The buy and hold strategy is super simple at its core. You buy investments – like stocks or funds – and you just hang onto them for a long time. We're talking years, or even decades.

The whole point is to stop stressing about the stock market's daily drama. Instead, you let your investments grow steadily over time, rather than trying to perfectly guess every up and down for a quick win.

What Is Buy and Hold Investing?

Imagine planting an oak tree. You don’t dig it up every week to check the roots, right? You give it water and sun, and you trust the process. That's the buy and hold idea in a nutshell. It's a patient, long-term game where you learn to ignore the market's daily mood swings.

Instead of trying to outsmart everyone, you focus on buying into solid, quality companies and letting them do the hard work for you. It’s no surprise that legendary investor Warren Buffett, one of the richest people on the planet, is a huge fan of this method.

He famously said:

"Our favorite holding period is forever."

This simple quote changes your role completely. You stop being a frantic trader glued to a screen and start acting like a business owner. You're not just buying a random stock symbol; you're buying a small piece of a real company, betting on its success over many years.

The Power of Time and Compounding

The real secret sauce behind buy and hold is something called compound interest. It's the magic that happens when your investment earnings start making their own earnings.

Picture a snowball rolling down a hill. It starts small, but as it rolls, it picks up more snow, getting bigger and bigger, faster and faster. That's your money at work.

