As we near the end of the wild ride that was 2017, it seems like a great time to look back on all the biggest events that shaped and shook the markets this year. From the inauguration of America’s first businessman president to Bitcoin’s stratospheric rise, here are the five events that most shaped the market landscape this year.

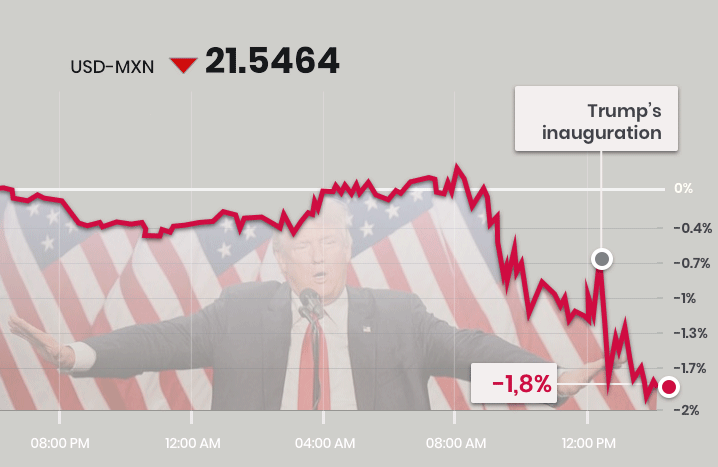

Trump’s Inauguration

Donald J. Trump, a real estate developer turned reality star turned politician, shocked the world when he defeated heavily favorited Hillary Clinton to become the 45th president of the United States on November 8, 2016. Even more shocking to most of the public and even seasoned investors was the reaction of the dollar to the news.

The USD/MXN hit an all-time high of 21.9555 on January 19, pushed by the statements by Trump about building a wall on the southern border with Mexico and ripping up the NAFTA trade agreements. Since then it has fallen throughout most of the year, to a current rate of 19.0683. As the rate is falling, it means the peso is now strengthening against the dollar, so a trader would’ve wanted to buy pesos and sell dollars. USD has also fallen over the course of the year, from a high of USD/EUR = 0.96 to USD.EUR= 0.84 currently. Again, in the situation, a trader would want to buy the strengthening currency (the Euro) and sell the weakening one (the dollar).

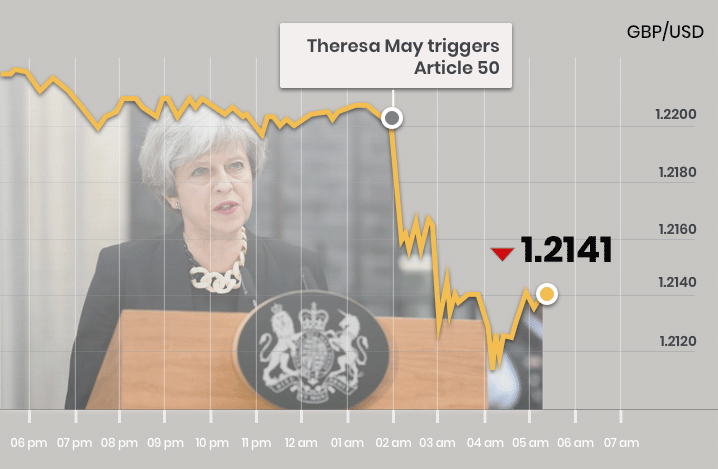

UK Activates Article 50

Perhaps presenting an early sign of the backlash against the so-called “elites” that led the election of Trump in America, on June 23, 2016, the United Kingdom voted to exit the European Union, stunning observers and bookmakers who had projected at least a 70% chance of the “stay” vote in the days leading up to the election. The prime minister of the UK, Theresa May, activated Article 50 the following March, formally entering the process for the UK’s exit of the European Union. Article 50 allows for a two-year negotiation period before a country’s exit from the EU, and if a trade deal is not ratified in that time period, the UK would leave without any substitute trade deal in place (negotiations are ongoing).

Following the “leave” vote, the British Pound plummeted in value, and is still down about 10% from its pre-vote price – learn more about currency rates. The pound hit a 31-year low against the dollar following the Brexit vote, with the GBP/USD hitting 1.33 and GBP/EUR falling 7%. Traders in these situations would have wanted to sell the pound and buy the quote currency (see how to read currency pairs). The reaction of the GBP/USD to the triggering of Article 50 was similar, although less extreme when compared to the Brexit vote. The GBP/USD fell about 0.6%, from 1.2559 to 1.2468.

