Ever heard a Wall Street expert call a stock "overweight" and felt totally lost? Don't worry about it. It's just finance jargon, and it's way simpler than it sounds. An overweight rating is basically a professional analyst giving a stock a massive thumbs-up. They're signaling they believe it's about to perform better than its rivals or the market in general.

Decoding the Analyst's Thumbs-Up

Imagine your investment portfolio is like your favorite playlist. You have a mix of different artists and genres to keep things balanced. An overweight rating is like a music critic telling you, "Hey, that new Taylor Swift album is a banger-you should add more of her songs to your playlist." You're giving that specific stock more "weight" or a bigger spot in your portfolio than you normally would.

This isn't just a random guess. It's a strong vote of confidence from someone who spends their days analyzing a company's financial health, its industry, and its future potential. They're basically telling investors that they see a bright future for this particular company.

Why This Rating Matters

An overweight rating is a recommendation based on data, not just a casual opinion. Analysts give this rating when they expect a stock to beat its benchmark, like the S&P 500, over the next 6 to 12 months. This confidence usually comes from solid fundamentals like growing profits, a cool new product launch, or positive trends in their industry.

For example, an analyst might give a gaming company an overweight rating right before they release a highly anticipated new video game, expecting a huge jump in sales and its stock price. It's a strategy used by legendary investors like Warren Buffett, who makes huge "overweight" bets on companies he deeply believes in, like his massive investment in Apple.