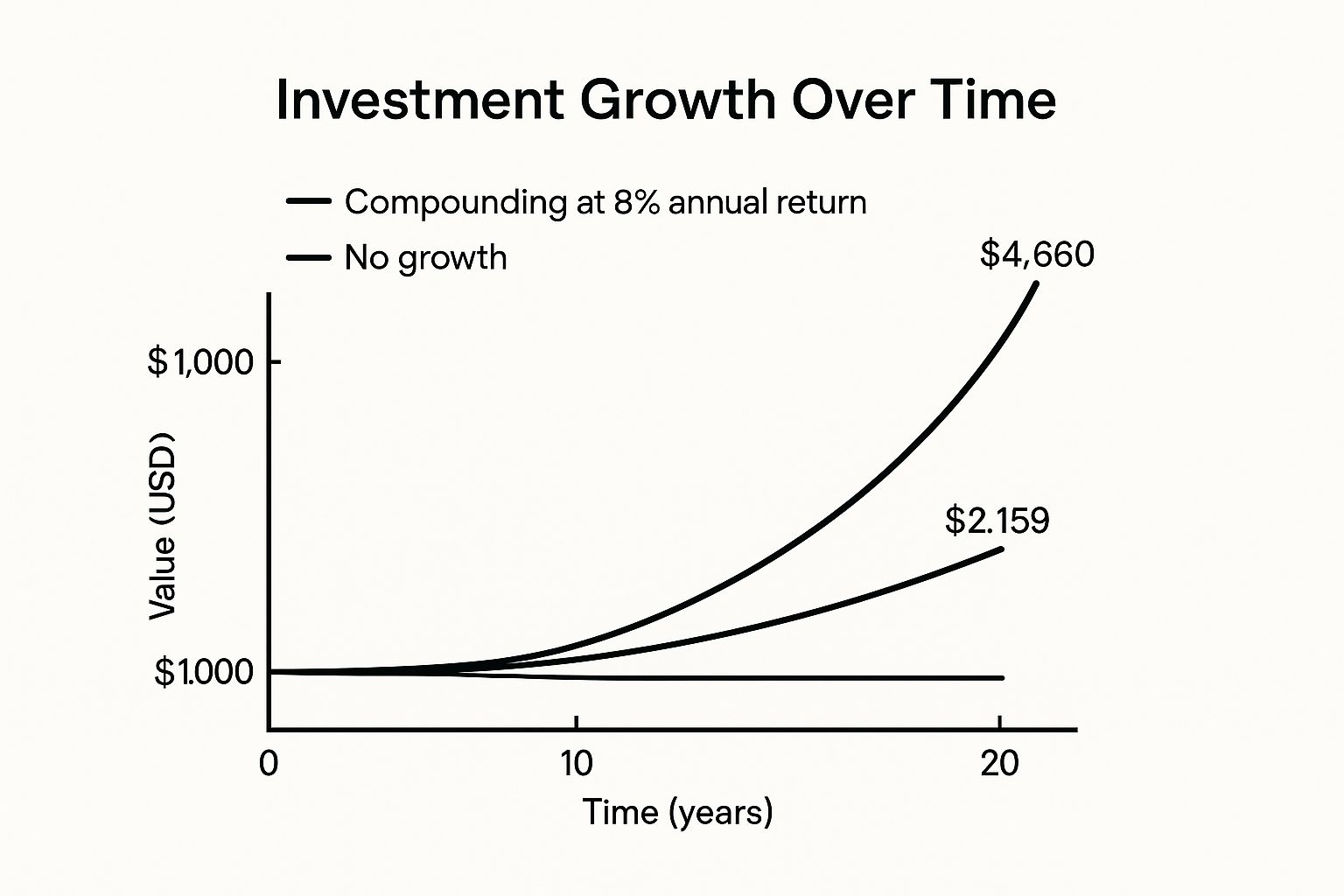

This chart shows just how powerful that effect can be. It pictures how a single $1,000 investment could blossom with an average 8% annual return over 20 years.

Notice the growth isn't a straight line. It curves up, speeding up as time goes on and your money starts making more money for you. That's compounding in action.

How It's Different from Day Trading

To really get why this calm, steady approach is so cool, let's compare it to its hyperactive cousin: day trading. Day traders jump in and out of stocks within the same day, trying to grab tiny profits from tiny price changes. It's a high-stress, high-fee game that requires you to be constantly watching the screen.

Buy and hold is the total opposite. You check in sometimes, but otherwise, you just let your strategy do its thing.

Here's a quick look at the main differences.

Buy and Hold vs Day Trading at a Glance

| Feature | Buy and Hold | Day Trading |

|---|---|---|

| Time Horizon | Long-term (years, decades) | Super short-term (minutes, hours) |

| Goal | Build wealth with compounding | Make quick profits from price swings |

| Activity Level | Low (you buy and… hold) | Very high (lots of trades every day) |

| Stress Level | Usually pretty low | Extremely high |

| Fees | Very few transaction costs | High because of all the trading |

| Mindset | Investor (like a business owner) | Trader (like a speculator) |

The two approaches couldn't be more different. One is a marathon, the other is a sprint. Buy and hold isn't about getting rich overnight. It's a proven way to build a solid financial future through discipline, patience, and the incredible power of time.

Why Patience Is Your Investing Superpower

If you only remember one thing about the buy and hold strategy, make it this: patience is everything. It's the secret ingredient that unlocks the most powerful force in finance – compound interest. Think of it like a snowball rolling downhill.

At first, it’s small. Your investment makes a little money. But then, that extra money starts earning its own money. Over decades, this cycle creates a kind of financial magic where your portfolio doesn't just grow, it accelerates. It's the ultimate “work smarter, not harder” move for your money.

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn't, pays it.” – A quote often linked to Albert Einstein.

This one idea is the engine that drives the whole buy and hold philosophy. By staying in the game for the long haul, you give your money the one thing it needs most to work its magic: time.

Riding Out the Storms

Let's be real, the stock market can feel like a rollercoaster. You get the awesome climbs, but you also get the stomach-lurching drops. It's during those drops that most people make their biggest mistake – they panic and sell at the worst possible time. It’s a gut reaction, but it locks in their losses and guarantees they miss the comeback.

A buy and hold mindset is your shield against that noise. It trains you to see market downturns not as a disaster, but as a temporary dip on a much longer journey. By simply staying invested, you make sure you're around for the rebound and all the growth that comes after.

Did you know that in the past 40 years, the stock market's 10 best days happened within just two weeks of the 10 worst days? If you panicked and sold during the bad days, you almost certainly missed the huge bounce-back that followed. The lesson is clear: staying patient through the chaos pays off.

