Jumping into the world of investing is a thrill, but let's be honest-the fees can feel like a surprise pop quiz. In a nutshell, brokerage fees are what you pay a platform to execute your trades on stocks, ETFs, and other assets. While ads for 'zero commission' trading are everywhere, brokers still have to keep the lights on. Figuring out how they do that is the key to comparing brokerage fees like a pro.

Decoding Your Brokerage Bill

Think of brokerage fees like the hidden charges on a concert ticket. The ticket price is just the start; it's the service fees that can really add up. Investing works the same way. The legendary Warren Buffett built his fortune by obsessively minimizing costs to maximize his returns. His famous mantra says it all: "Rule No. 1: Never lose money. Rule No. 2: Never forget rule No. 1." While he was talking about smart investments, sidestepping unnecessary fees is a massive part of that equation.

The good news? The game has changed for the better. Just a decade ago, commissions were a huge deal, making up around 25% of how brokers were judged. Today, that number has plummeted to just 5%, mostly because free stock and ETF trades have become the industry standard.

But "free" isn't really free. Brokers now make money through other methods, like a practice called Payment for Order Flow (PFOF). You can discover more insights about US brokerage fees and how this shift has reshaped the industry.

The Main Types of Brokerage Fees at a Glance

To make sense of it all, let's break down the most common fees you'll run into. This table gives you a quick and simple explanation of what each one is and who it impacts the most.

| Fee Type | What It Is (Simple Explanation) | Who It Affects Most |

|---|---|---|

| Commissions | A fee you pay your broker for making a trade (buying or selling). | Traders of specific assets like options or international stocks. |

| Spreads | The tiny difference between the buying and selling price of an asset. | Active traders and those investing in forex or crypto. |

| Account Fees | Charges for just keeping your account open, like for inactivity. | Investors who don't trade often or want to switch brokers. |

| Withdrawal Fees | A charge for taking your money out of your brokerage account. | Anyone who needs to access their cash from the platform. |

Understanding these four core fees will put you miles ahead. It helps you look past the flashy "zero commission" headlines and see where the real costs are hiding.

The Four Main Fees Every Investor Should Know

Before you can pick the right brokerage, you’ve got to speak the language-and that means understanding fees. When you start comparing platforms, you'll run into a few key terms over and over. Getting a handle on these is the first step to making a smart choice.

Think of them as the "big four" you need to watch out for. Let's break them down so you're never caught off guard.

Commissions and Spreads: The Trading Costs

First up, commissions. This is the most straightforward fee: a flat charge you pay for making a trade. Think of it like a service fee when you buy a concert ticket online. While tons of brokers now shout about "zero-commission" stock trades, these fees are still very much alive for assets like options, mutual funds, or crypto.

Then there’s the spread, which is a lot sneakier. It’s the tiny difference between the buying price (the "ask") and the selling price (the "bid") of an asset. A broker might buy a stock for $10.00 and offer to sell it to you for $10.01. That single penny difference is the spread, and it’s how they make money on so-called "free" trades.

"Rule No. 1: Never lose money. Rule No. 2: Never forget rule No. 1." – Warren Buffett

While Buffett was talking about picking winning stocks, his wisdom applies perfectly to fees. Every penny you pay in spreads or commissions is a penny that isn't working for you. Keep that in mind, because these tiny costs add up fast.

Account and Withdrawal Fees: The Hidden Annoyances

Beyond the cost of each trade, some brokers hit you with fees just for having an account. These can feel like a penalty for not using your account in the exact way they want you to.

Here are a few common ones to look for:

- Inactivity Fees: Some brokers will charge you if you go too long without making a trade, maybe 90 days or a year. This is a real headache for long-term, buy-and-hold investors who aren't constantly tinkering with their portfolios.

- Account Maintenance Fees: This is a recurring charge, often billed monthly or annually, just for the privilege of keeping your account open. Thankfully, most modern online brokers have ditched this, but it’s still out there.

- Transfer Fees: Thinking about moving your stocks to a different broker? Watch out. You could get slapped with a fee which can easily be $50-$100.

Finally, there are withdrawal fees. Yes, you read that right-some platforms charge you to take out your own money. This is more common for certain withdrawal methods, like wire transfers, but it’s always worth checking the fine print.