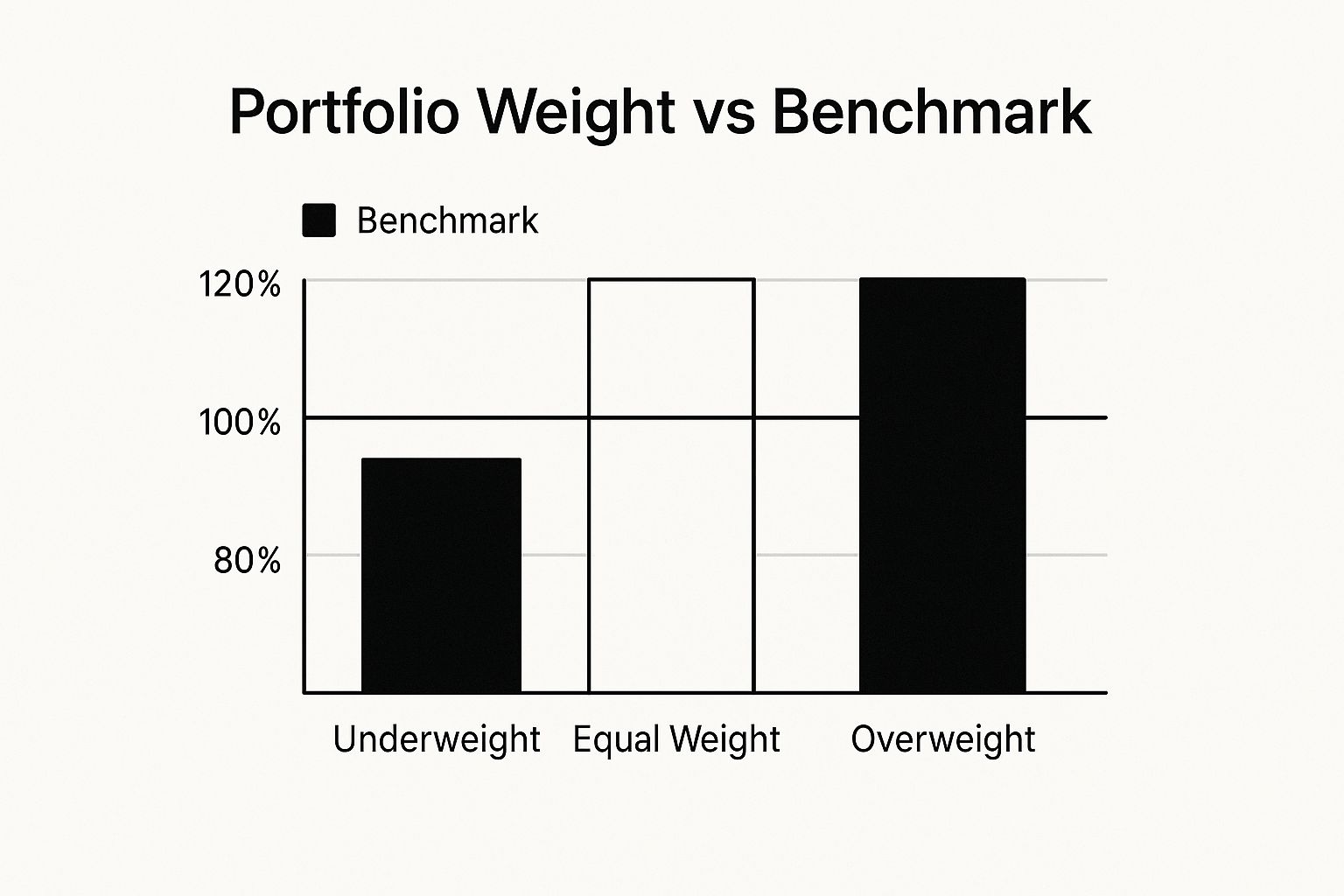

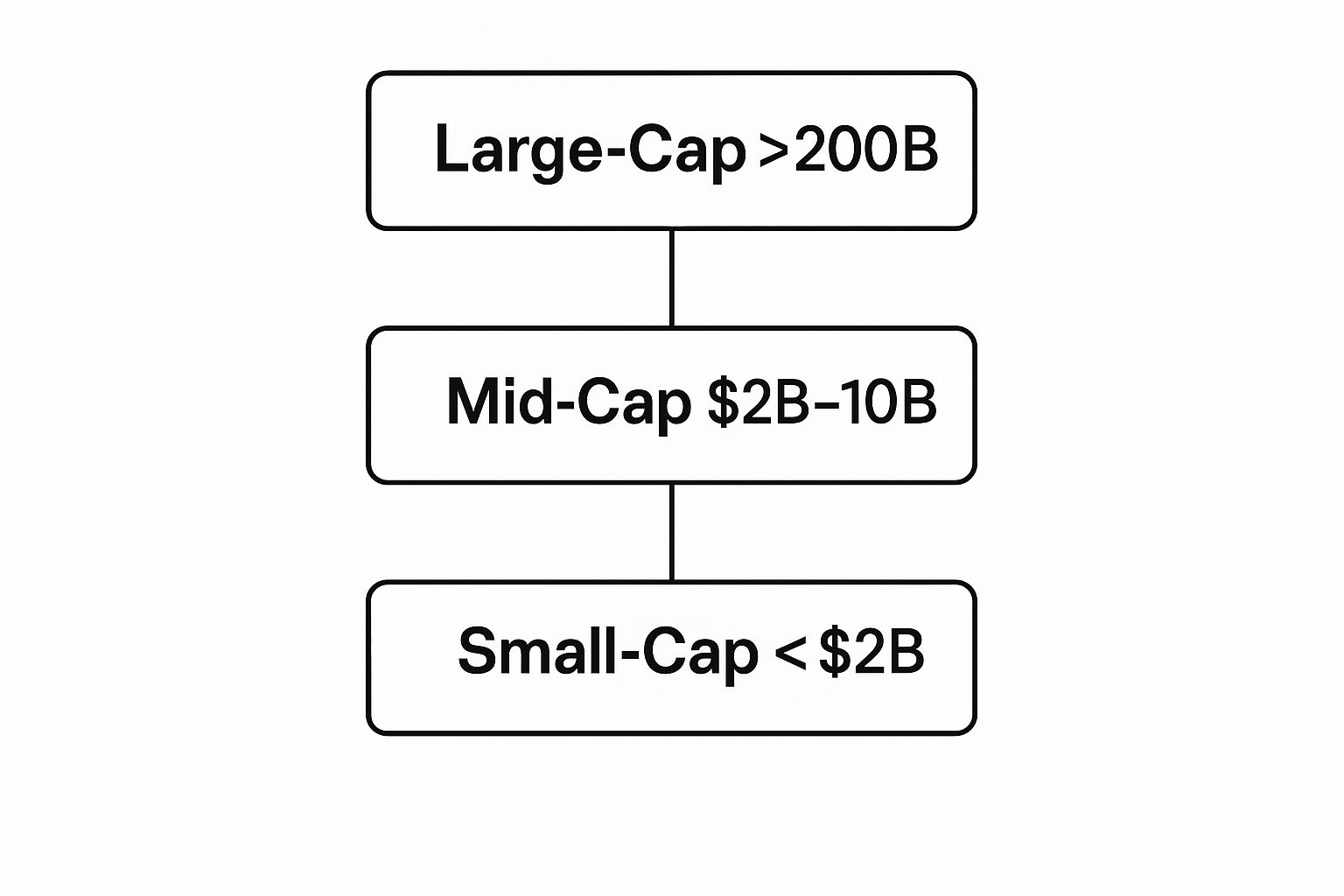

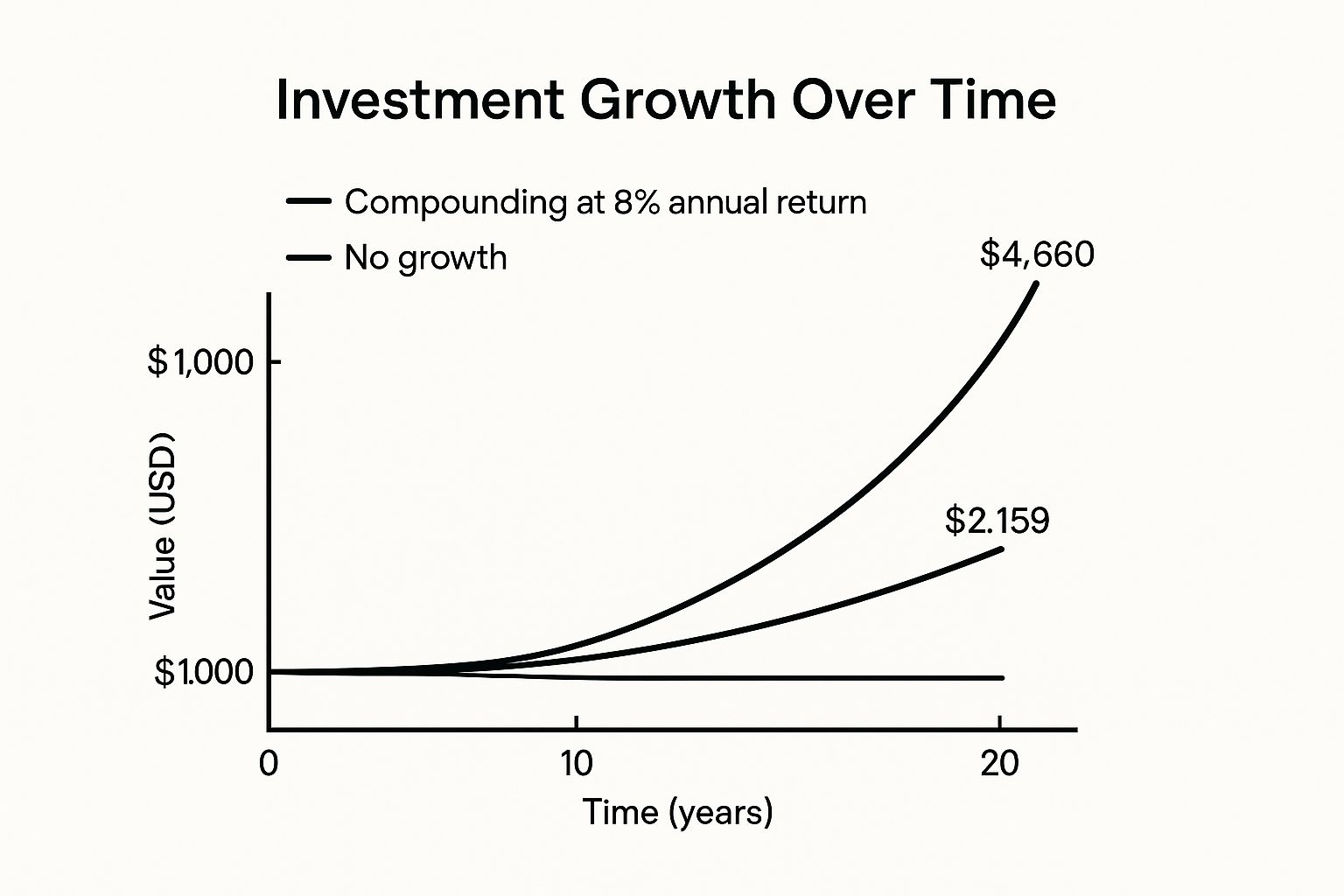

