Ever been to an airport currency exchange and seen two different prices for the same currency? One to buy it and another, slightly different price to sell it?

Congratulations, you've already seen the forex spread in action. That tiny gap between the prices is how those places make money. In forex trading, it’s the most basic cost you’ll encounter and the main way your broker gets paid for letting you trade on the global market.

What the Forex Spread Really Means for You

Think of it like starting a race a few feet behind the starting line. Every single time you open a trade, you begin with a small disadvantage equal to the spread. The market price has to move in your favor by that exact amount just for you to get back to zero.

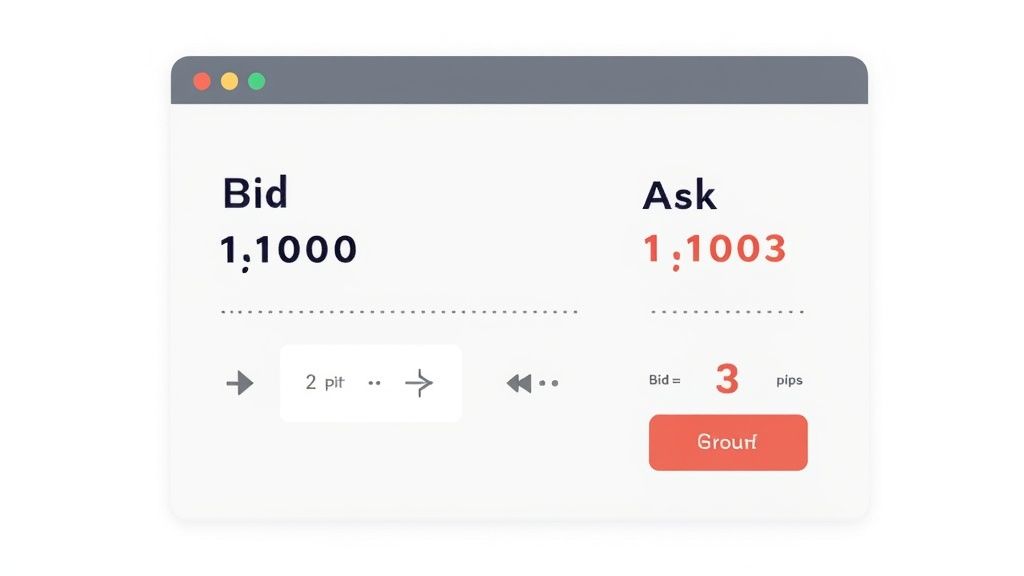

This gap is created by two key prices:

- The bid price is what your broker will buy the currency from you at. In simple terms, it's your sell price.

- The ask price is what your broker will sell the currency to you at. This is your buy price.

The spread is just the difference between these two. Simple, right?

Bid vs Ask Price At a Glance

Let's drop this into a quick table to make it crystal clear.

| Concept | What It Means for You | Example Price (EUR/USD) |

|---|---|---|

| Ask Price (Buy Price) | The price you pay to BUY the currency. | 1.0852 |

| Bid Price (Sell Price) | The price you get when you SELL the currency. | 1.0850 |

| The Spread | The difference – basically your broker's fee. | 0.0002 or 2 Pips |

The difference looks tiny, but trust me, it adds up.

Here’s a cool fact: the US dollar is involved in a whopping 88.5% of all forex trades. Because so many people are trading it, the market is super liquid. This means popular pairs like EUR/USD usually have very small, or "tight," spreads, making them cheaper to trade.

"The difference between the bid and the ask price is the spread. The spread is how 'no commission' brokers make their money." – Kathy Lien, Managing Director of FX Strategy for BK Asset Management

Nailing this concept is your first big step. To really get into the weeds of how these prices work, check out this a complete guide to defining spread in forex.

How to Calculate the Forex Spread

Ready for some math? Don’t worry, it's super easy. Before we get to the formula, you need to know about the pip.

A pip (short for "percentage in point") is the smallest price change a currency pair can make. Think of it as one point in a video game. For most pairs like EUR/USD, a pip is the fourth number after the decimal point (0.0001).