Knowing these four fee types is your superpower. It’s how you cut through the marketing noise and find a broker that’s truly low-cost.

How Real Brokerage Fee Structures Compare

Alright, let's get out of theory and into the real world. Comparing brokerage fees isn't as simple as finding the lowest number on a page; it's about finding the right cost structure for your specific style of investing. A cheap, no-frills broker might be perfect for one person, while another will gladly pay more for access to top-tier research and powerful trading tools.

Think of it like choosing a phone plan. One might offer "unlimited" data but slow you down after a few gigs, while another costs more but delivers lightning-fast speeds all month. Neither is objectively "better"-it all boils down to whether you're a casual emailer or a 4K video streamer. Brokerages work the same way. The goal is to match the fee structure to your actual investment habits.

Discount vs. Zero-Commission: A Practical Showdown

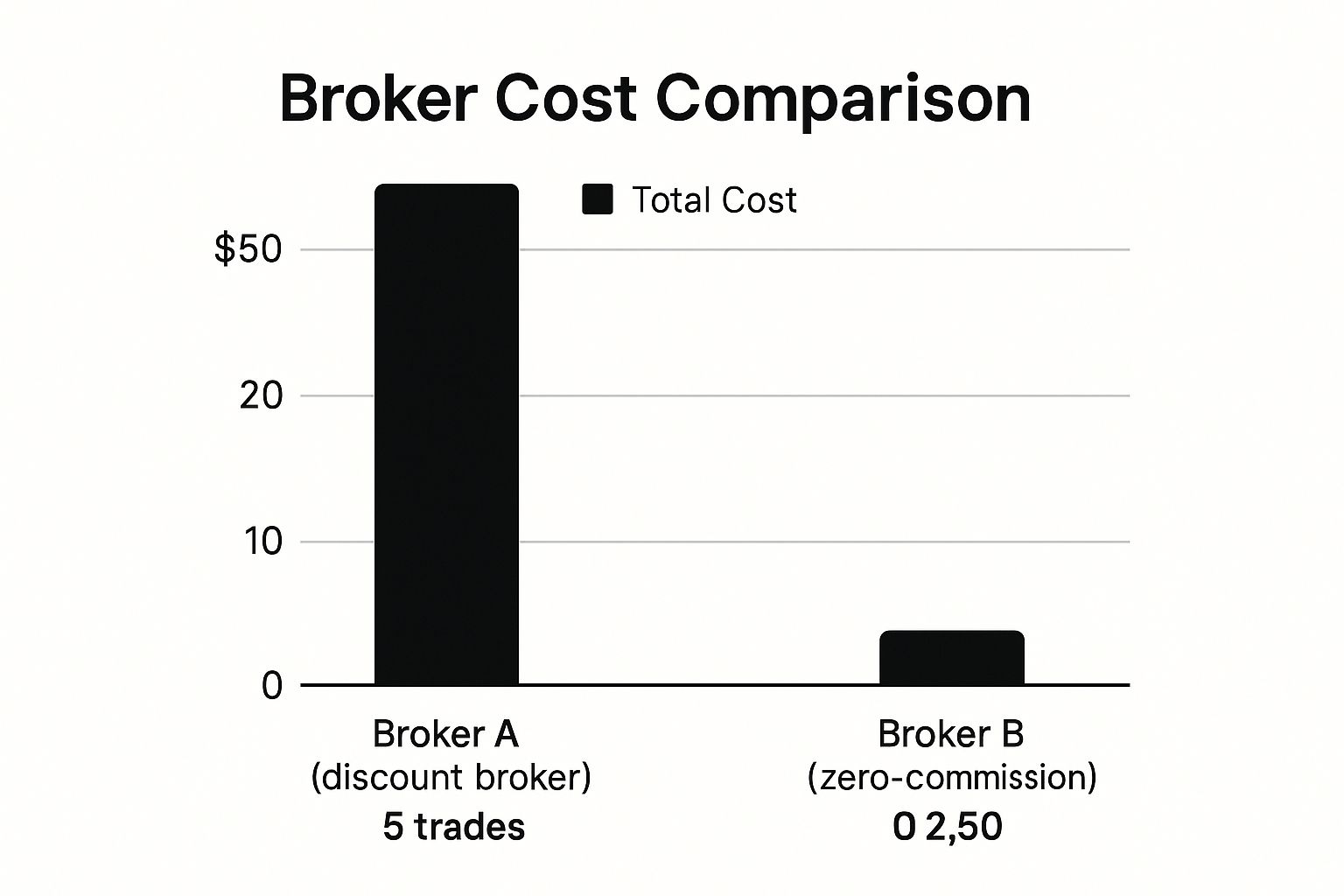

Let's make this real. Imagine you start with $1,000 and make five simple trades over a few months. This is where the slick marketing slogans hit a wall with reality.