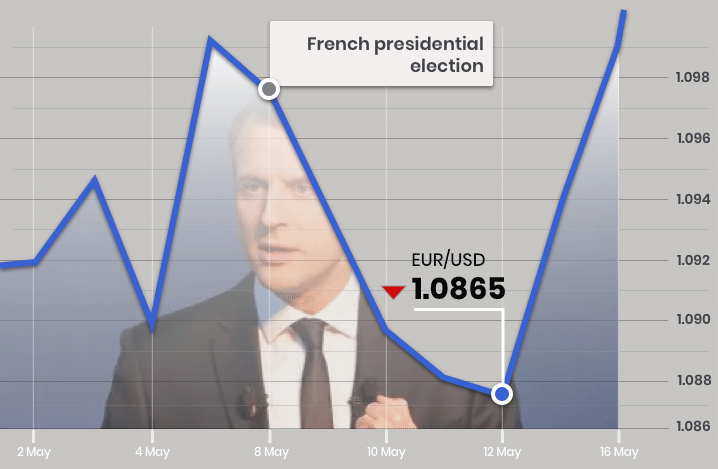

French Presidential Election

The French Presidential Election was held on April 23, 2017. As no candidate received a majority of votes in the first round, a runoff election was then held on May 7 between the two highest vote getters of the first round, Emmanuel Macron and Marine Le Pen. Macron ran on a center-left platform, promising economic reforms to jolt the country’s lagging growth rate, while Le Pen ran on a right-wing platform, prioritizing an exit from the Eurozone and a “nationalism” not dissimilar from Trump’s campaign promises in America. Macron handedly won the runoff election with 66.1% of the vote, becoming one of France’s youngest prime ministers and winning the country’s highest office in his first ever political race. Since his election, he has set about attempting to modernize France’s economy, attempting to ease some worker protections that have made companies hesitant to hire employees due to the impossibility of dismissing them. According to the OECD, economic growth will remain “robust at an annual pace of around 1.75%” in 2018, a solid growth rate for France and what would be the highest since 2011.

After it was projected that Macron would win the election, the Euro strengthened against the dollar, rising to 1.1023, which was the first time it rose above $1.10 since Trump’s election. The reason for this was clear: Macron is committed to staying on the Euro, and it strengthened as the uncertainty regarding a potential French exit was eliminated. Prior to the election, analysts had warned that a Le Pen win would’ve spelled disaster for the currency, as France leaving may have been a deathblow for the shared currency. Prior to the election, traders that thought Macron would win should’ve been buying the Euro, while traders thinking Le Pen had a solid chance at winning should have been selling it.

First UK Interest Rate Increase in a Decade

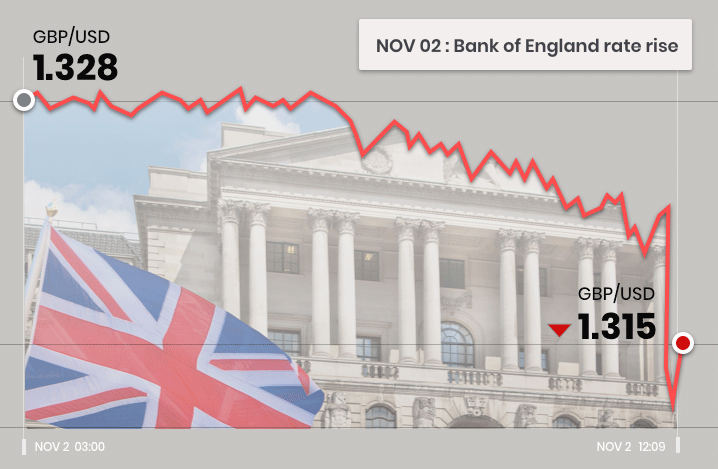

On November 2, the UK finally decided to hike their interest rates a quarter percent, raising them from a record low of 0.25% to 0.50%. The move was designed to slow increasing inflation, and the falling value of the pound had hurt consumers increasing the cost of imports. While, generally speaking, higher interest rates benefit savers, the extra quarter-percent won’t amount to a whole lot, and it will also increase the cost of borrowing, including mortgages. Rates were slashed worldwide following the Housing Crisis and recession started in 2007, and rates are only starting to rise, with almost all well below their pre-crisis levels. It sounds truly shocking now, but in 2006 the CD interest rate for a six month term period was 3.45%; now almost all are below 1%.