For pairs with the Japanese Yen (JPY), like USD/JPY, a pip is the second decimal place (0.01). This little unit is how we measure the spread.

The Simple Spread Formula

The calculation is just one step: subtract the bid price from the ask price. That's it! While we have another guide that goes deep on ask price vs bid price, all you need is this simple formula.

Spread = Ask Price – Bid Price

Let's use the mega-popular EUR/USD pair. Imagine your trading screen shows these prices:

- Ask Price (what you buy at): 1.0852

- Bid Price (what you sell at): 1.0850

Now, just plug those into the formula:1.0852 - 1.0850 = 0.0002

That result, 0.0002, is two pips. So, the spread on this trade is 2 pips. Easy peasy.

When you see a spread, you're not just looking at numbers; you're seeing the instant cost of getting into the market. A smaller number means a lower cost, giving you a better head start.

Let's try a JPY pair. Say the USD/JPY prices are:

- Ask Price: 157.45

- Bid Price: 157.42

Same deal:157.45 - 157.42 = 0.03

Since a pip for a JPY pair is the second decimal place, that 0.03 means the spread is 3 pips. Once you get this, you can instantly see your trading costs for any currency.

Why a Tiny Spread Can Make a Huge Difference

A few pips might sound like nothing, but in forex, they are a big deal. The spread is directly connected to your profit because every trade you open starts slightly negative. How negative? Exactly the size of the spread.

This means the market has to move in your favor just for you to break even. Only after the price covers the spread can you start thinking about profit. It's like a small hurdle you have to jump over at the start of every race.

The Power of Small Costs

Even billionaires worry about small costs. The legendary investor Warren Buffett has two famous rules: "Rule No. 1 is never lose money. Rule No. 2 is never forget Rule No. 1." The spread is a tiny, guaranteed loss you take the second you open a trade. Keeping it low helps you follow Buffett's rules.

A lower spread is your first advantage. It means a smaller gap to cross to become profitable, which can be the difference between a winning and losing strategy over time.

For traders who jump in and out of the market all day – known as scalpers – these tiny costs add up fast. A 2-pip spread on 20 trades is 40 pips in costs you have to beat just to break even. This is why understanding what is spread in forex isn't just theory; it's a survival skill.

This is especially true for us regular folks. While a mind-blowing $7.5 trillion is traded in the forex market daily, individual traders like us make up only about 5.5% of that. For us, tight spreads are vital. They lower our business costs and make it easier to actually turn a profit. You can find more cool stats like this from retail trader market statistics on currenciesfx.com.

Ultimately, managing these costs is your first real step toward success.

What Makes Forex Spreads Widen or Tighten?

If you've ever watched a trading chart, you’ve probably noticed the spread isn't set in stone. It breathes, shrinking and expanding all day. This isn't random. Two big forces are at play: liquidity and volatility. Every good trader knows how they work.

Liquidity: How Busy is the Market?

Think of liquidity like the number of people at a party. A currency pair like EUR/USD is a massive festival, buzzing with buyers and sellers 24/7. With so many people ready to trade, there's a ton of competition, which keeps the gap between the bid and ask price super small, or tight.

Now, imagine an exotic pair like USD/TRY (US Dollar/Turkish Lira). This is more like a small, quiet get-together. Fewer buyers and sellers mean it's harder to make a deal, so the price gap has to be bigger, or wider. It's simple supply and demand.

Volatility: The Market's Mood Swings

The second ingredient is volatility. Think of it as the market's mood – how quickly and crazily prices are jumping around. Imagine major news drops, like a central bank suddenly changing interest rates. It causes a ton of uncertainty.

During these chaotic moments, brokers widen their spreads. Why? It's a defensive move. They're protecting themselves from the wild price swings. For you, this means the cost to open a trade can shoot up in an instant.