- Broker A (Discount Broker): This platform is old-school. It might charge a flat $10 commission for every trade you make. For your five trades, you'd be out a total of $50 in fees. Simple, predictable, and a bit pricey for small-time trading.

- Broker B (Zero-Commission Broker): This one is all about "free" trades. But they have to make money somewhere, right? They do it on the spread for each trade. Let's say it works out to about $0.50 per trade. Your total cost here? A mere $2.50.

This chart really drives home how a traditional discount broker's costs stack up against a modern zero-commission model in our five-trade scenario.

As you can see, for a handful of simple trades, the zero-commission model seems like a no-brainer.

This quick comparison teaches a critical lesson: headline rates never tell the full story. The legendary investor Peter Lynch famously said, "Know what you own, and know why you own it." The exact same logic applies to your broker-you need to know what you're paying for and why.

Choosing a broker is like picking a teammate for your financial journey. You want one who plays to your strengths and doesn't slow you down with unexpected penalties. The "cheapest" option on paper might not be the best fit for your game plan.

A Deeper Look at Popular Broker Models

To give you an even clearer picture, let’s dig into the common fee structures you'll find with three popular types of online brokers. This will help you see where the costs might pop up unexpectedly.

Real-World Cost Showdown: Popular Online Brokers

Here’s a side-by-side look at how different broker types structure their fees, from zero-commission apps to platforms built for active traders. Notice how the "best" choice really depends on what kind of investor you are.

| Feature | Broker A (e.g., Robinhood) | Broker B (e.g., Fidelity) | Broker C (e.g., Interactive Brokers) |

|---|---|---|---|

| Stock/ETF Commissions | $0 | $0 | Often $0, but can have a small per-share fee |

| Key Revenue Source | Payment for Order Flow (PFOF), subscriptions | Interest on cash balances, premium services | PFOF, margin interest, per-share commissions |

| Options Fees | $0 per contract | ~$0.65 per contract | Tiered pricing, often lower for high volume |

| Account Minimum | $0 | $0 | Often $0, but Pro accounts may have minimums |

| Best For | New investors making simple stock/ETF trades. | Long-term investors who want research tools. | Active and professional traders seeking low costs. |

This breakdown makes one thing crystal clear: comparing brokerage fees forces you to look way beyond a single number. The right broker for you depends entirely on how often you trade, what you trade, and what tools you need to succeed.