Beyond the Numbers: The Mental Edge

There's more to this than just bigger bank account balances. Using a buy and hold strategy is just a calmer, saner way to invest. It’s about winning the mental game as much as the financial one.

Here are a few of the biggest perks:

- Lower Stress: You’re free from the pressure of daily market news. Your plan is set for years, not days, so you can focus on your life.

- Fewer Costs: Constantly jumping in and out of the market adds up in trading fees and can create a huge tax bill. Holding on keeps those costs way down.

- Simplicity: You don’t need to be a Wall Street genius with complicated charts. The strategy is wonderfully simple: pick good investments and give them time to grow.

- Builds Discipline: It forces you to manage your emotions and trust your plan, which is a powerful skill that helps with pretty much everything in life.

This strategy isn't just about buying stocks; it's about buying yourself time and peace of mind. It's a disciplined approach that rewards patience and lets the incredible force of compounding build real, lasting wealth for your future.

How to Invest Like a Legend

When you picture the world's richest investors, you might imagine frantic traders glued to screens, making risky moves every second. But the reality is often the total opposite.

Many of the greatest fortunes weren't built on speed, but on incredible patience and mastering the buy and hold strategy. By looking at their game plan, we can learn the secrets to creating lasting wealth.

There's no better example than Warren Buffett, also known as the "Oracle of Omaha." He’s a legend, not for some complex secret formula, but for a simple yet powerful philosophy. Way back in 1988, his company bought stock in Coca-Cola. They’ve held it ever since, watching that initial $1.3 billion investment grow into more than $25 billion – and that’s before you even count decades of dividend payments.

"Our favorite holding period is forever." – Warren Buffett

That one line says it all. It perfectly captures the buy and hold mindset. Buffett didn’t see a stock price; he saw a fantastic business with a timeless product. So, he bought it planning to never let go, trusting the company's long-term value to win out over short-term market drama.

You Don’t Need to Be a Billionaire

Here’s the best part: this strategy isn’t just for billionaires. It's a proven path for regular people, too.

Of course, to really invest like a legend, every decision has to be based on good reasons. This is where learning how to use data and research for evidence-based decision making becomes your superpower.

Just look at the amazing story of Ronald Read. He was a janitor and gas station attendant from Vermont who lived a simple life. No one knew he was quietly investing his small savings for decades. When he passed away in 2014, he left an $8 million fortune to his local library and hospital.

Read's story is powerful proof that you don't need a Wall Street job or a fancy degree to win with buy and hold. He simply stuck to a few core rules:

- Live below your means: This gave him the extra cash to invest consistently over time.

- Invest in solid, well-known companies: He bought shares in household names like Procter & Gamble, Johnson & Johnson, and JPMorgan Chase.

- Be incredibly patient: He held onto his investments for decades, giving compound interest the time it needed to do its thing.

These legends, from the Oracle of Omaha to a Vermont janitor, show us that successful investing isn't about timing the market. It’s about having a solid plan, choosing quality investments, and having the discipline to stick with it for the long run.

How to Handle the Market's Wild Mood Swings

Let's be real – the buy-and-hold strategy isn't always a walk in the park. There will be days, weeks, or even years when the market feels like it's in a freefall. Watching your account balance drop is one of the toughest tests you'll face as an investor.

This is the moment where your emotions are pushed to the limit. Every instinct might be screaming, "SELL!" just to stop the pain. But this is exactly when the most successful investors hold on tight.

Understanding that these downturns are a normal, expected part of the journey is what separates the winners from everyone else. The market has a long history of throwing tantrums, but it also has an even longer history of powerful recoveries.

Riding Out the Financial Storms

Think back to the big ones, like the 2008 global financial crisis. Fear was everywhere. It felt like the sky was falling, and many people panicked, selling their investments at the lowest prices and locking in huge losses.

