it drops to $50.05, or to sell it only if it climbs to $52.50.

Using a limit order is your best defense against paying more than you planned. It ensures your trade only happens at your price or better.

This approach gives you total control. The downside? If the stock never hits your price, your order might sit there unfilled.

So, when do you use which? Here’s a quick guide:

- Use a Market Order if: You’re trading a popular stock with a tight spread and you need to get the trade done instantly.

- Use a Limit Order if: You have a specific entry or exit price in mind, or if you're dealing with a less-traded stock with a wide spread.

Getting comfortable with both is a fundamental skill. To take your strategy to the next level, you might also find some great insights from these effective day trading tips. Knowing which order to use is how you turn a basic understanding of the bid-ask spread into a real trading advantage.

Bid and Ask Prices Beyond the Stock Market

The whole bid vs. ask price concept isn't just for stocks. Once you get it, you'll start seeing it everywhere in finance. It's the universal language of buying and selling pretty much any asset.

Take the huge foreign exchange (Forex) market. When you look at a currency pair like EUR/USD, the bid-ask spread is often razor-thin – we're talking fractions of a penny. That’s because countless banks and traders are constantly buying and selling, which keeps things super liquid. If you want to get into the details, our guide on how to read currency pairs breaks it down perfectly.

Commodities and Crypto Markets

This same principle powers the world of commodities. Whether it's a barrel of oil or an ounce of gold, you'll always find a bid and an ask price. Big news, like a surprise oil discovery, can make that spread widen in a heartbeat as traders scramble to react.

And yes, the same rules apply to the wild world of cryptocurrency. The bid-ask spread on a major player like Bitcoin might be pretty tight. But for a smaller, lesser-known altcoin? That spread can be huge. A wide gap is a dead giveaway for lower trading volume and higher risk. Fun fact: even celebrities get involved. When Ashton Kutcher's venture capital firm invested in a crypto project, it brought huge attention, which tightened the bid-ask spread as more people started trading it.

"The four most dangerous words in investing are: 'this time it's different'." – Sir John Templeton

This quote is a great reminder that no matter the asset – currency, commodity, or crypto – the fundamental principles of supply and demand, shown through the bid-ask spread, always apply.

Across all these markets, the core idea is the same. The bid is what buyers will pay, the ask is what sellers will accept, and the spread is the cost of making the trade happen. Grasping this simple dynamic gives you a powerful lens to view any asset you might consider trading.

Common Questions Answered

Got a few more questions rattling around? No problem. Here are some quick answers to the things new traders often wonder about.

What Is a Good Bid-Ask Spread?

Simple: a tight one. For big, popular stocks that trade millions of shares a day, the spread might only be a penny. A tiny spread is a great sign – it means the stock is super liquid (easy to get in and out of) and your trading costs are low.

On the other hand, a really wide spread should make you pause. It can be a red flag for low trading volume, wild price swings, or general riskiness.

Can I Buy at the Bid Price?

As a regular retail trader, the system is pretty set: you buy from the market at the ask price and you sell to the market at the bid price. Think of the bid price as the standing offer from buyers (like market makers) ready to take shares off your hands.

The best way to get control over your price is to use a limit order. This tells your broker the exact price you're willing to pay, giving you the final say.

Using limit orders is a smart habit that can stop you from overpaying if the price suddenly jumps right as you hit the buy button.

How Does the Spread Affect My Profit?

The spread is a direct, unavoidable cost of trading. If you buy a stock, its price has to climb higher than the spread itself just for you to break even.

This might seem small on one trade, but for active traders making dozens or hundreds of trades, these little costs can bleed you dry. They stack up fast and can take a serious bite out of your profits. Learning to minimize the impact of the spread is a key skill for any winning strategy.

Ready to put this knowledge into practice? financeillustrated.com offers a free Trading School that breaks down how markets really work. You can start with easy-to-digest lessons and then jump into risk-free simulators to build your confidence at https://financeillustrated.com.