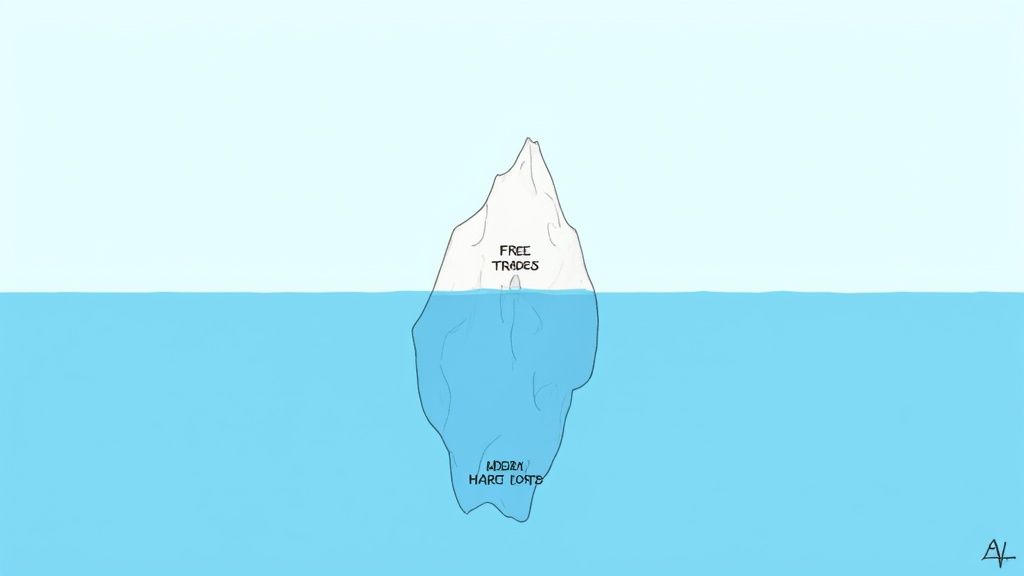

The Hidden Costs of 'Free' Trading

You’ve heard the old saying, right? "If something is free, you are the product." This has never been more true than in the world of 'commission-free' trading. It's a fantastic marketing hook, but it pays to be a little skeptical and ask how these brokers are keeping the lights on if they aren't charging for trades.

Let's pull back the curtain on how things really work.

One of the biggest ways these brokers make money is from a practice called Payment for Order Flow, or PFOF. It sounds technical, but the idea is pretty simple. Instead of sending your "buy" order straight to the New York Stock Exchange, your broker sells it to a massive, high-speed trading firm (think Citadel or Virtu).

That big firm is the one that actually executes your trade. For the privilege of getting your order, they pay your broker a tiny fee. Think of it like a referral kickback. The catch? You might not be getting the absolute best price on your stock. It could be off by a fraction of a cent, but when you multiply that by millions of trades, it adds up to real money for them.

Margin Loans: The Sneaky Debt Trap

Another huge moneymaker is the interest charged on margin loans. Margin is just a fancy word for borrowing money from your broker to buy more stocks than you can afford with your own cash. It’s a classic high-risk, high-reward move that can magnify your gains, but it can just as easily amplify your losses.

It's a strategy so risky that even billionaire investor Mark Cuban has warned against it, famously saying, "If you're using a margin account, you're a schmuck."

The interest rates on these loans can be shockingly high and vary wildly from one broker to the next. For anyone considering trading on margin, this difference is one of the most important cost factors to compare.

A 2025 analysis revealed a massive gap in margin loan rates. For a $100,000 loan, Robinhood's rate hovered around 5.55%. In contrast, traditional brokers like Fidelity and Charles Schwab were charging over 11%-nearly double. You can learn more about how these rates impact traders here.

This huge difference in rates shows just how aggressively some of the newer platforms are competing, while older brokers often rely on more expensive fee models. If you ever plan to use margin, this "hidden" cost could easily become your single biggest expense.

Getting a handle on PFOF and margin interest is vital. It proves that even when the sticker price says "$0 commissions," trading is never truly free. Knowing how these things work lets you look past the slick marketing and choose a broker whose fee structure genuinely aligns with your trading style-not just their bottom line.

How Fees Change for Different Investment Types

Think of your brokerage account like a restaurant menu. Ordering a simple soda (like buying a popular US stock) is cheap and straightforward. But when you start looking at the more complex meals (like options or international assets), the price tag changes. This is a critical detail to grasp when comparing brokers: what you trade directly impacts what you pay.

It's a common trap for new investors. They get lured in by "zero-commission" trades on US stocks and ETFs, only to be surprised by unexpected costs when they venture into other markets.

Fees for Forex and Options Trading

If you're drawn to the fast-paced world of Forex (foreign currency) trading, you'll almost always run into a small commission on every trade. The currency market moves at lightning speed, and brokers charge this fee for executing your orders instantly. For frequent traders, even a tiny commission can stack up quickly. In fact, these rates can vary wildly across the globe depending on the currency pair. You can see how Forex commissions differ globally here.

Options trading is another beast entirely, with its own unique fee structure. Brokers typically charge a per-contract fee, which often hovers around $0.65 per contract. That might sound tiny, but for active traders juggling dozens of contracts at a time, it's a major cost to factor in. This model is completely different from the flat-fee or zero-commission structure you find with stocks.