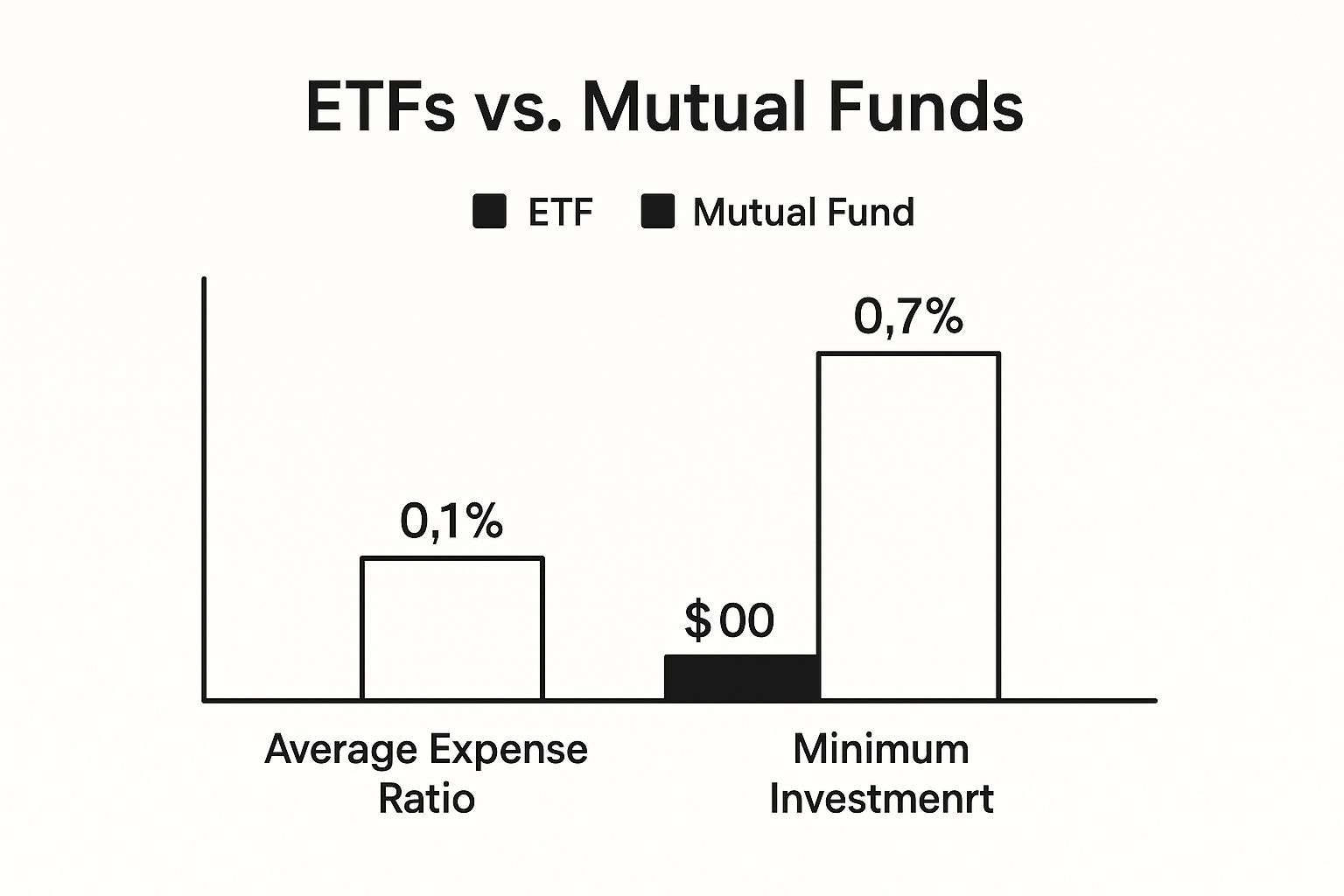

This chart gives you a quick visual of how an overweight position compares to others.

