Here you’ll find what to look out for in Bloomberg, Reuters and other major news outlet. More importantly, how to interpret the information you see and hear. Once you know what influences exchange rates, you can execute more and more successful trades.

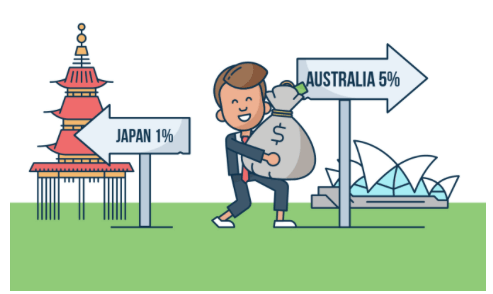

1. Interest Rates

Interest rates help to determine the “cost” of money in each country. For example, if interest rates are higher in the United Kingdom than the United States, then it is more attractive to deposit money in the U.K than the U.S. This is because the return from money held in savings accounts will be higher in the U.K. if interest rates are higher. This will lead to the demand of the GBP increasing, relative to the Greenback (see all currency nicknames).

Who Controls Interest Rates

Interest rate benchmarks are set and monitored by the central banks of developed nations. The 8 most influential central banks and their currency symbols are:

- U.S. Federal Reserve Bank (USD)

- European Central Bank (EUR)

- Bank of England (GBP)

- Bank of Japan (JPY)

- Swiss National Bank (CHF)

- Bank of Canada (CAD)

- Reserve Bank of Australia (AUD)

- Bank of New Zealand (NZD)

Negative Interest Rates

In recent times we have even seen some central banks put in place negative interest rates. Why would that happen? The European Central Bank announced that it would charge banks that deposited money with it a fee for that service. This was done by putting in place negative interest rates. The idea was to encourage banks to lend their capital to borrowers, rather than deposit it, in order to encourage economic growth. Negative interest rates are a sign that “normal” policies are not working, and more drastic action is needed.

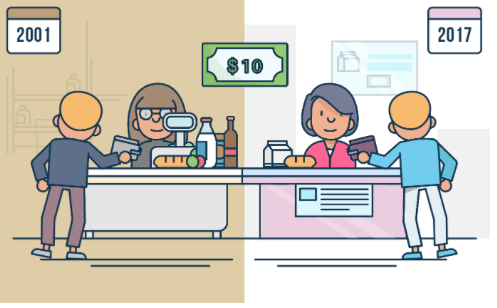

2. Inflation Rate

If you were to pinpoint the “pulse” of the economy, inflation would be it. Do you recall how much bread or your favorite chocolate cost when you were a child? How about the price of gasoline when you first started driving? It was much less than now wasn’t it? That’s because the price of things in an economy rise each year. This process is called inflation. Inflation is the annual increase of prices for a defined list of goods and services, measured in percentage terms.

Inflation will occur if there is excess money in a market, and that excess money is greater than the current demand for the goods and services in that market. This situation can occur in a growing economy when the workers in it begin to earn and spend more, but the production of goods and provision of services does not increase correspondingly. Another source of inflation is increasing costs for businesses. For example, if the price of coal increases, then the cost of generating electricity will also increase. The companies who generate electricity will then seek to maintain their profitability by charging their customers more. While it is most peoples first instinct to think that rising prices are a bad thing, that is not always the case.

3. Deflation

As you might have guessed, deflation is the opposite of inflation. It means that the prices of goods and services are decreasing. That sounds good, doesn’t it? But it actually isn’t a good thing at all if it goes on for a long time. If deflation occurs for more than a month or two then consumers begin to behave differently. Companies and consumers both stop spending money, hoping that they can buy things more cheaply later. This begins a negative chain reaction, which we can illustrate with a recent example from Greece. In 2014 and 2015, the financial crisis in Greece dragged on and demand for products and services weakened.