The Special Case of Mutual Funds

Mutual funds have long been a go-to for long-term investors, but they come with a sneaky internal fee known as the expense ratio. This isn't a fee you pay upfront when you click "buy." Instead, it's quietly deducted from the fund's assets every single year.

The expense ratio is like a slow leak in your tire-you might not notice it day-to-day, but over a long journey, it can seriously deflate your performance. A 1% expense ratio on a $10,000 investment will cost you $100 every single year, whether the fund makes money or not.

This hidden cost is exactly why comparing individual funds is just as crucial as comparing brokers. You can learn more about the differences between ETFs and mutual funds in our article and see how their fee structures really stack up.

Ultimately, understanding that different investments have different pricing models is the key to avoiding nasty surprises and keeping your trading costs under control.

Choosing the Right Broker for Your Investing Style

Alright, it’s time to pick your financial partner. After digging into brokerage fees, you've probably figured out that the cheapest option isn't always the right one. The most critical factor, by a long shot, is your personal investing style.

Are you aiming to be a long-term, "buy-and-hold" investor in the mold of the legendary Warren Buffett, who famously trades only when the stars align? Or are you more of an active trader, ready to pounce on market moves? Your answer changes everything.

"I will tell you the secret to getting rich on Wall Street. You try to be greedy when others are fearful. And you try to be fearful when others are greedy." – Warren Buffett

Buffett's quote is about psychology, but it also reveals a strategy. A patient investor who makes a handful of smart decisions each year has completely different needs than someone trading daily. Your broker needs to match your game plan, not fight against it.

A Quick Checklist for Choosing Your Broker

To find the perfect fit, you need to ask yourself a few key questions. This simple framework will help you cut through the marketing noise and make a smart, personalized decision.

- How often will I trade? If you're planning to trade multiple times a week, a broker with low or zero commissions and tight spreads is non-negotiable. For infrequent investors, a slightly higher per-trade cost might be perfectly fine if the platform offers better long-term tools.

- What tools and research do I need? Are you a beginner who just needs a simple buy button, or are you hungry for advanced charting software and in-depth analyst reports? Don’t pay for bells and whistles you’ll never use. Many investors find a free online stock trading course gives them a solid foundation before they ever need to pay for premium tools.

- What is my long-term goal? Is this for retirement, passive income, or something else entirely? As you compare brokers, look for those that offer comprehensive resources, like strategies for building a retirement stock portfolio. Your broker should support your ultimate financial destination.

Your goal is to find a broker that feels like a true partner on your financial journey-not just another monthly expense. This checklist makes that process a whole lot simpler.

Brokerage Fees: Your Questions Answered

Got a few lingering questions before you jump in? Perfect. Let's clear up some of the common things that trip up new investors when it comes to brokerage fees.

Can I Really Invest with Absolutely Zero Fees?

In short, not really. While tons of brokers shout from the rooftops about commission-free stock and ETF trades, it's almost impossible to invest without ever paying something.

Think of it like a "free" game on your phone-sure, the download costs nothing, but you know there are in-app purchases waiting. For brokers, the costs are just less obvious. They might make money from the spread (the tiny difference between the buy and sell price) or through something called Payment for Order Flow (PFOF).

Always hunt down the full fee schedule on a broker's website. You'll usually find it tucked away in the footer under "Pricing" or "Commissions."

Does a Broker with Higher Fees Mean It's Better?

Not necessarily. Sometimes, higher fees just mean you're paying for a bunch of premium services you'll never use, like personal financial advisors or super-complex research tools. If you're just getting started, a simple, low-cost platform is almost always the smarter move.

Even legendary basketball star LeBron James is famous for his financial discipline, once saying, "We are not throwing money to the ceiling." Your goal is the same: keep as much of your money as possible working for you. That starts by cutting out unnecessary costs.

A classic rookie mistake is paying for features you don’t use. If your plan is just to buy and hold a few ETFs, you don’t need a platform built for a high-frequency day trader-one that might hit you with higher account maintenance fees for those bells and whistles.

Choosing the right broker isn't about finding the one with the most features. It's about finding the one whose costs actually align with your simple, straightforward goals. Start small, keep it cheap, and build from there.

Ready to build your trading knowledge without the confusing jargon? At Finance Illustrated, we offer free, easy-to-understand lessons and simulators to get you started. Begin your trading education journey with us today!