As you can see, it’s all about intentionally putting more money into one stock than its "slice" of the market suggests. This isn't just theory; it has a real impact. One study found that stocks in the S&P 500 with a consensus overweight rating performed 4.2 percentage points better than their peers over the next year. You can find more cool facts like this over at SoFi's learning center.

Analyst Stock Ratings Explained

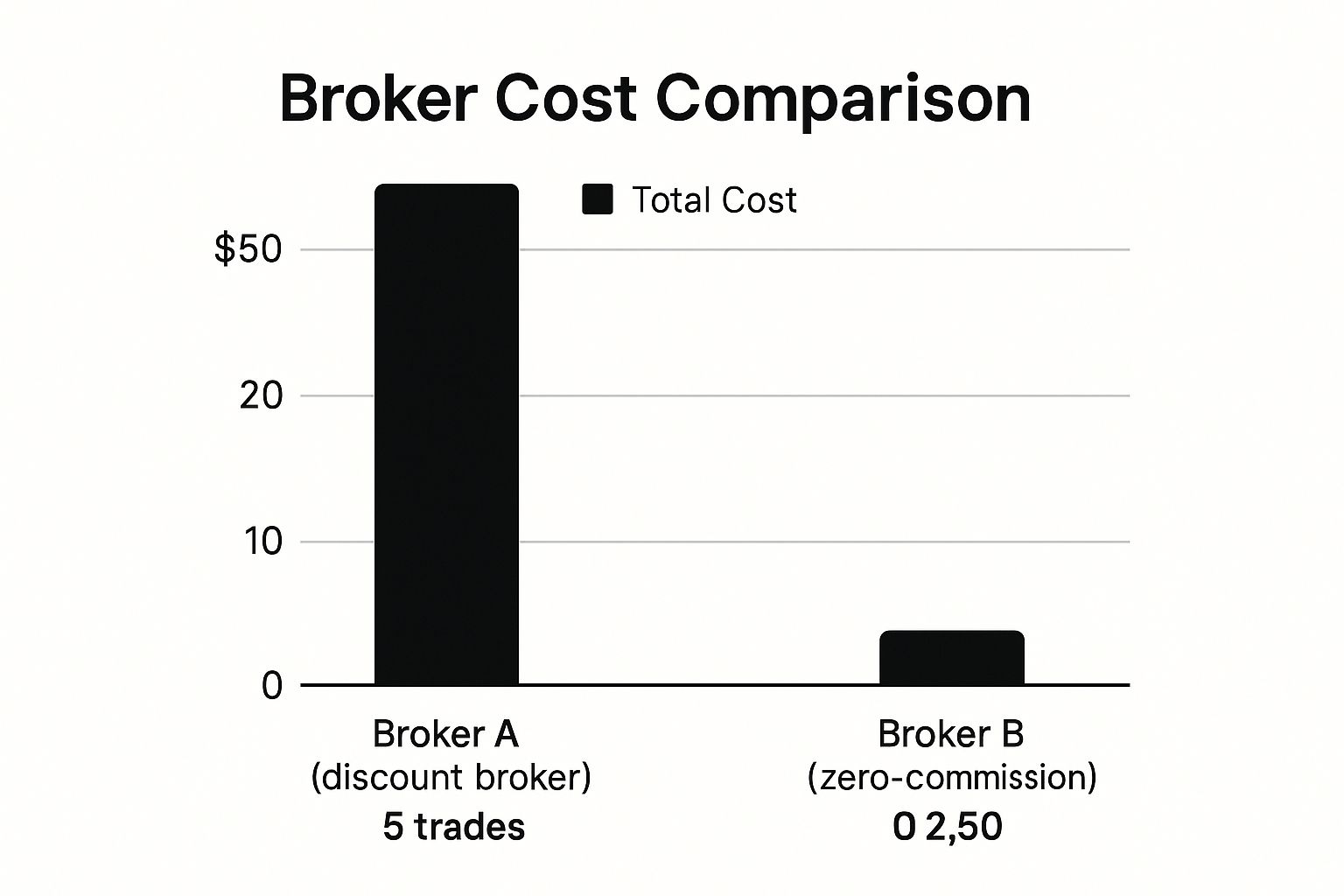

To get the full picture, it helps to see how "overweight" compares to the other common ratings analysts use. Here’s a simple chart to help you remember.

| Rating | What It Means for the Stock | Your Game Plan |

|---|---|---|

| Overweight (Buy) | The analyst is optimistic and expects the stock to do better than the rest. | Consider buying the stock or adding more if you already own it. |

| Equal-weight (Hold) | The analyst thinks the stock will perform about the same as the market. No big moves expected. | If you have it, keep it. If not, there might be more exciting options. |

| Underweight (Sell) | The analyst is pessimistic and expects the stock to do worse than others. | Consider selling your shares or avoiding this stock for now. |

Think of these ratings like a traffic light for your money: green for overweight, yellow for equal-weight, and red for underweight. It’s an easy way to understand what a professional analyst is thinking.

How Do Analysts Find These "Overweight" Stocks Anyway?

So, how does an analyst decide a stock is a potential superstar? It’s not a magic crystal ball-it's more like being a financial detective. They dig deep into a company's story, looking for clues that suggest it's ready to outperform everyone else.

This process involves some serious research. Think of it like a scout for a professional sports team checking out a rising star. They look at everything, from past performance to future potential, to decide if they've found the next big thing.

The Detective Work Behind the Rating

Analysts spend their days going through financial reports, searching for signs of a healthy, growing business. They're looking for specific signals that a company has a bright future, which would earn it that awesome overweight rating. It’s a detailed process that mixes hard numbers with a bit of a gut feeling about the future.

Some of the key clues they look for include:

- Strong Earnings Growth: Is the company making more money than it did last year? A history of growing profits is a huge green flag.

- A Solid "Moat": Does the company have a unique advantage that protects it from competitors? This could be a super strong brand (like Nike) or some killer technology nobody else has.

- Great Leadership: Is the CEO and their team experienced and respected? Think about how visionary leaders like Steve Jobs or Elon Musk transformed their companies.

- Favorable Industry Trends: Is the company part of a bigger trend, like the growth in artificial intelligence or electric vehicles? A rising tide lifts all boats.

"Investing is not a game, but a serious business where you must conduct proper research." – Benjamin Graham

The Numbers Tell the Story

This detective work isn't just about feelings; it's backed by powerful data. For example, a 2019 analysis found that S&P 500 stocks with overweight ratings had an average earnings growth rate of 23.5%. That completely smoked the 12.8% seen in stocks with an "equal-weight" rating.

The same study also showed that these top-rated stocks were 40% more likely to have better-than-average profit margins. This just proves how much strong financials matter. You can learn more about these findings and explore what an overweight rating indicates.

Ultimately, it could be anything from a groundbreaking new product, an expansion into a new country, or just a fantastic quarterly earnings report that convinces an analyst a company is ready for the spotlight.

Real-World Examples of Overweight Stocks

Alright, let's move from theory to reality with some brands you definitely know. Seeing an overweight rating on a company you recognize is often when the idea really clicks. Big names like Apple and Nike often get this positive nod from analysts, and understanding why can be a game-changer for your own investing mindset.

Analysts aren't just picking these names randomly. When a firm gives an overweight rating to a company like Apple, they’re pointing to solid, clear reasons for their optimism. It’s about connecting what we see as consumers-like the new iPhone everyone is talking about-to what an analyst sees as a great investment.

Why Analysts Love Big Brands

For a giant like Apple, the reasons for an overweight rating are usually right in front of us. Analysts love its massive, super-loyal customer base and its powerful ecosystem of products that keep users hooked. People literally camp out for the newest iPhone, and that loyalty turns into predictable, huge sales.

Nike's power is just as obvious. Its brand is a global force, recognized everywhere from New York to Tokyo. This brand power creates a huge competitive advantage, allowing Nike to charge premium prices and stay ahead of its rivals. Even celebrities and athletes like LeBron James are deeply tied to the brand, making it more of a cultural icon than just a sneaker company.

"Go for a business that any idiot can run – because sooner or later, any idiot probably is going to run it." – Peter Lynch

This famous quote from legendary investor Peter Lynch nails it. Analysts often look for companies with simple, powerful business models that are easy to understand. They want businesses with strong, lasting advantages that can survive tough times and changes in leadership.

Seeing the Rating in Action

When these huge companies get an overweight rating, it can often signal a period of strong performance is coming. For example, an analyst might upgrade Nike to overweight after seeing a massive increase in their international sales, betting that this growth will continue and push the stock price higher. Think of these ratings as a flare, signaling that the pros see hidden potential.

By looking at companies you already know and admire, you can start to think like an analyst. You begin to connect a great product or a dominant brand to its potential as a smart investment. It’s the best way to learn how the pros spot their next big winner.

Putting an Overweight Rating to Work in Your Portfolio

Okay, you get the idea behind an overweight rating. But how do you actually use this information? This is where you put on your investor hat and turn an analyst's opinion into a real strategy.

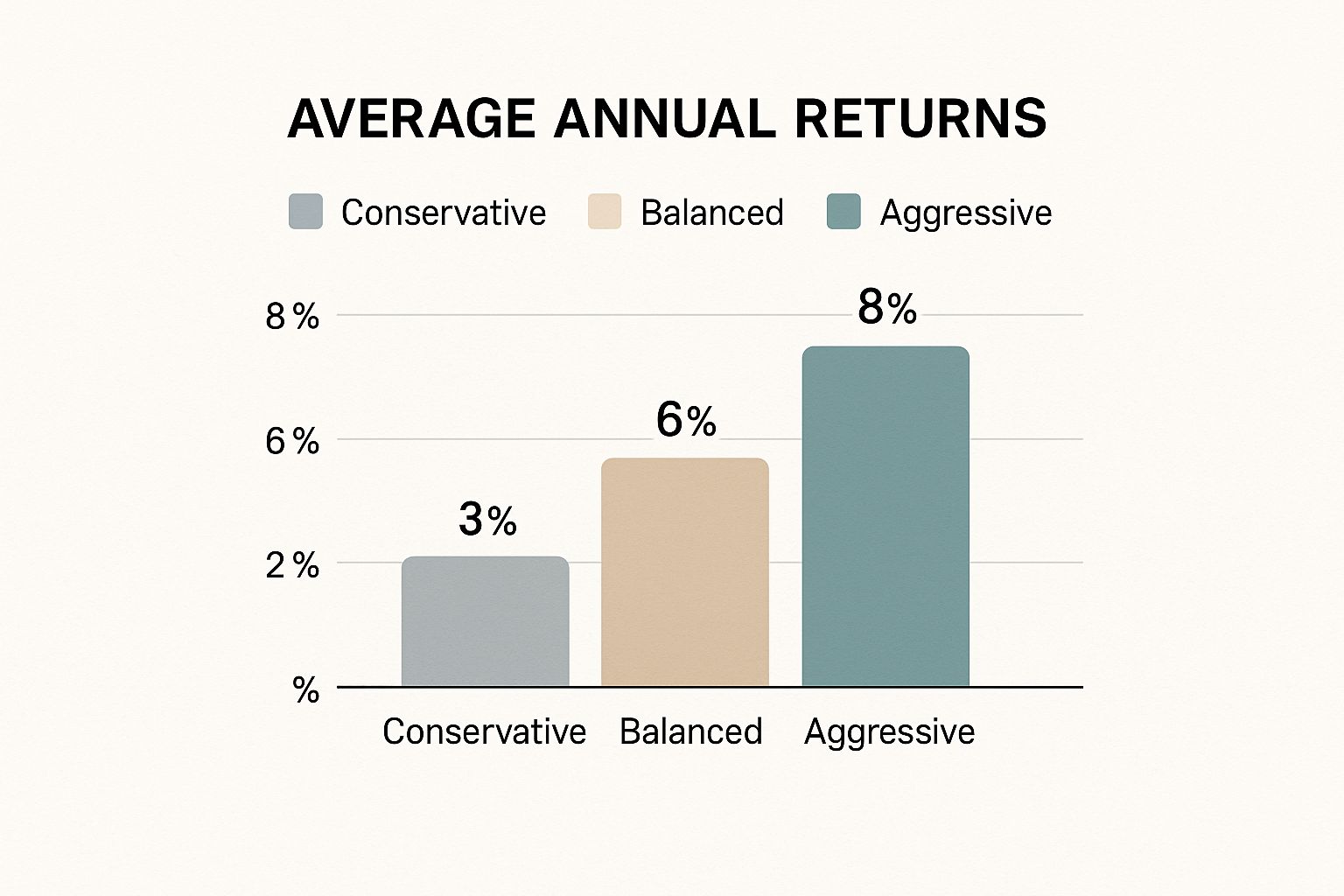

The concept isn't just about one company. You can apply it to a whole industry you believe is about to blow up, whether that’s artificial intelligence, clean energy, or even the esports world. It’s about tilting your portfolio toward the areas where you see the most potential.

Thinking Like a Portfolio Manager

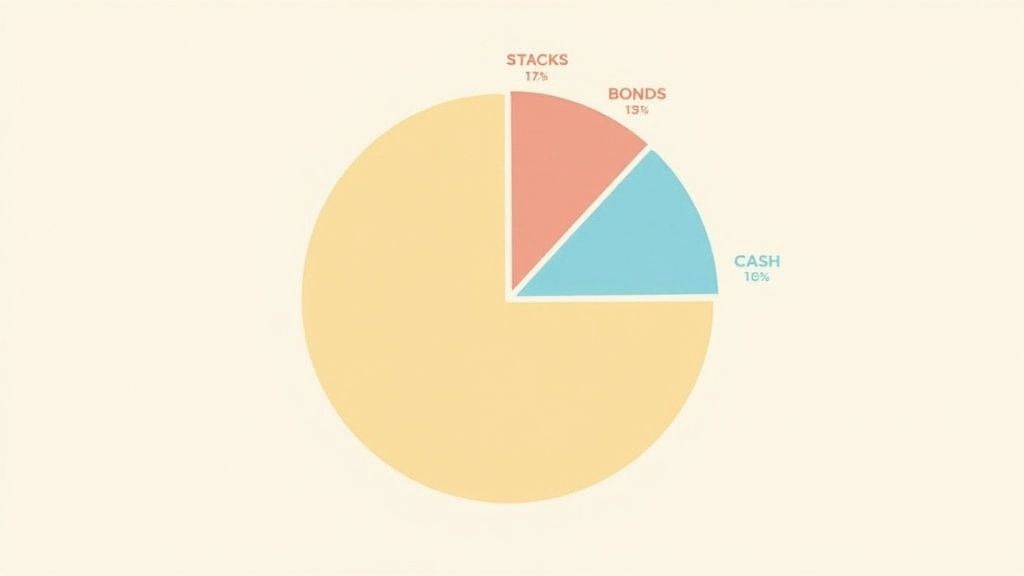

Think of your portfolio like a pizza. In a standard, balanced portfolio, each slice represents a different sector-maybe you have 25% in tech, 25% in healthcare, and so on. Pretty even.

But let's say you've done your research and you're super optimistic about the future of tech. You can decide to make that "tech slice" bigger, increasing its allocation to 35% or even more. Just like that, you are now overweight in technology. You've given it a bigger piece of your portfolio than its standard weighting, based on your own research and confidence.

This isn't just theory; it works. For instance, during the tech boom of 2020-2021, portfolios that were overweight in tech stocks managed to outperform the overall market by a whopping 18%. This shows how a smart overweight position can boost your returns when you get it right.

Building Your Overweight Strategy

Deciding to go overweight is a proactive move. It’s you saying, "I believe this area has more potential to grow than the others." It's a way to focus your bets on your strongest ideas instead of just spreading your money evenly everywhere.

To see what this looks like, let's compare a standard portfolio against one with a tech-heavy focus.

Portfolio View: Equal Weight vs. Overweight in Tech

| Portfolio Type | Tech Allocation | Healthcare Allocation | Financials Allocation | Other Allocation |

|---|---|---|---|---|

| Standard Portfolio | 25% | 25% | 25% | 25% |

| Overweight Tech | 40% | 20% | 20% | 20% |

This strategic shift is exactly how many smart investors build their wealth. They make focused, overweight bets on the companies and industries they truly believe will shape the future.

Of course, going overweight in one area means you’ll be underweight in others. This makes balancing your overall portfolio super important for managing risk. For a closer look at this balancing act, check out our full guide on how to diversify your investment portfolio. It’s a powerful strategy, but you need a smart approach to avoid putting all your eggs in one basket.

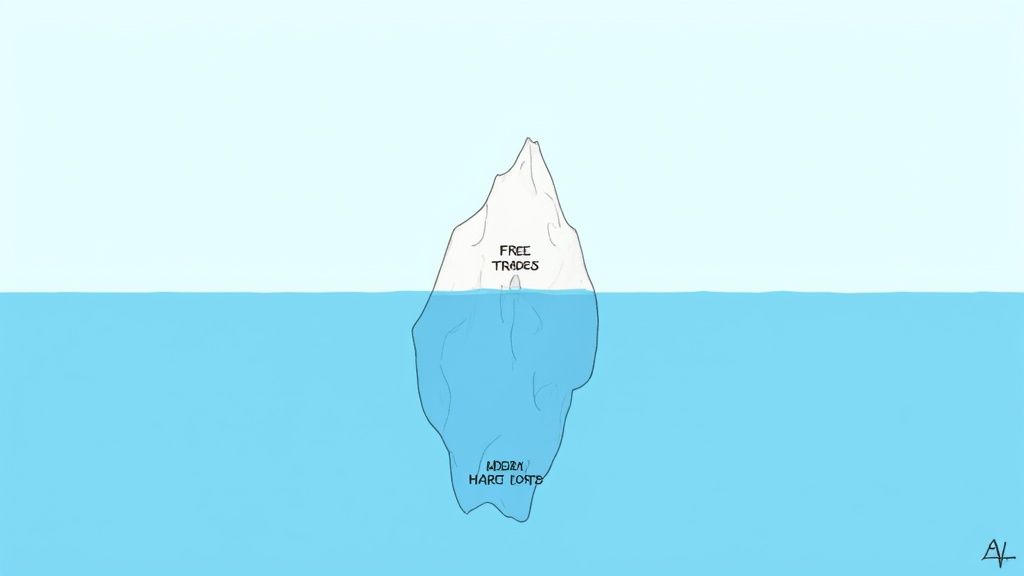

The Risks of Following Overweight Ratings

Seeing an "overweight" rating on a stock you own (or are watching) can feel exciting. It's easy to get caught up in the hype and think you've found a guaranteed winner.

But slow down. Before you even think about going all-in, you have to remember the golden rule of investing: there are no guarantees. Not one. Even the smartest experts on Wall Street can't predict the future.

Think of an overweight rating as a well-researched opinion, not a crystal ball. The market can be unpredictable. A surprise product launch from a competitor, a sudden economic shift, or even a viral tweet from someone like Elon Musk can completely change a stock's path overnight.

Forecasts Are Not Fortunes

Analysts do their homework, digging through financial reports and building complex models. But at the end of the day, their predictions are based on assumptions-and reality can shatter those assumptions in an instant. This is exactly why putting all your money into a single stock is one of the riskiest things a new investor can do.

"The key to making money in stocks is not to get scared out of them." – Peter Lynch

This classic quote from investing legend Peter Lynch hits the nail on the head. The best way to avoid getting scared out of the market is by not having all your hopes pinned on one stock. This is where your financial superpower comes in: diversification.

Why Diversification Is Your Best Friend

Diversification is a simple idea: don't put all your eggs in one basket. It’s about building a financial safety net.

By spreading your money across different stocks, industries, and even different types of investments, you protect your portfolio from the inevitable ups and downs. If one of your "overweight" picks suddenly drops, your other investments are there to soften the blow. It’s about building a portfolio that’s tough enough to handle whatever the market throws at it.

Smart investors use analyst ratings as a signal to start their own research, not as the final answer. It's always a good idea to check things out for yourself before putting real money on the line. In fact, learning how to backtest trading strategies is a great way to see how a stock might have performed in the past without risking any of your own cash.

An overweight rating is a clue, not the whole answer. It's your job to solve the rest of the puzzle.

Got Questions About Stock Ratings? Let's Clear Them Up.

Still have a few questions buzzing in your head? You're not alone. Let's tackle some of the most common ones so you can feel more confident.

What Happens if a Stock I Own Gets Downgraded?