- Businesses were forced to respond by cutting prices

- Consumers stopped buying, believing prices had further to fall

- Business income dried up, and businesses were forced to lay off employees

- As unemployment rose, purchasing power decreased even further and people became even more unwilling to spend

- As the situation worsened, businesses could not lay off more workers, and began to go bankrupt

- The debt of the Greek government grew and few as total tax revenue shrunk

4. GDP Rate

The GDP is a representation of the value of all of the goods, services and products that are created by a country. This is usually calculated on an annual basis. An annual increase of 3% – 3.5% in a nations GDP is an indicator of a strong economy. If the rate is higher than this, it may signal that inflation is too high. A lower rate or a declining rate is a signal of an possible economic downturn. If GDP growth is negative for 6 months, or two quarters, an economy is considered to be in recession. If GDP is higher than predicted, the value of that nations currency would typically rise. The same is true in the opposite situation, a lower than expected number would lead to currency falls.

5. Employment Statistics

Employment statistics measure the percentage of a nations possible workforce that was unemployed during the previous period, usually a month. Unemployment statistics are usually reported as “the unemployment rate”. If actual unemployment comes in lower than forecasts, this is a good thing, and a currency will rise as a result as strong employment is a sign of a growing economy.

6. Trade Balance

The trade balance of a nation is the difference between the value of exported goods and the value of imported goods. If exports are greater than imports, it indicates that other nations are willing to buy products produced by a country, which creates demand for the local currency.

- Imports > Exports = Trade Deficit

- Imports < Exports = Trade Surplus

When imports are greater than exports, that is called a trade deficit. A trade deficit shows that a nation has a great demand for foreign goods, which are purchased with foreign currency. This will strengthen the foreign currency and weaken the local currency.

7. Political Events

Political events can have huge and unforeseen effects on currency rates. Elections, referendum results and political turmoil can all affect the forex market. If a country is unstable due to planned (elections) or unplanned (resignations, protests) political events, the value of its currency will tend to decrease as most traders will seek to avoid the uncertainty attached to these events.

Elections

Elections create uncertainty about the future of a country, especially when the opinion polls about the likely winner are close. Different political parties have different approaches to monetary and fiscal policy, such as taxes and government spending. These variables have clear effects on currency levels. Pre-election polls are closely watched by traders for clues about the eventual outcome of an election. If the likely leader of a country is seen as good for the economy or business, the currency will tend to rise. On the other hand, if the polls show that a person who is considered unstable or a threat to the economy is likely to win, currency traders will sell that currency.

Referendums

Referendums have been a hit topic in the news recently, with the Brexit referendum and Italian referendum two examples from 2016. If we use the example of the Scottish independence referendum, we can see that the initial reaction was a decrease in the value of the Pound. However, traders who believed that Great Britain would ultimately stay together were able to benefit by buying the Pound as it weakened, as the currency rose after the referendum failed to win popular support.

Scandals

Political scandals are fairly regular, and can have the effect of inciting protests, large scale strikes or even snap elections. Instability means that currency rates fall as traders avoid uncertainty and the higher probability of losses.

8. Military Conflicts

If Russia were to suddenly send ground troops into Ukraine, what do you think would happen to the Rouble? It is likely that the Rouble would fall as money fled the country. However, there does not have to actually be any “boots on the ground” for the currency to fall. The threat of any armed conflict will influence the currency of the nations involved. Military conflicts can hurt economies, as economic sanctions imposed by other nations, trade barriers and reduced consumer spending due to fear all usually follow. They also increase the demand for perceived “safe” currencies like the U.S. Dollar as Swiss Franc.

9. Quantitative Easing

Quantitative easing (QE) might sound terribly complicated, but in actual fact its not too difficult to understand. QE is intended to put some “fuel” into the economy after or during severe downturns. The way it does this is basically the same as the negative interest rate policies we covered earlier – by creating incentives to lend money.

If the currency of a country decreases, which of these groups DOES NOT benefit?

If an economic indicator is published, and it meets previously announced forecasts, what is the most likely effect for that currency?

If an economic indicator beats forecast expectations, what is the most likely effect for that currency?

Share your Results: