Copy trading transforms beginners into informed investors by letting you mirror the exact moves of professional traders. In just a few clicks, you can align your portfolio with experts who’ve spent years mastering the markets.

But here’s the catch – not every “popular investor” on eToro deserves your trust or capital. Some showcase impressive gains that vanish under closer inspection. Others take reckless risks that look brilliant during bull markets and catastrophic when trends reverse.

We’ve built this carefully-curated list of top eToro traders after analyzing hundreds of portfolios, risk patterns, and historical performance data. Each trader below has been vetted for consistency, transparency, and sustainable strategies – not just short-term luck. This list is updated monthly to protect you from copying traders whose strategies have deteriorated or whose risk levels have become unstable.

Copy trading isn’t about gambling on someone else’s hunches. It’s about strategic portfolio allocation with proven professionals. Let’s find the right traders for your goals.

What if you had invested $ ago?

Table of Contents

- Curated List of the Top eToro Traders

- Main Variables That Build Trust in a Pro Trader

- What is Copy Trading and How Does It Work?

- Pros and Cons of Copy Trading

- How to Find the Best Traders to Copy

- Frequently Asked Questions

Curated List of the Top eToro Traders to Copy in 2025

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Jeppe Kirk Bonde | Gain 18.80% | Risk score 4 | Manages $500K+ | 29502 Copiers | VIEW 61% of retail CFD accounts lose money |

Amit Kupfer | Gain 4.99% | Risk score 5 | Manages $500K+ | 8522 Copiers | VIEW 61% of retail CFD accounts lose money |

Thomas Parry Jones | Gain 29.72% | Risk score 5 | Manages $500K+ | 31552 Copiers | VIEW 61% of retail CFD accounts lose money |

Dario Martiskovic | Gain 19.19% | Risk score 5 | Manages $500K+ | 647 Copiers | VIEW 61% of retail CFD accounts lose money |

Pietari Laurila | Gain 12.23% | Risk score 4 | Manages $500K+ | 12862 Copiers | VIEW 61% of retail CFD accounts lose money |

Celestino Brunetti | Gain 11.97% | Risk score 5 | Manages $500K+ | 1807 Copiers | VIEW 61% of retail CFD accounts lose money |

Mike Moest | Gain 11.70% | Risk score 4 | Manages $500K+ | 2909 Copiers | VIEW 61% of retail CFD accounts lose money |

Catalina Norena Valderrama | Gain 6.49% | Risk score 2 | Manages $500K+ | 1103 Copiers | VIEW 61% of retail CFD accounts lose money |

Rhys Adams | Gain 12.41% | Risk score 5 | Manages $500K+ | 2249 Copiers | VIEW 61% of retail CFD accounts lose money |

Vasile Iliescu | Gain 12.27% | Risk score 3 | Manages $500K+ | 813 Copiers | VIEW 61% of retail CFD accounts lose money |

*Total Gain calculations do not guarantee future profits.

The traders above aren’t just posting impressive numbers – they’re actively contributing to the eToro community. Each one shares market insights, explains their reasoning behind major positions, and maintains transparent communication with copiers. This level of engagement seperates professional popular investors from those simply chasing quick returns.

Before you click “Copy,” take time to explore their individual profiles. Read through their recent trades, check how they performed during market downturns (not just rallies), and see if their trading strategy matches your risk tolerance and investment timeline.

Main Variables That Build Trust in a Pro Trader

Not all “profitable” traders deserve your money. Here’s what actually matters when evaluating someone to copy:

1. Maximum Drawdown – This shows the largest peak-to-valley drop in their portfolio. A trader with 80% annual returns but 60% drawdowns will give you sleepless nights and potential panic selling. Look for drawdowns under 25% for moderate risk tolerance.

2. Risk Score – eToro calculates this from 1-10 based on portfolio volatility. Beginners should stick with risk scores of 6 or lower. High returns mean nothing if one bad week wipes out months of gains.

3. Profit Consistency – Check the monthly performance chart. Does the trader make steady gains, or do wild swings dominate? Consistent 3-5% monthly returns often outperform erratic 20% / -15% patterns over time.

4. Trading History Length – Anyone can get lucky for three months. Look for traders with at least 18-24 months of verifiable history. This captures different market conditions – bull runs, corrections, and sideways markets.

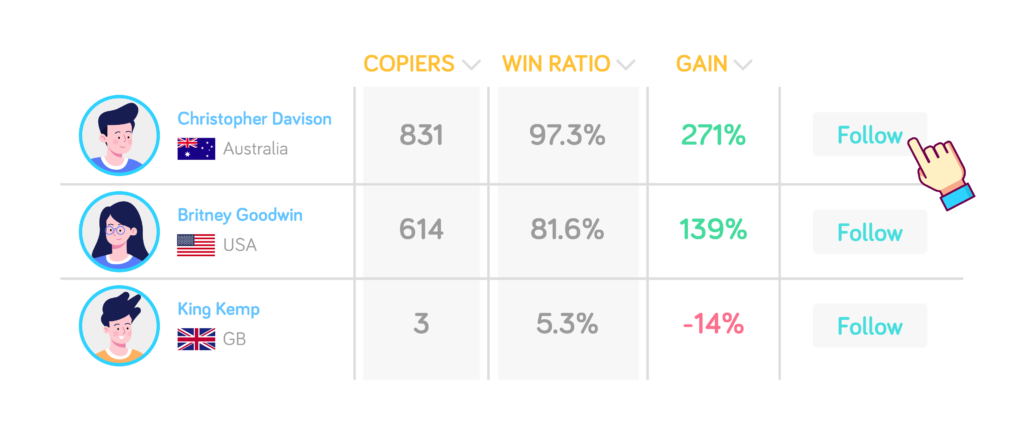

5. Number of Active Copiers – While popularity isn’t everything, a growing copier count signals sustained trust. More importantly, check if the number is increasing or declining. A dropping copier count often precedes performance issues.

Why we deliberately excluded profit percentages from our main criteria: Headline returns are seductive but misleading. A trader showing 150% annual gains might be one leveraged bet away from losing everything. The variables above reveal sustainability – and that’s what protects your capital long-term.

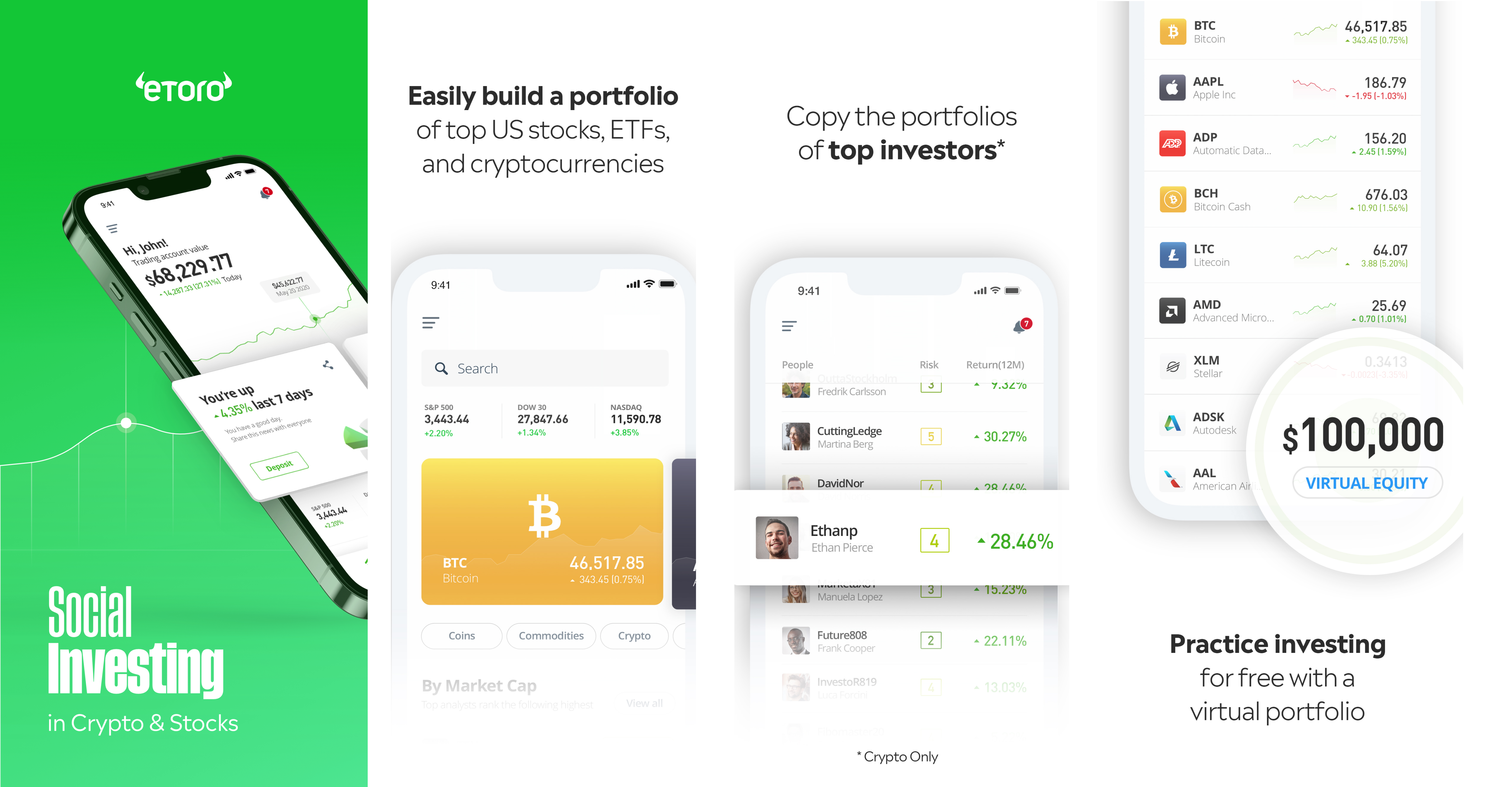

What is Copy Trading (Social Trading) and How Does It Work?

Copy trading is a form of automated portfolio mirroring where your account replicates the exact trades of experienced investors in real-time. When they buy Tesla shares, you buy Tesla shares (proportionally to your allocated amount). When they close a position, your matching position closes automatically.

The mechanics are straightforward but worth understanding completely:

You maintain full control of your funds. The trader you copy never touches your money directly. They don’t withdraw anything, can’t move funds, and have no access to your account. You’re simply automating the replication of their market actions.

Proportional allocation. If you allocate $1,000 to copy a trader and they invest 10% of their portfolio into Apple, your account automatically invests $100 into Apple. The ratio stays constant regardless of the trader’s total portfolio size.

Popular investors earn from copiers. Experienced traders with many copiers receive compensation from eToro based on their assets under management. This creates alignment – they profit when you profit. However, it also means some traders prioritize gaining copiers over sustainable strategies. Hence our careful vetting process.

You can stop anytime. Uncopying a trader closes all positions that were opened through copying them. You walk away with whatever gains or losses accumulated during the copy period.

Think of copy trading as hiring a portfolio manager, except you’re not paying management fees and you can fire them instantly. It’s passive investing that remains fully transparent – you see every trade, every rationale, every adjustment in real-time.

Unlike traditional mutual funds where your money disappears into a black box until quarterly reports arrive, copy trading lets you observe and learn from every decision. Which brings us to an underrated benefit – educational value.

What are the Pros and Cons of Copy Trading?

Pros

✅ Perfect for time-poor investors. No need to monitor charts, read earnings reports, or set alerts. Your copied trader handles the analysis and execution.

✅ Instant diversification across unfamiliar markets. Want exposure to Japanese equities or emerging market currencies but lack the expertise? Copy a specialist trader in those areas.

✅ Real-world education. Watching a skilled trader navigate volatile markets teaches you more than any textbook. You see how professionals respond to Fed announcements, earnings surprises, and geopolitical events.

✅ Lower barrier to entry. You can start copying with as little as $200 on eToro, gaining access to strategies that would typically require significant capital and knowledge to implement independently.

✅ Copy multiple traders simultaneously. Spread your capital across 3-5 different traders with varied strategies (long-term stocks, day trading forex, crypto speculation) to create a balanced meta-portfolio.

Cons

❌ No guarantees, even with proven traders. Past performance never predicts future results. A trader with 24 months of gains can still have a catastrophic quarter that wipes out your investment.

❌ Can become a crutch that prevents real learning. Some copiers spend more time analyzing trader statistics than actually understanding markets. You risk becoming dependent on others without developing your own trading instincts.

❌ Strategy changes without warning. A trader might shift from conservative dividend stocks to aggressive crypto speculation. You won’t know until the trades appear in your portfolio.

❌ Emotional decisions still matter. You might panic and stop copying during a drawdown right before the trader recovers. The best traders can’t protect you from your own psychology.

❌ Platform dependency. You’re locked into eToro’s ecosystem. If they change fee structures, limit certain traders, or face regulatory issues, your strategy gets disrupted.

The uncomfortable truth: Copy trading works brilliantly for disciplined investors who treat it as one tool among many. It fails spectacularly for those seeking a “set and forget” path to wealth. Markets are too unpredictable for completely passive approaches, regardless of who you copy.

How to Find the Best Traders to Copy on eToro

The eToro platform showcases thousands of traders, all competing for copiers. Most aren’t worth your attention. Here’s how to separate sustainable professionals from lucky amateurs:

✅ Performance History Across Market Conditions

Don’t just look at total returns. Examine monthly performance during both rising and falling markets. A great trader shows resilience during corrections, not just gains during bull runs. Specifically check:

- How did they perform in Q4 2024 when markets pulled back?

- Did they protect capital during volatility or take massive hits?

- Are there unexplained gaps in their trading history? (Red flag for deleted losing periods)

✅ Return Patterns and Sustainability

Consistent 30-50% annual returns beat erratic 100% one year, -40% the next. Look at the slope of their cumulative return chart. Steady upward trajectory? Good. Staircase pattern with huge jumps followed by crashes? Dangerous.

Calculate their Sharpe ratio if you’re comfortable with math (return divided by volatility). Higher numbers mean better risk-adjusted returns. But honestly, just eyeballing the consistency of monthly gains tells you most of what you need.

✅ Copier Count Trends

Raw copier numbers matter less than the trend direction. A trader who dropped from 5,000 copiers to 2,000 is sending a warning signal. Either their strategy changed, performance declined, or they did something to lose trust.

Conversely, steadily growing copier counts indicate the community trusts this trader over time. Check the “Copiers” graph on their profile, not just the current number.

✅ Risk Score Alignment

eToro’s 1-10 risk score isn’t perfect, but it’s a useful starting filter. Match the risk level to your personal tolerance:

- Risk 1-3: Ultra-conservative. Expect 5-15% annual returns with minimal volatility.

- Risk 4-6: Moderate. The sweet spot for most investors. Targets 20-40% returns with manageable drawdowns.

- Risk 7-10: Aggressive to reckless. Can deliver 50%+ returns or lose half your capital in weeks.

If you’re copying with money you can’t afford to lose, stay below risk level 5. Period.

✅ Portfolio Composition Transparency

Click into their current portfolio. What are they actually trading? If it’s 80% leveraged positions or obscure penny stocks, you’re looking at a gambler, not an investor. Healthy diversification across asset classes (stocks, commodities, currencies, some crypto) suggests a thoughtful approach.

Also check position sizes. One position taking up 30%+ of their portfolio? That’s concentration risk that could destroy months of gains in a single bad earnings report.

✅ Communication and Transparency

The best traders explain their thinking. Check their social feed for posts about why they entered or exited positions. Do they share market analysis? Respond to copier questions? Acknowledge mistakes?

Radio silence from a popular investor is concerning. It suggests they’re not actually engaged with their copiers or don’t want to justify questionable decisions.

✅ Verify with External Research

Don’t rely solely on eToro’s platform data. Search the trader’s username on Reddit, Twitter, or trading forums. Have other copiers shared experiences? Any complaints about sudden strategy shifts or poor communication?

Cross-reference their claimed expertise with their actual positions. If they claim to be a “forex specialist” but their portfolio is 70% tech stocks, something doesn’t add up.

The overlooked factor: Start small and test your emotional response. Copy a trader with just $200-300 for two months. How do you feel watching their trades? Can you stomach the drawdowns? Do their decisions make sense to you? This psychological compatibility matters more than most beginners realize.

If you want to learn more about building a solid foundation before diving into copy trading, explore our comprehensive Forex Trading School. Understanding market fundamentals makes you a better judge of which traders deserve your trust.

Frequently Asked Questions About Copy Trading on eToro

Is copy trading profitable?

Copy trading can be profitable, but it’s not a guaranteed income stream. Your returns depend entirely on the performance of traders you copy. Some eToro users have made consistent gains over years by carefully selecting and monitoring their copied traders. Others have lost money by chasing high returns without understanding the underlying risks.

The realistic expectation: With well-chosen traders and diversified allocation, achieving 15-35% annual returns is possible. But prepare for quarters where you’re down 10-15%. That’s normal market volatility, not failure.

Remember the golden rule: never invest money you can’t afford to lose completely. Copy trading reduces the time requirement for active trading, but it doesn’t eliminate investment risk.

Is copy trading legal?

Yes, copy trading is completely legal in most countries, including the US, UK, EU, and Australia. However, regulations vary by region. eToro operates under licenses from major financial authorities (FCA in the UK, CySEC in Europe, ASIC in Australia), ensuring the platform meets legal standards for investor protection.

Always verify that any broker offering copy trading is properly regulated in your jurisdiction. Unregulated platforms pose serious risks – you have no legal recourse if they mishandle your funds.

What’s the minimum amount needed to start copy trading on eToro?

eToro requires a minimum of $200 to copy a single trader. However, starting with just $200 is risky because you can’t diversify. A better approach is beginning with $1,000-2,000, which allows you to copy 3-5 different traders at $200-500 each.

This diversification protects you if one trader underperforms. You’re not putting all your trust in a single person’s decisions.

Can you lose money with copy trading?