But history tells a much different story for those who stayed put. The S&P 500, a collection of the 500 biggest US companies, fell by a scary 37% in 2008. But guess what happened in 2009? It shot up by 26.5%. Patient investors who held on not only recovered but saw incredible growth in the years that followed. You can explore the S&P 500's historic performance and see this strength for yourself.

This pattern isn't a fluke; it's the market's natural rhythm. Steep drops are almost always followed by powerful recoveries.

Actionable Tips to Stay the Course

Knowing this history is one thing, but living through a downturn is another. The trick is to have a game plan before the storm hits, so you can rely on logic instead of fear.

Here are a few things you can do to keep your cool when the market gets wild:

- Stop Checking Your Account: When the market is dropping, constantly refreshing your portfolio is like picking at a scab. It just makes it worse. Limit yourself to checking once a month – or even less – to avoid a knee-jerk reaction.

- Remember Why You Started: Go back to your original financial goals. Are you investing for retirement in 30 years? A down payment in 10? Reminding yourself of your long-term "why" helps ignore the short-term noise.

- Focus on What You Can Control: You can't control the stock market, but you can control your actions. Stick to your plan of investing regularly. This is called dollar-cost averaging, and it means you automatically buy more shares when prices are low – a huge advantage over time.

The legendary investor Peter Lynch had a great way of looking at it.

"The real key to making money in stocks is not to get scared out of them."

In the end, your greatest asset isn't your stock-picking skill; it's your emotional discipline. It’s not about being fearless. It’s about acting despite the fear, trusting your long-term plan, and letting time do the hard work for you.

Your Simple Guide to Getting Started

Alright, you're ready to stop learning and start doing. This is where the fun begins, and trust me, it’s way easier than you think. Getting started with a buy and hold plan is less about having a lot of money and more about taking that first simple step.

Let's break it down into a super simple, beginner-friendly launch plan.

Your First Mission: Open the Right Account

The first mission is just to open the right kind of account. Think of this like getting your driver's permit before you can hit the road – it's the first essential step.

You'll need a brokerage account, which is just a fancy name for an account that lets you buy and sell investments. You could also look into a Roth IRA if you're thinking about retirement, since it offers some awesome tax advantages later on. Many online platforms let you open one in minutes with no minimum deposit.

What Should You Actually Buy?

Okay, account open. Now what? The number of choices can feel overwhelming, but for a buy and hold strategy, the best answer is usually the simplest one. You don't need to be a stock-picking genius.

Instead, look at low-cost index funds or Exchange-Traded Funds (ETFs).

Think of an ETF as a pre-made Spotify playlist of stocks. Instead of trying to pick the single best song (stock), you buy the entire "Top 500 Hits" album at once. This gives you instant diversification, spreading your money across hundreds of companies automatically.

This is a great starting point because it protects you from the risk of one single company doing poorly. For a deeper dive into how these funds compare, you can learn more about the differences between ETFs and mutual funds in our detailed guide.

To make it even easier, here are examples of popular, diversified ETFs that are great for a new buy and hold investor.

Simple Portfolio Ideas for Beginners

| ETF Ticker | What It Invests In | Why It's a Good Starting Point |

|---|---|---|

| VOO (Vanguard S&P 500 ETF) | The 500 largest companies in the U.S., like Apple and Microsoft. | It’s a classic for a reason. You get a piece of the core U.S. stock market. |

| VTI (Vanguard Total Stock Market ETF) | The entire U.S. stock market – large, medium, and small companies. | Even more diverse than the S&P 500, giving you a tiny piece of thousands of companies. |

| VT (Vanguard Total World Stock ETF) | Companies from all over the world, including the U.S., Europe, and Asia. | The ultimate one-stop-shop for global diversification, reducing the risk of one country's economy struggling. |

These aren't specific recommendations, but they show how simple and powerful a starting portfolio can be. Just one of these ETFs can give you a massively diversified foundation.

Your Secret Weapon for Consistency

Now for the last piece of the puzzle – how to invest without stressing. The secret is a technique called Dollar-Cost Averaging (DCA). It sounds technical, but it’s incredibly simple.