The GBP/USD plunged following the announcement of the rate hike, a fairly unexpected result, by about 1.306%. This was due to a statement in the minutes of the Monetary Policy Committee, in which they said they were in “no hurry” to raise rates again. Generally speaking, an interest rate hike is “bullish” for a currency (that is, the base currency strengthens against the quote currency), so traders will generally want to buy a currency when the central bank raises rates. This is because the highest return that can be earned attracts foreign investment. However, the reaction of the pound to the news shows the risk in this strategy: there are often a number of factors that affect a currency’s movement.

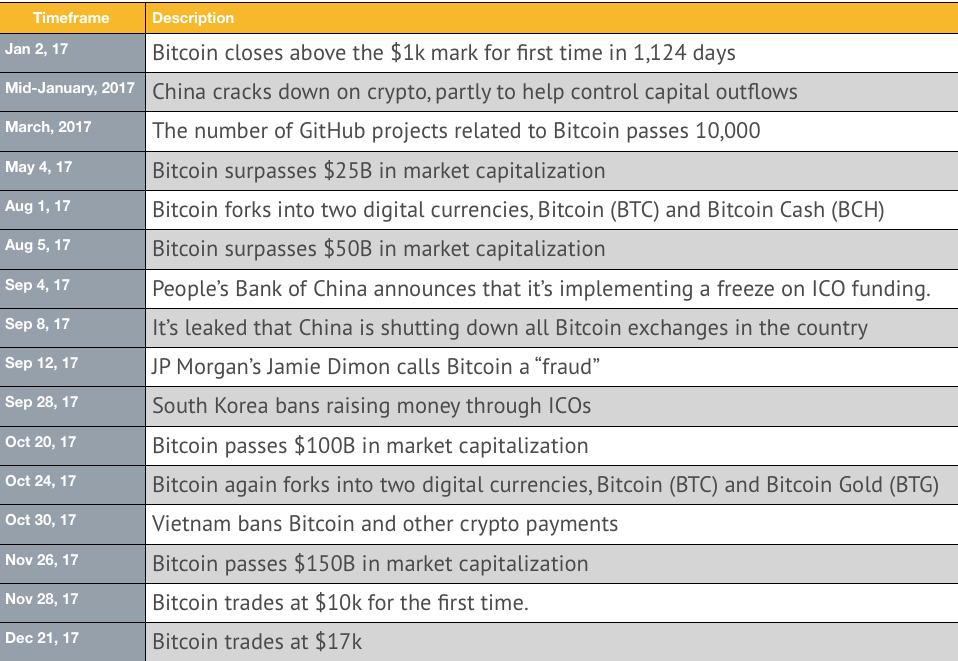

The Rise of Bitcoin

First gaining widespread notoriety in anarticle published on Gizmodo in 2011, the bitcoin hit the mainstream consciousness in 2017, spiking in price and causing a spike in many other, smaller cryptocurrencies. Bitcoins market capitalization shot up to $300B, rougly equal to the current market cap of Nike, Netflix and Honeywell, combined. The price of a single bitcoin has traded above $18,000 this year, and the one year return currently sits at a whopping 17,000%, handing huge returns to even minor investors and minting millionaires (and in the case of the Winklevoss twins of The Social Network fame, billionaires) out of the larger investors.

Bitcoin presents a unique problem for investors, however; with no actual asset backing, there is no derivable intrinsic value (see the biggest bitcoin crashes). Notable investors such as John McAfee and the part-owner of the Golden State Warriors, Chamath Palihapitiya, have said the price of a single bitcoin could hit $1,000,000. On the other side, notables such as Mark Cuban and JPMorgan CEO Jamie Dimon have called the meteoric rise a clear sign of a bubble, warning investors to steer clear unless they are prepared to lose their entire investment. It’s fairly clear that most bitcoin projections for 2018 are simply an educated guess, but, if the bubble were to pop, it seems likely to be considerably less damaging than the dot-com bubble in 2000 and the housing bubble in 2007 due to the more niche market.

Happy holidays and a lot of PIPS in 2018! : )