Absolutely. Copy trading doesn’t eliminate market risk – it only outsources the decision-making. If your copied trader makes poor trades, you lose money proportionally. Some scenarios where losses occur:

- The trader misjudges market direction during major news events

- Over-leveraged positions move against them quickly

- Their strategy stops working as market conditions change

- They take excessive risks to attract more copiers (and it backfires)

The worst mistake is copying a high-risk trader with money you can’t afford to lose, then panicking and stopping the copy during a temporary drawdown – locking in losses right before a potential recovery.

What should you know before starting to copy trade?

Before allocating real money, understand these essentials:

1. The assets being traded. If a trader focuses on forex trading, learn basic currency pair mechanics. Crypto-focused? Understand blockchain volatility. Stock traders? Know how earnings seasons impact portfolios.

2. Market hours and timing. Some traders capitalize on Asian market opens, others trade during US sessions. If you’re copying someone trading when you’re asleep, you can’t react if something goes wrong.

3. Stop-loss discipline. Decide in advance: at what loss percentage will you stop copying? -20%? -30%? Set this rule before emotions take over during a drawdown.

4. Fee structures. While copying itself is free on eToro, you still pay spreads on each trade and overnight financing fees on leveraged positions. These costs accumulate, especially with active traders.

5. Tax implications. Copy trading generates capital gains/losses just like manual trading. Keep records for tax reporting. In some countries, frequent trading might be taxed differently than long-term investing.

How many traders should you copy at once?

For most investors, copying 3-5 traders offers optimal diversification without becoming unmanageable. Here’s a practical allocation strategy:

- 40%: Conservative, low-risk trader (risk score 2-4) for stability

- 30%: Moderate trader (risk score 5-6) focused on stocks or indices

- 20%: Forex or commodity specialist for diversification

- 10%: Higher-risk, higher-reward trader (risk score 7-8) for growth potential

Copying more than 7-8 traders simultaneously becomes difficult to monitor effectively. You won’t be able to track each one’s performance, strategy changes, or communication. Quality over quantity applies here.

What happens if the trader I’m copying closes their account?

If a popular investor closes their eToro account or gets banned, all copying relationships terminate automatically. Your open positions from copying them will close at current market prices, and you’ll retain whatever profits or losses accumulated.

You’ll receive a notification from eToro when this happens. The funds return to your available balance immediately, ready to copy someone else or withdraw.

This is why monitoring your copied traders regularly matters. If you see warning signs (deteriorating performance, reduced activity, suspicious trades), you can proactively stop copying before they potentially abandon their account.

Can I modify the trades my copied trader makes?

No, when copy trading is active, you cannot modify individual trades opened through the copy relationship. It’s an all-or-nothing system. Either you’re copying everything they do automatically, or you stop copying entirely (which closes all related positions).

However, you can pause new copy trades. This means existing positions stay open, but new trades the popular investor makes won’t be replicated in your account. This is useful if you’re concerned about their recent decisions but don’t want to close profitable existing positions.

If you want full control while learning from others, consider manually replicating their trades instead of using the automatic copy feature. More work, but complete flexibility.

Copy trading isn’t about finding a magic trader who generates effortless wealth. It’s about strategically allocating capital to professionals whose approach aligns with your risk tolerance, learning from their decisions, and staying disciplined during inevitable market turbulence.

The traders in our curated list above represent different strategies, risk levels, and market focuses. None of them are perfect. All of them will experience losing periods. But each has demonstrated the consistency, transparency, and risk management that seperates sustainable trading from gambling.

Start small, diversify across multiple traders, monitor performance monthly, and never invest money you need for essential expenses. Treat copy trading as one component of a broader financial strategy – not your entire plan.

If you’re ready to dive deeper into understanding how professional traders analyze markets, check out our guide on technical analysis basics. The more you understand about what your copied traders are actually doing, the better you’ll be at selecting who deserves your trust.

Want to Master Forex Trading Fundamentals?

Before copy trading, build a solid foundation. Our comprehensive Forex Trading for Beginners guide covers everything from currency pair mechanics to risk management strategies used by professionals.

What you’ll learn:

- How forex markets actually work (beyond the basics)

- Reading charts and identifying trade opportunities

- Risk management techniques that protect your capital

- Common mistakes that destroy beginner accounts

- Strategies used by successful currency traders

Get Your Free PDF – No Email Required

Instant download. No signup forms. Just pure trading education.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Well, according to a study by Harvard professors, CEO’s work approximately 62.5 hours a week (the average employee works 40 hours a week).

Well, according to a study by Harvard professors, CEO’s work approximately 62.5 hours a week (the average employee works 40 hours a week).