"In the short run, the market is a voting machine but in the long run, it is a weighing machine." – Benjamin Graham

Benjamin Graham's famous quote is perfect here. It highlights how emotional the market can get in the short term. The daily forex market turnover exploded from $1.5 trillion in 1998 to $7.5 trillion in 2022, and spreads have become even more sensitive to news. You can dig into more of these fascinating Forex market statistics at BestBrokers.com.

During major world events or surprise economic news, spreads can blow out. Knowing when this is likely to happen is a huge part of understanding the spread. Keep an eye on the economic calendar, and you'll be in a better position to time your trades and avoid paying extra.

Smart Strategies to Manage Spread Costs

Knowing what the spread is gets you in the game. Learning how to manage it is how you start to win. Keeping these costs low is a skill, and it all begins with timing.

One of the biggest mistakes new traders make is trading right when big economic news is announced. During these high-volatility moments, spreads can explode from 1 pip to 10 pips in seconds, making your trade way more expensive from the start. A smarter move is to wait for the dust to settle.

Trading During the Golden Hours

To get the best spreads, trade when the market is busiest. The sweet spot is when two major trading sessions overlap – especially the London and New York sessions.

This overlap happens from about 8 AM to 12 PM EST. With so many people trading at once, liquidity is at its peak, and brokers offer their tightest spreads. Simply trading during these high-traffic times is an easy way to lower your costs.

Spreads aren't just a fee; they're a live indicator of market conditions. By choosing when to trade, you can pick moments when the cost of entry is lowest, giving you an immediate edge.

Choosing the Right Broker and Account

Finally, your choice of broker is huge. Different brokers and account types offer different spread models.

- Fixed Spreads: These are predictable, so you always know your cost. The downside? They're usually wider than variable spreads.

- Variable Spreads: These change with the market and can be incredibly tight during calm periods. They are often the best choice for active traders.

When you're starting, it's a great idea to read up on comparing brokerage fees to see what fits your style. Also, look into related costs like slippage in trading, which is when your trade goes through at a slightly different price than you expected.

Still Have Questions About Forex Spreads?

Got some questions still rattling around? Totally normal. Let's tackle a few common ones so you can get started with confidence.

Which Is Better for a Beginner: Fixed or Variable Spreads?

This really depends on your personality. Fixed spreads are like a set menu at a restaurant – you know the price upfront. This is great for planning your costs when you're just starting. The catch? The price is usually a bit higher.

Variable spreads are more like the daily specials. They can be super cheap (sometimes as low as 0.1 pips) when the market is calm but can spike during big news events. A smart strategy for beginners is to use an account with tight variable spreads but only trade during those calm, high-volume hours to avoid nasty surprises.

Can a Forex Spread Actually Be Zero?

For a regular trader, seeing a true zero spread is like finding a unicorn. It's super rare. Brokers might advertise "zero spread" or "raw spread" accounts, which sounds awesome. But there's almost always a catch.

Instead of making money from the spread, these brokers charge a fixed commission on every trade. So while the price gap might be almost zero, you're still paying a fee. It's like a concert ticket with no "service fee" that has a mandatory "venue fee" at checkout.

Always look at the total cost – spread plus commission – to figure out which account is actually the better deal for you.

How Can I See the Live Spread on My Trading Platform?

This is one of the easiest – and most important – things to learn. Most modern platforms, like the famous MetaTrader 4 (MT4) and MetaTrader 5 (MT5), make this simple.

Just find the "Market Watch" window where all the currency pairs are listed. You'll see columns for the "Bid" and "Ask" prices.

Pro Tip: In most platforms, you can right-click on the column headers (like "Bid") and add a "Spread" column. This will show you the live spread in pips for every pair, updating in real-time.

Doing this turns an abstract idea into a real number you can use. It's the key to truly understanding what is spread in forex from a practical standpoint, letting you see your costs before you even click buy or sell.

Ready to put what you've learned into action? At financeillustrated.com, we believe learning about the markets should be simple and engaging. Dive into our free Trading School, practice with our risk-free trading simulators, and build the skills you need to trade with confidence. Start your learning journey with Finance Illustrated today!