With DCA, you invest a fixed amount of money on a regular schedule, like $25 every two weeks, no matter what the market is doing.

- When prices are high, your $25 buys fewer shares.

- When prices are low, that same $25 buys more shares.

Over time, this smooths out your purchase price and removes the temptation to "time the market." It puts your buy and hold plan on autopilot, which is exactly where you want it.

Just set it, forget it, and let time and consistency do the hard work for you. Getting started really is that simple.

Building a Stronger Portfolio with Diversification

You’ve definitely heard the advice, "don't put all your eggs in one basket." It might be a cliché, but it’s the perfect way to think about diversification – and it’s a must-have for a smart buy and hold strategy.

Think of it like building a championship sports team. You wouldn't just sign a dozen star quarterbacks, would you? Of course not. You need defense, offense, and specialists, all bringing different skills to win consistently. Your investment portfolio works the same way.

Spreading your money across different types of investments is your best defense against surprises. It means owning a mix of assets, like stocks from big U.S. companies, smaller tech firms, and even international businesses. When one part of your portfolio is having a rough time, another part might be doing great, which helps smooth out the ride.

Why Spreading Out Is So Powerful

This isn't just about playing it safe; it's about giving yourself more chances to win. The economy is huge and complex, and different parts of it shine at different times. By diversifying, you make sure you have a piece of the action no matter which area of the market is leading the way.

The long-term impact of this is truly mind-blowing. One study showed that if you had invested $10,000 back in 1992 into just the S&P 500, it would have grown to about $230,000 by 2022. That's amazing! But if you had put that same $10,000 into a diversified portfolio with different types of assets, it could have grown to nearly $300,000. That's a life-changing difference.

Diversification is the only free lunch in investing. It allows you to reduce risk without sacrificing expected return.

To get the most out of your long-term plan, it helps to know how your mix of investments should change over time. Learning about different strategies for 401k asset allocation by age can give you a solid plan for building a strong portfolio. For more actionable advice, our guide on how to diversify your investment portfolio also breaks down practical steps you can take today.

Got Questions About Buy and Hold? Let's Clear Things Up.

Alright, let's tackle some of the questions that always pop up when people first hear about the buy and hold strategy. Getting these sorted out is often the last step before feeling confident enough to actually get started.

How Much Money Do I Really Need to Start?

Honestly? You can probably start with whatever you have in your pocket right now. Thanks to things like fractional shares (where you can buy just a small piece of a stock) and low-cost funds, you can get in the game with as little as $5 or $10.

The real secret isn't starting with a huge pile of cash. It's all about building the habit of investing, bit by bit, on a regular basis. Consistency is what builds wealth, not some massive one-time investment.

Ashton Kutcher, the actor and successful tech investor, once said something interesting about this. He focuses on "finding the signal in the noise," which is exactly what a consistent, automated investing plan helps you do. You ignore the daily drama and focus on your long-term plan, which is the real signal for success.

Isn't Buy and Hold… Kinda Boring?

Some people might call it boring, but I prefer to call it effective. Let's be real: investing isn't meant to be a trip to the casino. It's a powerful tool for building real financial freedom for your future.

Sure, day trading might look exciting in movies, but that "excitement" comes with a mountain of stress, tons of fees, and a much, much higher chance of losing money. Buy and hold is "boring" in the best way possible – it just works quietly in the background, growing your wealth while you live your life.

Okay, So When Should I Actually Sell?

While the whole point is to hold on for the long haul (think 10+ years), life happens. There are a few logical reasons you might decide to sell.

- You've hit a major financial goal. This is the best reason! Maybe you've saved enough for a down payment on a house or to pay for college.

- The fundamentals have totally changed. If the main reason you invested in a company has completely and permanently soured – say, a huge scandal or a new technology makes its business model useless – it might be time to rethink.

The one time you never sell? Just because the market took a nosedive. That's panic, not a strategy. Letting fear make your decisions is the biggest mistake a long-term investor can make.