First of all, don't panic. If an analyst downgrades a stock you own-say, from "overweight" to "equal-weight"-remember that it's just one person's opinion changing. It might cause the stock price to dip for a bit as some people sell, but it’s definitely not a command to dump your shares.

Instead, use it as a reminder to do your own homework. Go back to why you bought that stock in the first place. If your original reasons are still solid, holding on might be the smart move, especially if you're investing for the long term.

How Often Do These Ratings Actually Change?

Ratings aren't set in stone; they can change pretty often. You'll frequently see analysts update their ratings every three months, right after a company releases its latest earnings report.

But they can also change unexpectedly because of big news, like a major merger, a revolutionary new product launch, or even a scandal. It’s a dynamic process that moves with the constant flow of new information.

"The stock market is filled with individuals who know the price of everything, but the value of nothing." – Phillip Fisher

This is a great reminder that a rating is often tied to a short-term price. Your focus should always be on the real, long-term value of the business itself.

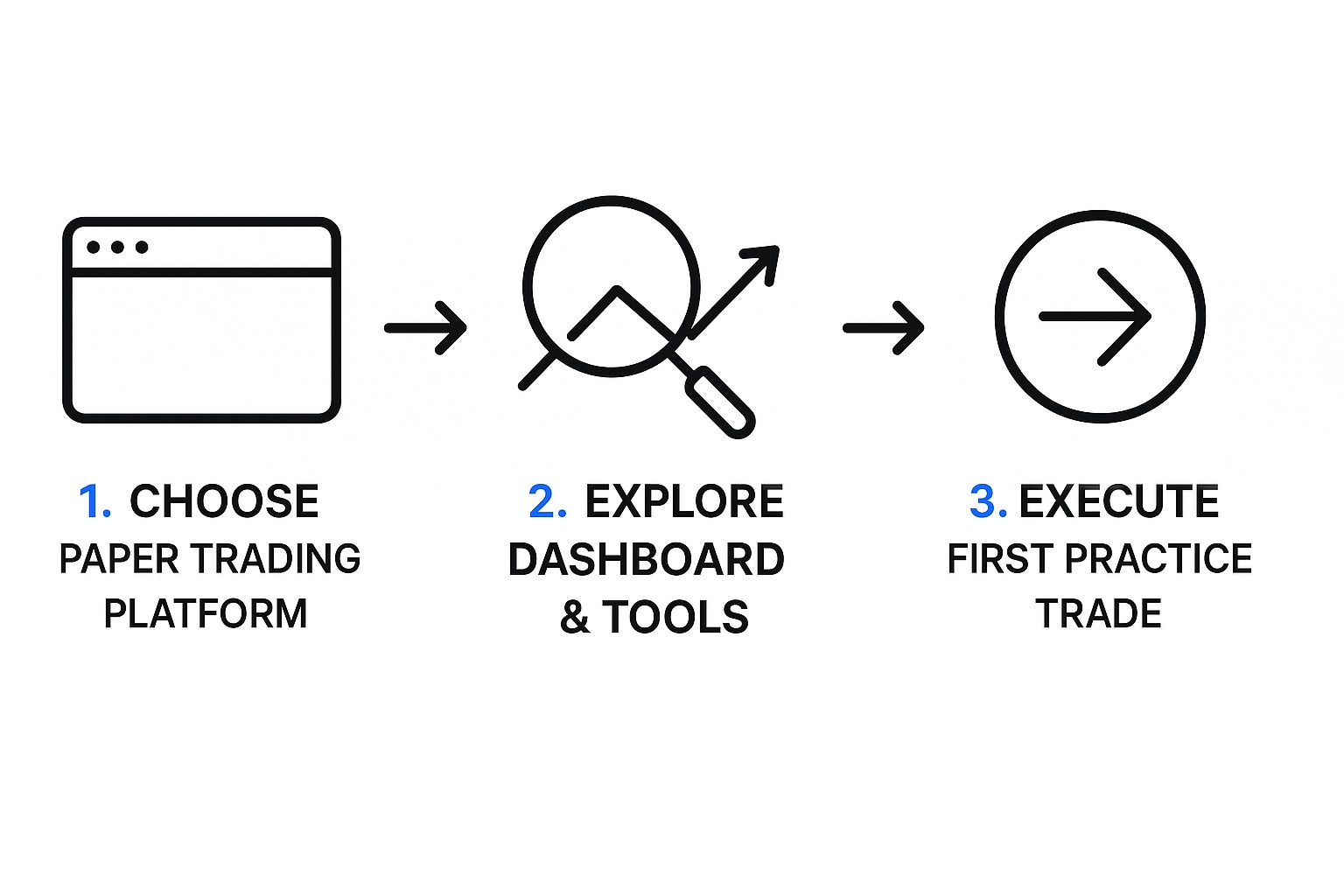

Okay, So Where Do I Find These Ratings?

Good news: you don’t need a secret Wall Street password to find this information. Analyst ratings are widely available.

You can easily find them on major financial news websites like Yahoo Finance, Bloomberg, and MarketWatch. Most online brokerage platforms also include this information right on their stock research pages, giving you direct access. Just remember, it's one tool in your toolbox, not the whole set.

Ready to stop just learning and start doing? At financeillustrated.com, we make trading simple and fun with interactive simulators and bite-sized lessons. Build your skills risk-free before you ever invest a dollar. Check out our free Trading School at https://financeillustrated.com.